Get the free Schedule M1M Income Additions and Subtractions 2014

Show details

201455Schedule M1M, Income Additions and Subtractions 2014

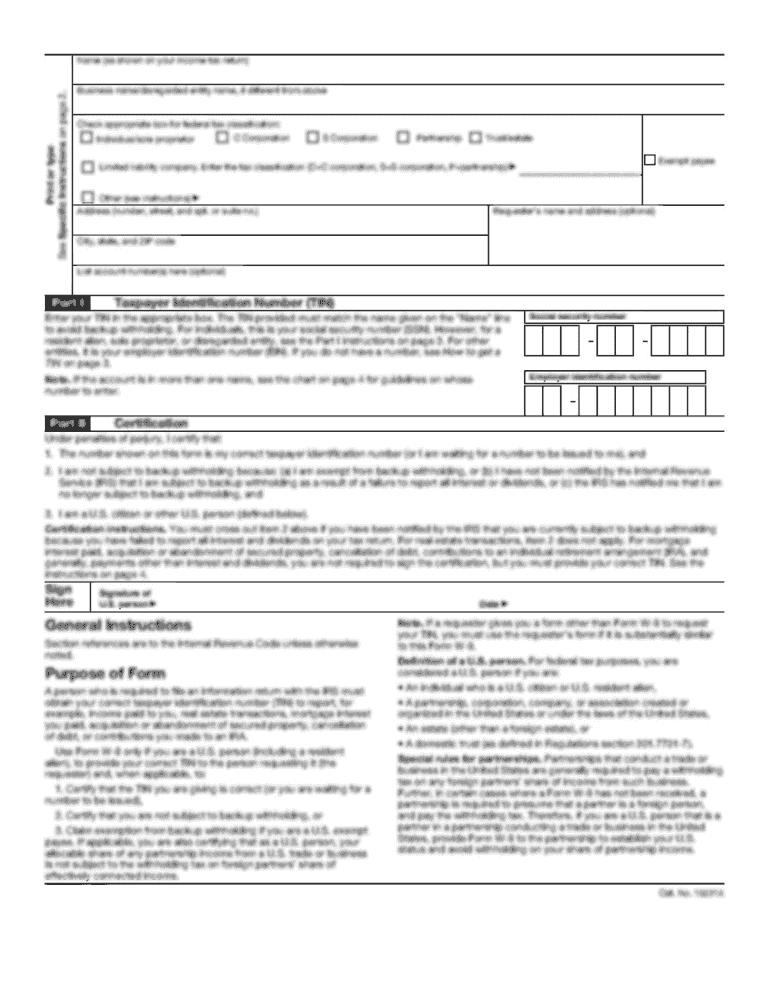

Sequence #3Complete this schedule to determine line 3 and line 6 of Form M1.

Your First Name and Initially Numerous Social Security NumberAdditions

We are not affiliated with any brand or entity on this form

Instructions and Help about schedule m1m income additions

How to edit schedule m1m income additions

How to fill out schedule m1m income additions

Instructions and Help about schedule m1m income additions

How to edit schedule m1m income additions

Edit the schedule m1m income additions form by using a PDF editing tool like pdfFiller. This tool allows you to fill in the necessary fields, make corrections, and add or remove information as needed. Once your edits are complete, you can save the updated form for your records.

How to fill out schedule m1m income additions

To fill out the schedule m1m income additions, follow these steps:

01

Gather all relevant income documents before beginning.

02

Access the schedule m1m income additions form either from the IRS website or a tax form provider.

03

Fill in your personal information, including your name, address, and Social Security number.

04

Report any additional income sources as required on the form.

05

Review all entries for accuracy before submitting.

Latest updates to schedule m1m income additions

Latest updates to schedule m1m income additions

Stay informed about the schedule m1m income additions by checking the IRS website for any updates or changes in tax regulations that may affect the form. Major updates can impact who must file, deadlines, and reporting requirements.

All You Need to Know About schedule m1m income additions

What is schedule m1m income additions?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Form vs. Form

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About schedule m1m income additions

What is schedule m1m income additions?

The schedule m1m income additions is a tax form used by certain taxpayers in the United States to report additional income sources for state and federal tax purposes. This form helps ensure proper income reporting and compliance with tax regulations.

What is the purpose of this form?

The purpose of the schedule m1m income additions is to document and report any additional income that is not typically included in your main tax return. This may include income from sources such as self-employment, investments, or miscellaneous income.

Who needs the form?

Taxpayers who have supplemental income that must be reported but is not included in their standard income figures are required to use the schedule m1m income additions. This form is particularly relevant for those with diverse income streams.

When am I exempt from filling out this form?

You may be exempt from filling out the schedule m1m income additions if you do not have any additional income to report or if your main income is fully reported through your primary tax return form. Always check IRS guidelines to confirm your specific situation.

Components of the form

The schedule m1m income additions typically includes sections for entering personal information, the types of additional income being reported, and spaces for calculations. Each section is crucial for ensuring comprehensive reporting.

Form vs. Form

The schedule m1m income additions should not be confused with other tax forms such as the standard 1040 or 1099 forms. Each of these forms serves distinct purposes in tax reporting, so it is essential to use the correct form for your specific income situation.

What payments and purchases are reported?

When filling out the schedule m1m income additions, you need to report all payments from supplemental income sources. This includes items such as interest income, rental income, and specific bonuses that may not be adequately covered in other forms.

How many copies of the form should I complete?

Generally, you should prepare multiple copies of the schedule m1m income additions: one for your records and at least one to submit to the IRS. Depending on your situation, you might also need additional copies for state tax purposes.

What are the penalties for not issuing the form?

Failing to file the schedule m1m income additions when required can lead to penalties, which may include fines and interest on unpaid taxes. It is important to comply with all filing requirements to avoid complications during audits or financial assessments.

What information do you need when you file the form?

When filing the schedule m1m income additions, you need to have documentation of your additional income sources, tax identification numbers, and details regarding any deductions or credits applicable to your situation. Proper documentation is crucial for accurate reporting.

Is the form accompanied by other forms?

The schedule m1m income additions may need to be filed alongside your main tax return, such as the 1040 form, and potentially other supporting documents that verify your income sources. Be sure to check the specific requirements for your situation before filing.

Where do I send the form?

The completed schedule m1m income additions should be sent to the appropriate IRS address as listed on the form itself. This may vary based on your location and the nature of the income being reported, so consult the latest IRS guidelines for accuracy.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.