Get the free Schedule X Other income on Form 1 or Form 1-NR/BY 2015

Show details

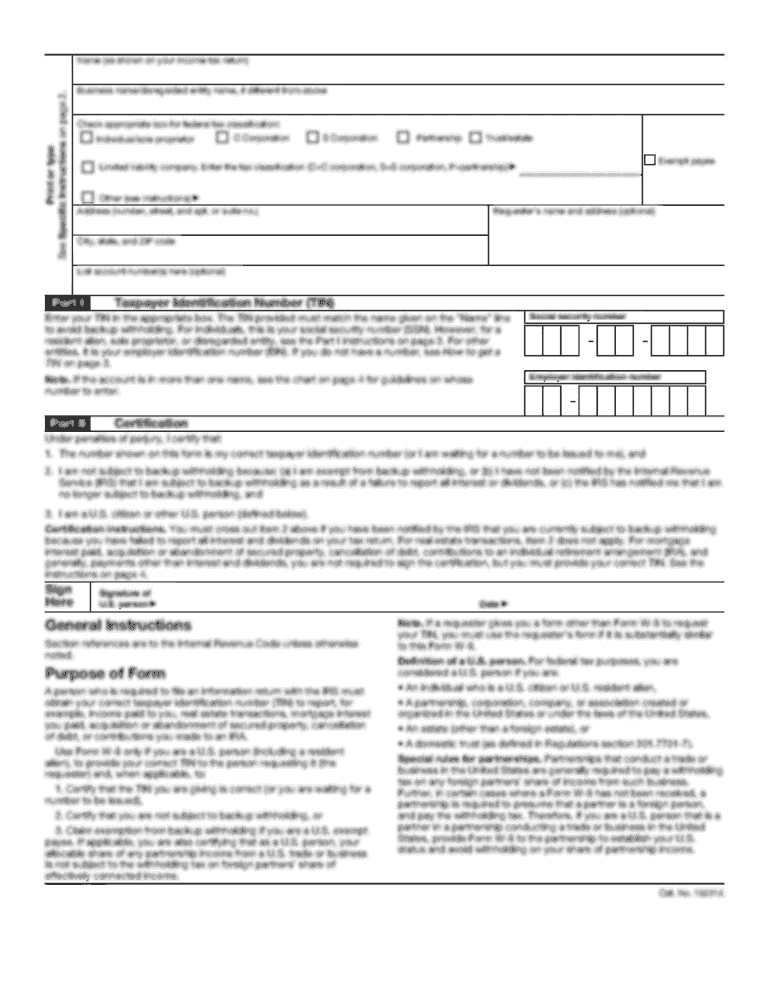

File pg.5FIRST NAME. I.LAST ASOCIAL SECURITY Cumbersome: If reporting other income on Form 1, line 9 or Form 1NR/BY, line 11 and/or claiming other deductions on Form 1, line 15, or Form 1NR/BY, line

We are not affiliated with any brand or entity on this form

Instructions and Help about Schedule X Other Income

How to edit Schedule X Other Income

How to fill out Schedule X Other Income

Instructions and Help about Schedule X Other Income

How to edit Schedule X Other Income

To edit Schedule X Other Income, you need to access the original form using PDF-based software. Utilize pdfFiller's tools to modify any details required for accuracy, such as correcting amounts or updating personal information. After making the necessary changes, save the document to ensure your edits are recorded.

How to fill out Schedule X Other Income

Filling out Schedule X Other Income involves a few clear steps. Begin by gathering all relevant financial documents, including records of any income eligible for reporting. Then, follow the instructions detailed on the form, entering your other income in the specified sections. Be attentive to any specific guidelines regarding income sources to ensure compliance.

Latest updates to Schedule X Other Income

Latest updates to Schedule X Other Income

Stay abreast of the latest updates to Schedule X Other Income by regularly checking the IRS website. Updates may include changes in form structure, eligibility criteria, or filing procedures. Ensuring you have the most current version of the form is crucial for accurate filing.

All You Need to Know About Schedule X Other Income

What is Schedule X Other Income?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About Schedule X Other Income

What is Schedule X Other Income?

Schedule X Other Income is an IRS tax form used by individual taxpayers to report income not classified under traditional employment. This can include rental income, royalties, or any other miscellaneous income sources. Accurate completion of this form is critical for correct tax reporting and compliance.

What is the purpose of this form?

The purpose of Schedule X Other Income is to document various types of income that are not reported on the standard tax return forms. It helps the IRS evaluate a taxpayer's total income accurately, ensuring proper tax liability calculation. Correctly reporting all other income enhances transparency in tax filings.

Who needs the form?

Taxpayers who receive income from miscellaneous sources that are not considered wages need to file Schedule X Other Income. This includes freelancers, landlords, and individuals who earn money from investments or other irregular income streams. If your total other income exceeds the reporting threshold stated by the IRS, you are required to use this form.

When am I exempt from filling out this form?

You may be exempt from filling out Schedule X Other Income if your total other income is below the minimum threshold set by the IRS or if you have no income to report. Additionally, certain types of income may be excluded based on specific IRS guidelines. Review IRS publications to determine your exemption status.

Components of the form

Schedule X Other Income consists of several components that require specific financial information. This includes sections for listing different categories of income, deductions applicable, and final calculated amounts. Ensure each section is completed accurately to prevent potential audit issues.

What are the penalties for not issuing the form?

Failing to file Schedule X Other Income when required can result in penalties from the IRS. These penalties may include fines for underreporting income and interest on unpaid taxes due to incomplete filings. To avoid penalties, ensure compliance with all reporting requirements each tax year.

What information do you need when you file the form?

When filing Schedule X Other Income, you need detailed records of all income sources, including amounts and dates received. Prepare any associated documentation, such as 1099 forms, to support your reported income. Having accurate and complete information helps ensure a smoother filing process.

Is the form accompanied by other forms?

Schedule X Other Income might be accompanied by other tax forms depending on your individual circumstances. Common complementary forms include the standard tax return form (Form 1040) and related schedules. Review IRS guidelines to ascertain which forms are necessary for your filing situation.

Where do I send the form?

Where to send Schedule X Other Income depends on your state and whether you are filing electronically or by mail. Check the IRS instructions specific to your filing method. If using pdfFiller, you can easily submit your completed form directly through the platform for electronic filing.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.