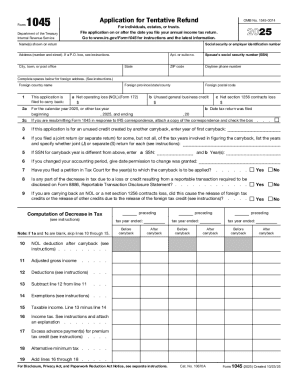

IRS 1045 2018 free printable template

Show details

Cat. No. 10670A Form 1045 2018 Page 2 continued General business credit see instructions Net premium tax credit see instructions Other credits. Your signature Date Spouse s signature. If Form 1045 is filed jointly both must sign. Print/Type preparer s name Paid Preparer Use Only Under penalties of perjury I declare that I have examined this application and accompanying schedules and statements and to the best of my knowledge and belief they are true correct and complete. Form OMB No*...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1045

Edit your IRS 1045 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1045 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 1045 online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 1045. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1045 Form Versions

Version

Form Popularity

Fillable & printabley

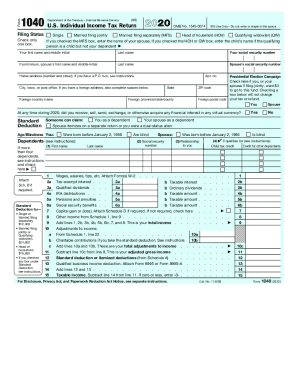

How to fill out IRS 1045

How to fill out IRS 1045

01

Download the IRS Form 1045 from the IRS website or obtain a paper copy.

02

Fill in your name and Social Security Number (SSN) at the top of the form.

03

Indicate your tax year for which you are claiming a refund due to a carryback.

04

Complete Part I by entering your net operating loss (NOL) for the current year.

05

In Part II, calculate your carryback period and the amount of the NOL you are applying.

06

For Part III, provide details of your income, deductions, and tax for the years involved.

07

Sign and date the form at the bottom to certify that the information provided is accurate.

08

Submit the completed Form 1045 to the appropriate IRS address as indicated in the instructions.

Who needs IRS 1045?

01

Individuals or businesses that have incurred a net operating loss and want to carry it back to previous tax years to claim a refund.

02

Taxpayers who need to adjust their tax liability from prior years due to an NOL.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of the Form 1045?

An individual, estate, or trust files Form 1045 to apply for a quick tax refund resulting from: The carryback of an NOL. The carryback of an unused general business credit. The carryback of a net section 1256 contracts loss.

What is the schedule A of 1045?

Form 1045 Schedule A is used to compute a net operating loss (NOL) and determine the amount available for carryback or carryforward. Those with a negative balance on Form 1040 line 41 may have a net operating loss. Form 1045 Schedule A allows you to determine the actual amount of your net operating loss.

Where do I send my 1045?

File Form 1045 with the Internal Revenue Service Center for the place where you live as shown in the instructions for your 2022 income tax return. Don't include Form 1045 in the same envelope as your 2022 income tax return. Attach copies of the following, if applicable, to Form 1045 for the year of the loss or credit.

What is form 1045 for?

An individual, estate, or trust files Form 1045 to apply for a quick tax refund resulting from: The carryback of an NOL. The carryback of an unused general business credit.

When can I use Form 1045?

Generally, you must file Form 1045 within 1 year after the end of the year in which an NOL, unused credit, net section 1256 contracts loss, or claim of right adjustment arose. If you were affected by a federally declared disaster, you may have additional time to file your Form 1045.

How long does it take to get a 1045 refund?

How long does it take to get a 1045 refund? The IRS states that it generally takes 16 to 20 weeks to process a Form 1045.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS 1045 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign IRS 1045 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I create an eSignature for the IRS 1045 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your IRS 1045 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete IRS 1045 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your IRS 1045. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is IRS 1045?

IRS 1045, also known as 'Application for Tentative Refund', is a form used by taxpayers to request a quick refund of overpayments of taxes.

Who is required to file IRS 1045?

Taxpayers who are eligible for a refund due to a carryback of a net operating loss, certain credit carrybacks, or other specific situations can file IRS 1045.

How to fill out IRS 1045?

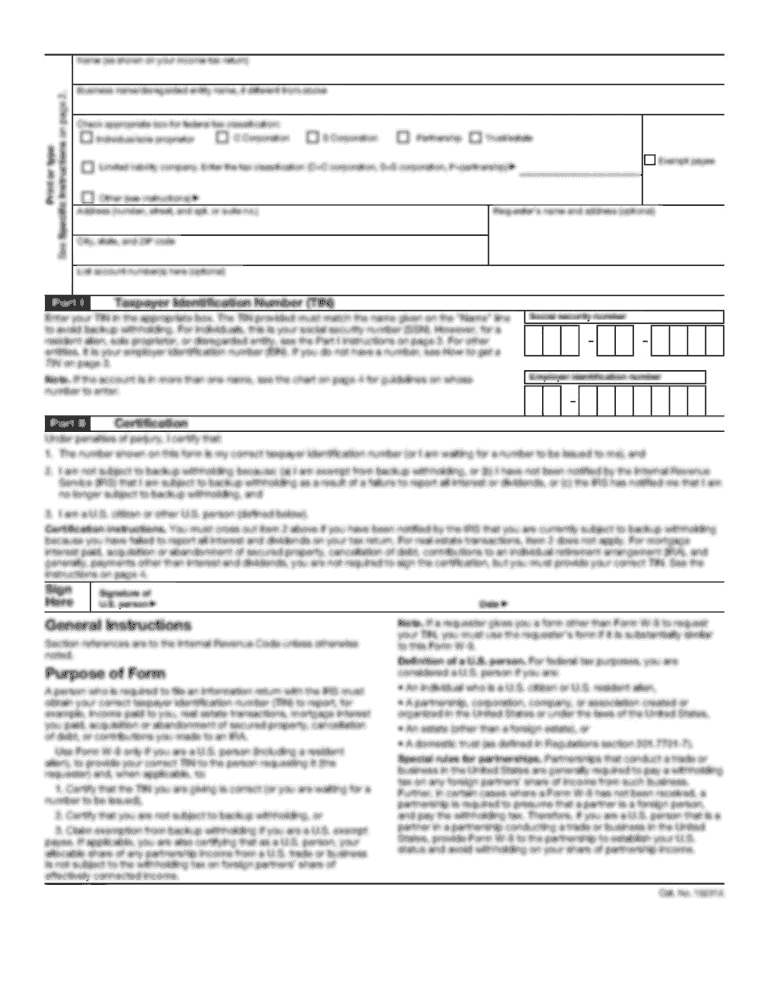

To fill out IRS 1045, taxpayers must provide personal information, details regarding the tax return being amended, the specific amounts involved in the refund due to carrybacks, and sign the form.

What is the purpose of IRS 1045?

The purpose of IRS 1045 is to allow taxpayers to claim a refund based on losses or credits that can be applied to prior years' tax returns, expediting the process of receiving a refund.

What information must be reported on IRS 1045?

Information required on IRS 1045 includes taxpayer identification details, prior year tax return information, amounts being claimed for refund due to carrybacks, and the specific credits or losses involved.

Fill out your IRS 1045 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1045 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.