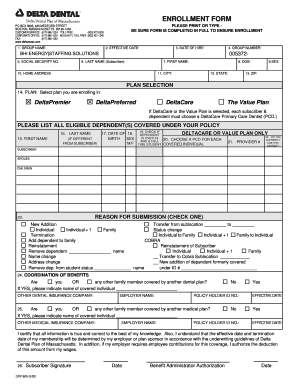

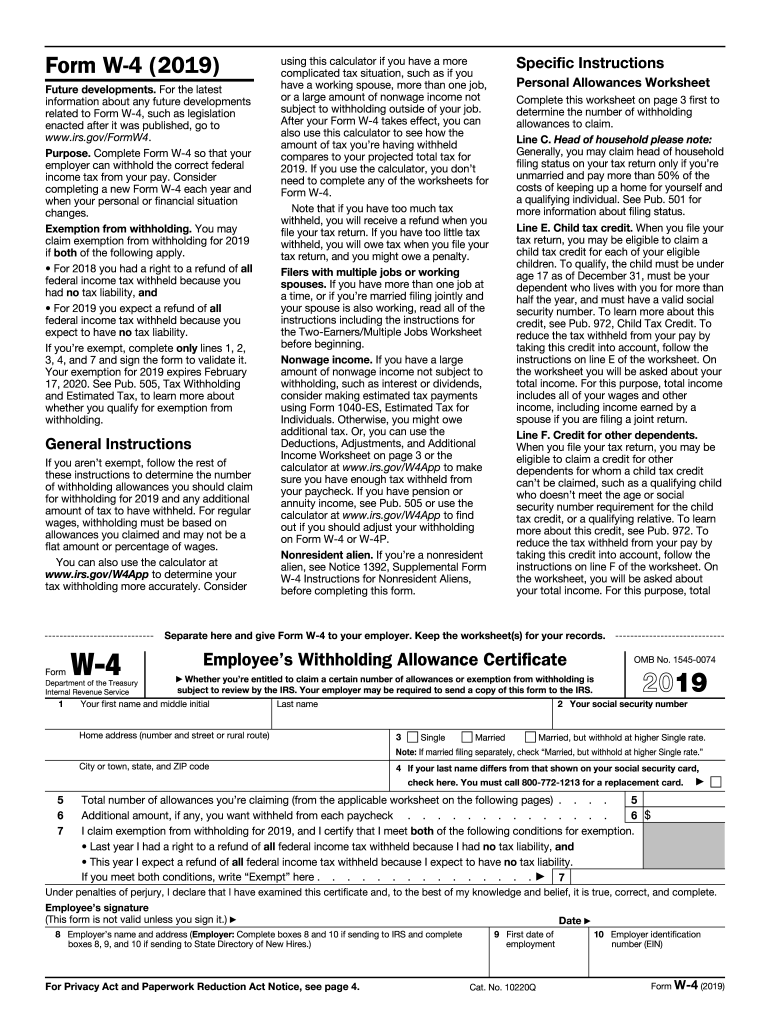

IRS W-4 2019 free printable template

Instructions and Help about IRS W-4

How to edit IRS W-4

How to fill out IRS W-4

About IRS W-4 2019 previous version

What is IRS W-4?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS W-4

What should I do if I make a mistake on my IRS W-4 after submission?

If you realize that you made an error on your IRS W-4 after submitting it, you should submit a new W-4 form with the corrected information. The IRS allows you to make changes anytime, and your employer will update your withholding accordingly once they receive the new form.

How can I confirm that my IRS W-4 has been received and processed?

To confirm that your IRS W-4 has been received, check with your employer's HR or payroll department, as they manage the collection and submission of W-4 forms. Unfortunately, the IRS does not provide individual confirmations for these forms.

What measures should I take to ensure my personal information on the IRS W-4 is secure?

To protect your personal information on the IRS W-4, only provide it to trusted employers. You may also opt for e-filing options that employ encryption and secure data handling practices. Retain a copy of your submitted form in a safe place.

Are there any special considerations for non-residents filing an IRS W-4?

Non-residents filing an IRS W-4 must be aware that their tax withholding may differ from residents. They should consult the IRS guidelines for non-resident aliens and may need to provide additional documentation along with their W-4 form to ensure proper withholding.

What should I do if my IRS W-4 is rejected during e-filing?

If your IRS W-4 is rejected during e-filing, review the rejection codes provided by the e-filing system to identify the issue. Correct any errors and resubmit. If needed, consult the e-filing software’s help resources for specific troubleshooting guidance.

See what our users say