Get the free Documentary Stamp Tax - Florida Dept. of Revenue - keralaregistration gov

Show details

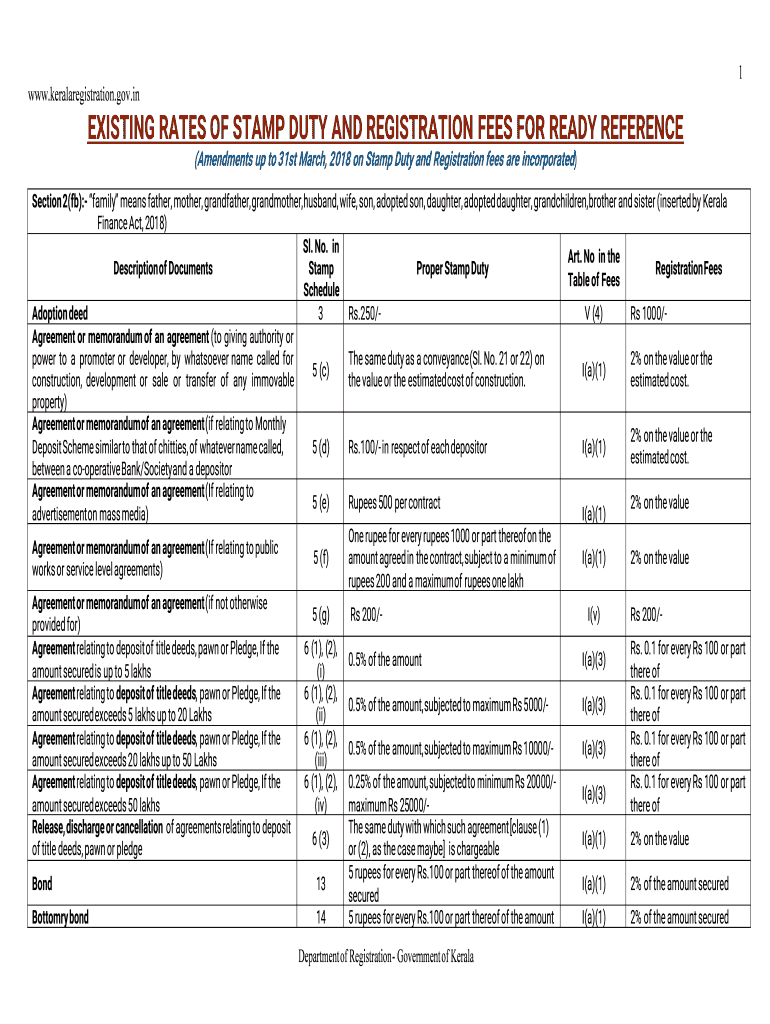

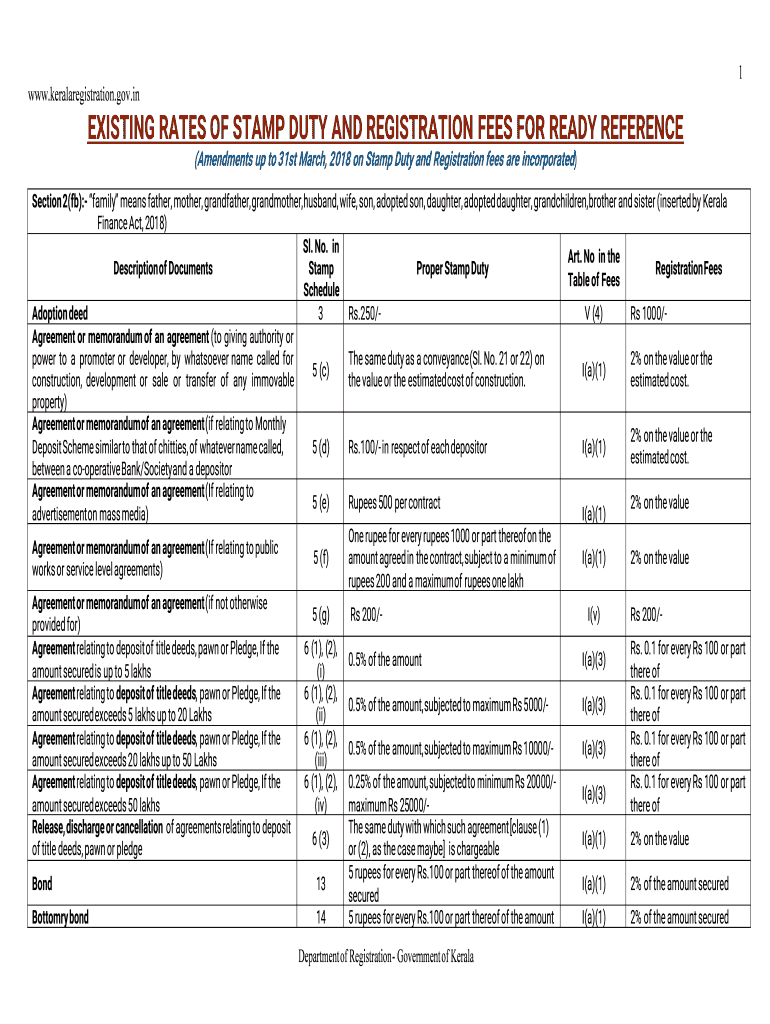

1www.keralaregistration.gov.existing RATES OF STAMP DUTY AND REGISTRATION FEES FOR READY REFERENCE

(Amendments up to 31st March 2018 on Stamp Duty and Registration fees are incorporated)Section 2(FB):

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign documentary stamp tax

Edit your documentary stamp tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your documentary stamp tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing documentary stamp tax online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit documentary stamp tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out documentary stamp tax

How to fill out documentary stamp tax

01

To fill out the documentary stamp tax, follow these steps:

02

Identify the type of document that requires a documentary stamp tax.

03

Determine the applicable tax rate for the document. The tax rates vary depending on the type of document.

04

Calculate the tax amount by multiplying the applicable tax rate with the value of the document.

05

Purchase the required documentary stamps from an authorized stamp vendor or government office.

06

Affix the documentary stamps to the original document in the designated area.

07

Make sure all necessary information is provided on the document, such as the names of the parties involved, a description of the transaction, and the value of the document.

08

File the document with the appropriate government agency and pay the documentary stamp tax.

09

Keep a copy of the document for your records in case of any future reference or verification.

Who needs documentary stamp tax?

01

Documentary stamp tax is required by individuals or companies involved in certain transactions or possessing specific documents.

02

The following entities generally need documentary stamp tax:

