OK 538-S 2018 free printable template

Instructions and Help about OK 538-S

How to edit OK 538-S

How to fill out OK 538-S

About OK 538-S 2018 previous version

What is OK 538-S?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about OK 538-S

What should I do if I realize I've made a mistake after filing the 538 form?

If you've filed the 538 form and discover an error, you need to submit an amended form. This involves completing a corrected version of the original 538 form and including a note explaining the changes. Ensure you file this amended form as soon as possible to avoid potential penalties.

How can I track the status of my 538 form after submission?

To verify the status of your 538 form, you can usually check online through the IRS website or contact their helpline. Look for any tracking options provided by the e-filing software you used, as these may offer updates on processing. Keep an eye out for common rejection codes if you filed electronically.

Are there specific legal requirements for electronic signatures on the 538 form?

Yes, electronic signatures are acceptable on the 538 form as long as they meet IRS standards. Make sure your e-signature complies with the requirements set for electronic filing to ensure your submission is valid. Always retain a copy of the signed form for your records.

What do I do if my 538 form submission is rejected?

If your 538 form submission is rejected, the e-filing system should provide a reason for the rejection. Review the rejection code and correct the errors before resubmitting. You may also need to check for compatibility issues with your software or browser that could have led to the rejection.

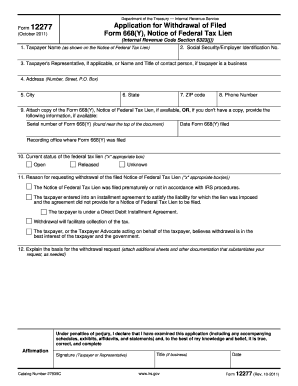

What should I consider when filing a 538 form on behalf of someone else?

When filing a 538 form on behalf of another individual, ensure you have the proper power of attorney (POA) documentation. This is crucial for authorized representatives. Make sure you understand any specific filing requirements or issues that may arise when dealing with nonresidents or foreign payees.