IRS 1045 2021 free printable template

Show details

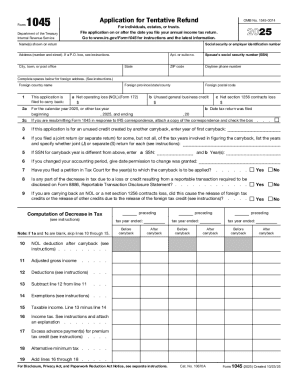

1045FormOMB No. 15450098For individuals, estates, or trusts. Mail in separate envelope. (Don't attach to tax return.) Go to www.irs.gov/Form1045 for instructions and the latest information.2021Department

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1045

Edit your IRS 1045 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1045 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 1045 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 1045. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1045 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 1045

How to fill out IRS 1045

01

Obtain IRS Form 1045 from the IRS website or your local IRS office.

02

Fill out your name, address, and Social Security number at the top of the form.

03

Indicate the tax year for which you are claiming the refund.

04

Complete Part I by calculating your net operating loss (NOL) for the year.

05

Move to Part II to determine your carryback period for the NOL.

06

Use Part III to list the tax returns affected, including the amount of refund claimed for each.

07

Review Part IV to provide any additional information or statements required.

08

Sign and date the form at the bottom.

09

Submit the completed Form 1045 to the appropriate IRS address for processing.

Who needs IRS 1045?

01

Individuals or businesses that have incurred a net operating loss (NOL) in a tax year.

02

Taxpayers who seek to apply for a quick refund resulting from the carryback of the NOL.

03

People who have losses that can reduce their taxable income for prior years.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file 1045?

A person must file Form 1045 within 1 year after the end of the year in which an NOL, unused credit, a net section 1256 contract loss, or claim of right adjustments arose.

What is a tentative refund?

Tentative Refund applications (“Quick Refund”) that are supposed to be processed by the IRS within 90 days are now routinely taking six months or longer, with some taxpayers waiting for over a year.

How long does it take IRS to process 1045?

How Does IRS Form 1045 Work? If one of the above situations occurs, then an individual, estate, or trust might decide to file IRS Form 1045 so they can quickly get a tax refund. When this happens, the IRS generally processes the application within 90 days and will tentatively pay the refund.

Can Form 1045 be E filed?

Can Form 1045 be e-filed? At this time, the IRS does not allow Form 1045 to be e-filed (refer to Accepted Forms and Schedules). Note that because the Form 1045 is filed separately from Form 1040, the tax return and all other supporting schedules can still be e-filed.

How do I fax a form to the IRS?

Fax: 855-215-1627 (within the U.S.)

Can Form 1045 be faxed?

Eligible Forms 1045 may be faxed to 844-249-6237.

What to include with 1045?

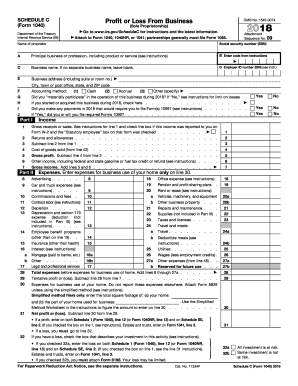

While Form 1045 is filed separately from the taxpayer's main tax return, it should include the first two pages of Form 1040, any Form 4952, and all Schedules K-1. Internal Revenue Service.

Can you still fax Form 1045?

For example, if the taxpayer gave a Form 1120-X/1040-X to an IRS examination team, it has not been processed. The FAQs also state that a taxpayer should not attempt to fax an amended return at the time of faxing Form 1139/1045.

When can you use Form 1045?

An individual, estate, or trust files Form 1045 to apply for a quick tax refund resulting from: The carryback of an NOL. The carryback of an unused general business credit. The carryback of a net section 1256 contracts loss. An overpayment of tax due to a claim of right adjustment under section 1341(b)(1).

What is a tentative carryback application?

A taxpayer may file an application for a tentative carryback adjustment of the tax for the prior taxable year affected by a net operating loss carryback provided in section 172(b), by a business credit carryback provided in section 39, or by a capital loss carryback provided in subsection (a)(1) or (c) of section 1212,

When can I use Form 1045?

An individual, estate, or trust files Form 1045 to apply for a quick tax refund resulting from: The carryback of an NOL. The carryback of an unused general business credit. The carryback of a net section 1256 contracts loss. An overpayment of tax due to a claim of right adjustment under section 1341(b)(1).

Can Form 1045 be filed?

Can Form 1045 be e-filed? At this time, the IRS does not allow Form 1045 to be e-filed (refer to Accepted Forms and Schedules). Note that because the Form 1045 is filed separately from Form 1040, the tax return and all other supporting schedules can still be e-filed.

Can a 1045 be filed?

Can Form 1045 be e-filed? At this time, the IRS does not allow Form 1045 to be e-filed (refer to Accepted Forms and Schedules). Note that because the Form 1045 is filed separately from Form 1040, the tax return and all other supporting schedules can still be e-filed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS 1045 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your IRS 1045 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I get IRS 1045?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the IRS 1045 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit IRS 1045 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute IRS 1045 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is IRS 1045?

IRS 1045 is the 'Application for Tentative Refund' form used by taxpayers to apply for a refund of overpaid taxes.

Who is required to file IRS 1045?

Taxpayers who have undergone a net operating loss, capital loss carryback, or certain other tax adjustments are required to file IRS 1045 to expedite their refund claim.

How to fill out IRS 1045?

To fill out IRS 1045, taxpayers must provide their personal information, details of the losses or adjustments for which they are claiming a refund, and calculations of the tax effects, following the instructions provided with the form.

What is the purpose of IRS 1045?

The purpose of IRS 1045 is to allow taxpayers to apply for a quick refund of taxes paid in previous years due to losses in the current year, allowing them to reclaim overpayments promptly.

What information must be reported on IRS 1045?

The information that must be reported on IRS 1045 includes taxpayer identification, details of the net operating loss or other tax changes, adjusted gross income information, and calculations of the refund requested.

Fill out your IRS 1045 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1045 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.