Get the free Form 2 Schedule I Montana Additions to Federal Adjusted Gross Income

Show details

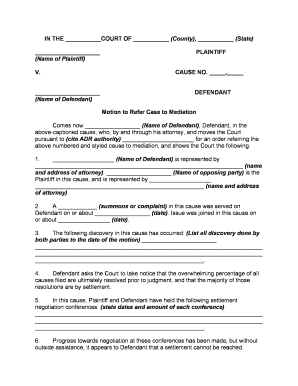

Form 2, Page 4 2017Reset Nonsocial Security Number:Schedule I Montana Additions to Federal Adjusted Gross IncomeColumn A (for single, joint, separate, or head of household)Enter your additions to

We are not affiliated with any brand or entity on this form

Instructions and Help about form 2 schedule i

How to edit form 2 schedule i

How to fill out form 2 schedule i

Instructions and Help about form 2 schedule i

How to edit form 2 schedule i

To edit form 2 schedule i, begin by accessing the form through the official IRS website or a reliable form provider. Download the form and open it with a PDF editor like pdfFiller, which allows you to easily adjust the text fields. Make necessary changes by typing directly into the fields. Once completed, save your changes before submission.

How to fill out form 2 schedule i

To fill out form 2 schedule i accurately, first ensure you have all relevant financial information at hand. This includes payment details and identification information required for the form. Start by entering your name and identification number at the top of the form, followed by the necessary financial figures in the designated sections. Double-check each entry for accuracy before submitting it.

Latest updates to form 2 schedule i

Latest updates to form 2 schedule i

Stay informed about any recent updates to form 2 schedule i by visiting the IRS website regularly. Changes may include adjustments to filing procedures, deadlines, or requirements. It is crucial to ensure that you are using the most current version of the form to avoid any compliance issues.

All You Need to Know About form 2 schedule i

What is form 2 schedule i?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About form 2 schedule i

What is form 2 schedule i?

Form 2 schedule i is an IRS document used for reporting specific types of payments. It is essential for individuals and businesses that need to report and disclose payments to the IRS accurately. This form aids the IRS in tracking payments made to various parties throughout the tax year.

What is the purpose of this form?

The primary purpose of form 2 schedule i is to report payments that require tax tracking and compliance. It ensures that all income is accurately accounted for, thereby supporting tax transparency and preventing tax evasion. The form helps the IRS in processing various tax obligations effectively.

Who needs the form?

Individuals and entities that make reportable payments, such as contractors or vendors, need to fill out form 2 schedule i. This can include businesses that hire independent contractors or those that issue specific types of income. Review the IRS guidelines to determine if your payments fall under the reporting requirements.

When am I exempt from filling out this form?

You may be exempt from filling out form 2 schedule i if your payments do not meet the reporting thresholds set by the IRS. Additionally, certain types of payments, like those made to corporations, might not require reporting on this form. Always consult the IRS guidelines to confirm your exemption status.

Components of the form

Form 2 schedule i includes several components, such as payer information, recipient details, and payment amounts. Each section must be filled out accurately to ensure compliance with IRS regulations. Errors or omissions in these components can lead to penalties or delays in processing.

What are the penalties for not issuing the form?

Failing to issue form 2 schedule i can result in significant penalties imposed by the IRS. These penalties can vary depending on the severity and duration of the non-compliance. It is important to file the form on time and accurately to avoid these financial repercussions.

What information do you need when you file the form?

When filing form 2 schedule i, you will need pertinent information, including your name, Tax Identification Number (TIN), the recipient’s details, and the amount of payment made. Ensure that you have documentation supporting these entries to facilitate an accurate filing process.

Is the form accompanied by other forms?

Form 2 schedule i may need to be accompanied by other forms, depending on the context of the payments being reported. Check the IRS requirements for specific filings to determine any additional forms you might need to submit along with form 2 schedule i.

Where do I send the form?

After completing form 2 schedule i, it should be mailed to the address specified in the instructions of the form. Different mailing addresses are designated for various states and types of filers. Ensure that you send your form to the correct address to avoid delays in processing.

See what our users say