Get the free 2017 Nebraska Tax Calculation Schedule for Individual Income Tax

Show details

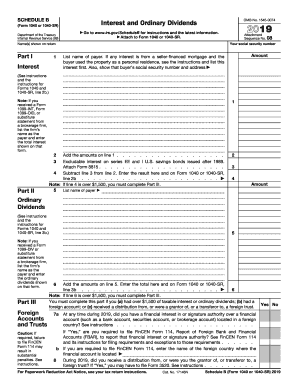

2017 Nebraska Tax Calculation Schedule for Individual Income Tax This calculation represents Nebraska income tax before any credits are applied. Enter on line 15, Form 1040 N. Single Taxpayers Nebraska

We are not affiliated with any brand or entity on this form

Instructions and Help about 2017 nebraska tax calculation

How to edit 2017 nebraska tax calculation

How to fill out 2017 nebraska tax calculation

Instructions and Help about 2017 nebraska tax calculation

How to edit 2017 nebraska tax calculation

To edit the 2017 Nebraska tax calculation form, obtain a printable version of the form from the Nebraska Department of Revenue website. Once downloaded, you can make adjustments manually. If utilizing pdfFiller, upload the form to access tools that allow for easy text edits, annotations, and digital signatures. Ensure all edits are accurate to avoid complications during filing.

How to fill out 2017 nebraska tax calculation

Filling out the 2017 Nebraska tax calculation form requires careful attention to detail. Start by entering your personal information, including your name, address, and Social Security number. Next, provide details about your income, deductions, and credits. Finally, calculate your total tax liability and ensure that all sections are complete. If using pdfFiller, the platform provides a guided process to simplify the completion of each section.

Latest updates to 2017 nebraska tax calculation

Latest updates to 2017 nebraska tax calculation

The 2017 Nebraska tax calculation form has not undergone significant changes post-filing for the 2017 tax year; however, always check for any legislative updates or changes in tax rates that could impact calculations for subsequent years.

All You Need to Know About 2017 nebraska tax calculation

What is 2017 nebraska tax calculation?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About 2017 nebraska tax calculation

What is 2017 nebraska tax calculation?

The 2017 Nebraska tax calculation form is used by residents and non-residents to report income earned within the state and to calculate the corresponding state tax liability. This form collects various personal, income, and deduction information to determine the exact amount owed or refunded.

What is the purpose of this form?

The primary purpose of the 2017 Nebraska tax calculation form is to determine the amount of state income tax that a taxpayer is obligated to pay based on their reported income and allowable deductions. Proper use of this form ensures compliance with Nebraska tax laws and facilitates accurate tax assessment.

Who needs the form?

Any individual or business entity that earned income in Nebraska during the 2017 tax year must complete the 2017 Nebraska tax calculation form. This includes full-time residents, part-time residents, and non-residents who derived income from Nebraska sources.

When am I exempt from filling out this form?

You may be exempt from filling out the 2017 Nebraska tax calculation form if your total income is below the filing threshold for the state. Additionally, certain exempt entities, like non-profit organizations, may not be required to file this form. Always verify current regulations for your specific situation.

Components of the form

The 2017 Nebraska tax calculation form includes sections for personal information, income reporting, deductions, and credits. Each part requires accurate entries to ensure that the tax assessment is properly calculated. Accompanying worksheets may also be necessary for specific deductions or credits.

Due date

The due date for filing the 2017 Nebraska tax calculation form was April 18, 2018. Extensions could have been requested, but it is essential to check the Nebraska Department of Revenue for details on any extended deadlines.

What are the penalties for not issuing the form?

Failing to file the 2017 Nebraska tax calculation form may lead to penalties, including fines or interest on any unpaid tax. Nebraska tax authorities may also initiate collection actions if the issue remains unresolved. It's crucial to address non-filing issues promptly to mitigate potential consequences.

What information do you need when you file the form?

When filing the 2017 Nebraska tax calculation form, you need your Social Security number, residency status, income details from all sources, and documentation of deductions and credits. Having your Federal tax return handy can also aid in completing the state form accurately.

Is the form accompanied by other forms?

Yes, the 2017 Nebraska tax calculation form may need to be accompanied by additional supporting forms, such as W-2s for wage income, 1099s for other income types, and any schedules for specific deductions or credits you are claiming. Refer to the state’s filing guidelines to ensure you include all necessary forms.

Where do I send the form?

The completed 2017 Nebraska tax calculation form should be sent to the Nebraska Department of Revenue. The mailing address varies based on whether you are including a payment with your filing. Always verify the correct address on the Nebraska Department of Revenue's website to avoid misdirected submissions.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.