Get the free Personal Investment Management Service Application

Show details

Personal Investment Management Service Application This Application Form should be read in conjunction with the current Personal Investment Management Service Brochure and Key Features. A copy of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal investment management service

Edit your personal investment management service form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal investment management service form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit personal investment management service online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit personal investment management service. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal investment management service

How to fill out personal investment management service:

01

Research and gather information: Start by researching different personal investment management services available. Look for trustworthy and reputable firms or individuals who offer these services. Gather information about their investment strategies, track records, fees, and any specific requirements they may have.

02

Assess your financial goals: Before filling out a personal investment management service, it is important to have a clear understanding of your financial goals. Determine whether you are looking for long-term investments, retirement planning, wealth accumulation, or any other specific objectives. This will help you find a service that aligns with your goals.

03

Evaluate your risk tolerance: Assess your risk tolerance level to determine the types of investments you are comfortable with. Some individuals are more risk-averse and prefer conservative investments, while others may be more open to taking higher risks for potentially higher returns. Consider your age, financial situation, and investment experience when evaluating your risk tolerance.

04

Determine your investment budget: Decide on the amount of money you are willing to allocate for investment purposes. Having a clear budget will help you narrow down the potential investment management services that are suitable for your financial capacity.

05

Seek professional advice: If you are unsure about the investment management process or need expert guidance, consider consulting a financial advisor. They can provide personalized advice and help you make informed decisions based on your unique financial situation and goals.

06

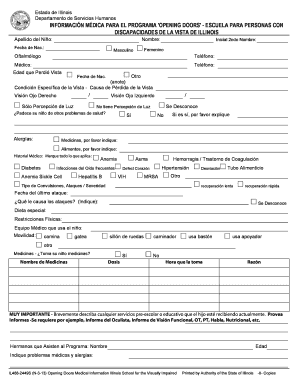

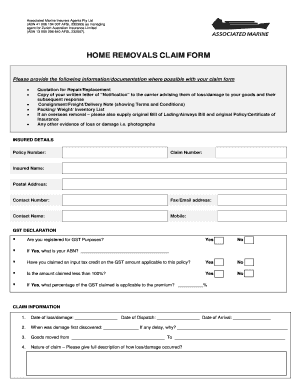

Fill out the application: Once you have chosen a personal investment management service, you will need to fill out the application form provided by the firm or individual. The form will typically require your personal information, financial status, investment goals, risk tolerance, and other relevant details. Take your time to complete the application accurately and provide all the required information.

07

Review and sign the agreement: Before finalizing your investment management service, carefully review the terms and conditions, fees, and investment strategies outlined in the agreement. Seek clarification on any areas you are uncertain about. If you are satisfied with the terms, sign the agreement and submit it to the service provider.

Who needs personal investment management service:

01

Individuals lacking investment knowledge: Personal investment management services are beneficial for individuals who have limited knowledge or experience in investment strategies. These services provide expert advice and guidance, helping individuals make informed investment decisions.

02

High-net-worth individuals: Personal investment management services are particularly useful for high-net-worth individuals who have substantial assets to manage. These services can help them maximize their returns, minimize risks, and efficiently manage their wealth.

03

Busy professionals: Professionals with demanding careers may not have the time or expertise to manage their investments effectively. Personal investment management services allow them to delegate the responsibility to experts, freeing up their time and ensuring their investments are handled professionally.

04

Individuals seeking diversification: Personal investment management services offer access to a diversified portfolio. This is beneficial for individuals looking to spread their investments across multiple asset classes and industries, reducing the risk of concentration in a single investment.

05

Individuals seeking personalized attention: Personal investment management services provide personalized attention and customized investment strategies based on individual goals and risk tolerance. This level of individualized service can be beneficial for individuals who prefer a tailored approach rather than generic investment options.

Overall, personal investment management services are suitable for individuals who want professional guidance, personalized attention, and effective management of their investments to achieve their financial goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is personal investment management service?

Personal investment management service is a service that helps individuals manage their investments and financial assets to achieve their financial goals.

Who is required to file personal investment management service?

Individuals who use personal investment management services are required to file relevant documentation and reports.

How to fill out personal investment management service?

To fill out personal investment management service, individuals need to gather information about their investments, financial goals, and risk tolerance, and work with a professional advisor.

What is the purpose of personal investment management service?

The purpose of personal investment management service is to help individuals grow and protect their wealth through strategic investment decisions.

What information must be reported on personal investment management service?

Information such as investment holdings, performance reports, fees incurred, and investment strategy must be reported on personal investment management service.

How can I manage my personal investment management service directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign personal investment management service and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I create an electronic signature for the personal investment management service in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your personal investment management service in minutes.

How do I edit personal investment management service straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing personal investment management service, you can start right away.

Fill out your personal investment management service online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Investment Management Service is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.