Get the free Ins Loss Prev - ENG 2013.doc - svpta

Show details

(916) 440-1985 FAX (916) 440-1986 E-mail info Capra.org www.capta.org .... of Insurance to each unit, may file annual Evidence of Insurance with the ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ins loss prev

Edit your ins loss prev form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ins loss prev form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ins loss prev online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ins loss prev. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

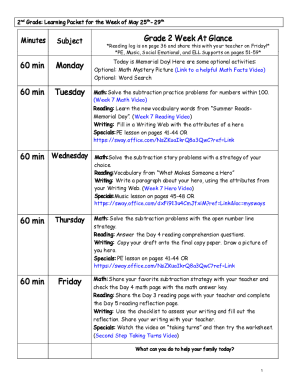

How to fill out ins loss prev

How to fill out ins loss prev:

01

Start by gathering all relevant information about your insurance policy and any recent losses or claims.

02

Carefully review the insurance loss prevention form provided by your insurance company.

03

Begin by providing your personal information, including your name, address, and contact details.

04

The form may ask for details about your property or assets that require insurance coverage. Fill in this information accurately and comprehensively.

05

Depending on the form, you may need to specify the types of risks or threats you are trying to prevent. Provide details about the potential hazards and risks that are relevant to your situation.

06

Some forms may ask you to provide information about any safety measures or security systems you have in place to mitigate risks. Include details about alarms, surveillance systems, fire prevention measures, etc.

07

If the form includes a section for documenting previous losses, describe each incident in detail, including the date, description, and cost of the loss. Attach any supporting documentation, such as photographs or repair estimates.

08

Read through the completed form carefully to ensure accuracy and make any necessary corrections before submitting it to your insurance company.

Who needs ins loss prev?

01

Every individual or business that has insurance coverage for their property, assets, or other liabilities can benefit from insurance loss prevention.

02

Homeowners who want to protect their investment and belongings from potential risks and damages should consider insurance loss prevention.

03

Businesses of all sizes, including small businesses, should prioritize insurance loss prevention to mitigate financial losses due to accidents, theft, or natural disasters.

04

Industries with high-risk environments, such as construction, manufacturing, or transportation, should have dedicated insurance loss prevention measures in place to ensure the safety of employees and assets.

05

Landlords and property owners can use insurance loss prevention to safeguard their rental properties and minimize the risk of potential damages caused by tenants or other external factors.

06

Individuals or businesses operating in regions prone to certain risks, such as earthquakes, hurricanes, or floods, should particularly consider insurance loss prevention to protect themselves from significant financial losses.

By following the steps outlined in the first section, anyone in need of insurance loss prevention can properly fill out the necessary forms and ensure their assets and liabilities are adequately protected.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the ins loss prev in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your ins loss prev in minutes.

Can I create an electronic signature for signing my ins loss prev in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your ins loss prev right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit ins loss prev on an Android device?

The pdfFiller app for Android allows you to edit PDF files like ins loss prev. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is ins loss prev?

Insurance loss prevention refers to the methods and practices used to reduce the likelihood of losses or damages to property, assets, or individuals covered by insurance.

Who is required to file ins loss prev?

Insurance companies, businesses, and individuals who want to prevent losses and maintain their insurance coverage are required to file insurance loss prevention reports.

How to fill out ins loss prev?

Insurance loss prevention forms can usually be filled out online through the insurance provider's website or by submitting paper forms directly to the insurance company.

What is the purpose of ins loss prev?

The purpose of insurance loss prevention is to minimize the risk of losses or damages covered by insurance policies, thereby reducing the cost of claims and premiums for policyholders.

What information must be reported on ins loss prev?

Information such as details of the insured property, potential hazards, risk assessment, safety measures in place, and any previous claims history may need to be reported on insurance loss prevention forms.

Fill out your ins loss prev online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ins Loss Prev is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.