IRS 1120-F - Schedule M-1 & M-2 2018 free printable template

Show details

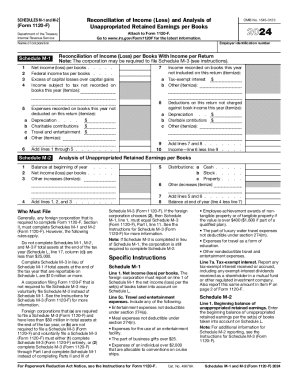

Reconciliation of Income (Loss) and Analysis of Unappropriated Retained Earnings per BooksSCHEDULES M1 and M2(Form 1120F)Department of the Treasury Internal Revenue Service1 2 3 42018Go to www.irs.gov/Form1120F

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1120-F - Schedule M-1 M-2

How to edit IRS 1120-F - Schedule M-1 M-2

How to fill out IRS 1120-F - Schedule M-1 M-2

Instructions and Help about IRS 1120-F - Schedule M-1 M-2

How to edit IRS 1120-F - Schedule M-1 M-2

To edit IRS 1120-F - Schedule M-1 M-2 using pdfFiller, follow these steps:

01

Upload the form to your pdfFiller account.

02

Use the editing tools to make changes as needed.

03

Save your edits and review the document for accuracy.

Editing your form in pdfFiller allows for easy adjustments, ensuring your information is correct before submission.

How to fill out IRS 1120-F - Schedule M-1 M-2

To fill out IRS 1120-F - Schedule M-1 M-2 accurately, adhere to the following guidelines:

01

Gather necessary financial documents related to income and expenses.

02

Improve accuracy by referring to the form instructions for each line item.

03

Review all entries for compliance with IRS regulations.

Utilizing pdfFiller can streamline the completion process by providing clear fields for accurate input.

About IRS 1120-F - Schedule M-1 M-2 2018 previous version

What is IRS 1120-F - Schedule M-1 M-2?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1120-F - Schedule M-1 M-2 2018 previous version

What is IRS 1120-F - Schedule M-1 M-2?

IRS 1120-F - Schedule M-1 M-2 is a tax form used by a foreign corporation to reconcile its books with its taxable income as reported on Form 1120-F, U.S. Income Tax Return of a Foreign Corporation. This form provides critical information about accounting methods and adjustments necessary for U.S. tax compliance.

What is the purpose of this form?

The main purpose of IRS 1120-F - Schedule M-1 M-2 is to disclose the differences between the accounting income of the corporation and the taxable income required to be reported to the IRS. This helps in ensuring that all income and deductions are appropriately accounted for when determining the corporation's U.S. tax liability.

Who needs the form?

Foreign corporations that have U.S. source income and must file Form 1120-F are required to complete and submit IRS 1120-F - Schedule M-1 M-2. Those with a U.S. trade or business must also fill out this form to comply with IRS regulations regarding income tax reporting.

When am I exempt from filling out this form?

Filers may be exempt from completing IRS 1120-F - Schedule M-1 M-2 if they meet any of the following criteria: they do not have any U.S. source income, they are not engaged in a trade or business in the United States, or they qualify under certain tax treaty exemptions. It is important to review these criteria carefully to determine eligibility.

Components of the form

The IRS 1120-F - Schedule M-1 M-2 comprises several key sections, including a reconciliation of book income to taxable income and a breakdown of adjustments. These adjustments can include items such as depreciation differences, foreign tax credits, and disallowed deductions.

Due date

The IRS 1120-F - Schedule M-1 M-2 must generally be filed by the 15th day of the fourth month following the end of the corporation's tax year. For most foreign corporations, this means the form is due on April 15th for calendar year taxpayers. However, extensions may be available under specific circumstances.

What are the penalties for not issuing the form?

Failure to file IRS 1120-F - Schedule M-1 M-2 can lead to significant penalties. The penalties can include a fee for failing to file timely, which can be substantial. Additionally, failure to comply may lead to the inability to claim certain tax benefits or deductions, impacting the overall tax liability.

What information do you need when you file the form?

When filing IRS 1120-F - Schedule M-1 M-2, filers should gather key information, including the corporation's financial statements, details of U.S. source income, and any relevant tax treaties affecting the corporation's tax obligations. Having this information readily available will facilitate accurate completion of the form.

Is the form accompanied by other forms?

IRS 1120-F - Schedule M-1 M-2 is typically filed alongside Form 1120-F and may require attachments or supporting documents, such as schedules detailing foreign income and expenses. Depending on the specific situation, additional forms may also be necessary to provide complete and accurate information to the IRS.

Where do I send the form?

IRS 1120-F - Schedule M-1 M-2 must be sent to the appropriate IRS address based on the filing corporation's location and whether a payment is enclosed. Generally, these forms are filed directly to the Internal Revenue Service, with distinct addresses provided in the form instructions.

See what our users say