Get the free Sch. A on Form 2106 - Employee Business Expenses &/or Sch. C ...

Show details

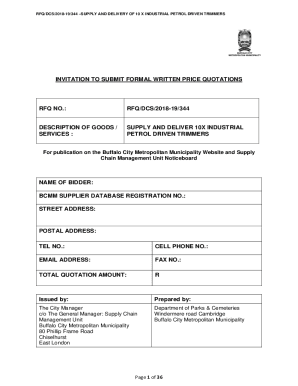

Sch. An on Form 2106 — Employee Business Expenses &/or Sch. C — Business Use Of Vehicle Expenses Supplemental Questionnaire THE BIGGEST IN TAX SAVINGS COMPANY, A Division Of: Plus Incorporated

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sch a on form

Edit your sch a on form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sch a on form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sch a on form online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sch a on form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sch a on form

How to fill out Sch A on form:

01

Begin by obtaining Form 1040 (U.S. Individual Income Tax Return) or Form 1040-SR (U.S. Tax Return for Seniors) from the IRS website or your local tax office.

02

Locate Schedule A (Itemized Deductions) on the form. It is a separate section where you can report your eligible deductions.

03

Gather documentation to support the deductions you plan to claim. This may include receipts, invoices, medical records, mortgage interest statements, and other relevant documents.

04

Start filling out the Sch A by providing your name and Social Security number at the top of the form.

05

Proceed to Part I - Medical and Dental Expenses. Here, you can report your eligible medical and dental expenses that exceed a certain percentage of your adjusted gross income (AGI). Calculate the total amount and enter it in the appropriate line.

06

Move on to Part II - Taxes You Paid. In this section, you can report state and local income taxes, real estate taxes, personal property taxes, and other deductible taxes you have paid throughout the year. Enter each type of tax and the corresponding amount in the designated lines.

07

Continue to Part III - Interest You Paid. This is where you can report deductible mortgage interest, investment interest, and any other qualifying interest payments. Enter the required details and amounts accurately.

08

Proceed to Part IV - Gifts to Charity. Here, you can report your charitable contributions made during the year. Provide information about each organization you donated to, the cash or non-cash amount, and any additional details required.

09

Move on to Part V - Casualty and Theft Losses. If you experienced any significant losses due to a casualty event or theft, you can report them here. Provide all relevant details as requested on the form.

10

Finally, complete the remaining parts of Sch A, if applicable, such as Job Expenses and Certain Miscellaneous Deductions (Part VI) and Other Miscellaneous Deductions (Part VII). Be sure to follow the instructions and fill out each section accurately.

Who needs Sch A on form:

01

Individuals who want to claim itemized deductions instead of taking the standard deduction may need to fill out Sch A on their tax forms.

02

Taxpayers who have incurred significant medical expenses, paid substantial amounts in state and local taxes, made substantial charitable contributions, or experienced qualifying casualty or theft losses may find it beneficial to fill out Sch A.

03

It is essential to review the instructions and eligibility criteria for itemized deductions or consult with a tax professional to determine if filling out Sch A is the right option for your specific tax situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in sch a on form?

With pdfFiller, the editing process is straightforward. Open your sch a on form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my sch a on form in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your sch a on form right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out sch a on form using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign sch a on form and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your sch a on form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sch A On Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.