03

- Real estate buyers and sellers

04

- Borrowers and lenders for mortgage or loan agreements

05

- Stockholders and corporations for the issuance of stocks or certificates

06

- Parties involved in lease agreements

07

- Individuals or organizations engaged in insurance policies

08

- Parties involved in the transfer of property titles

09

- Individuals conducting business transactions that require specific documents

10

Please note that the exact requirement for documentary stamp tax depends on the jurisdiction and the type of document or transaction involved. It is advisable to consult with a tax professional or refer to the specific guidelines provided by the relevant government agency.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send documentary stamp tax to be eSigned by others?

When your documentary stamp tax is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for signing my documentary stamp tax in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your documentary stamp tax and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out documentary stamp tax using my mobile device?

Use the pdfFiller mobile app to fill out and sign documentary stamp tax on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is documentary stamp tax?

Documentary stamp tax is a tax imposed on the transfer of documents, instruments, or transactions.

Who is required to file documentary stamp tax?

Individuals or entities involved in the sale or transfer of certain documents or transactions are required to file documentary stamp tax.

How to fill out documentary stamp tax?

To fill out documentary stamp tax, you need to provide information about the document or transaction being taxed and calculate the applicable tax rate.

What is the purpose of documentary stamp tax?

The purpose of documentary stamp tax is to generate revenue for the government from the transfer of certain documents or transactions.

What information must be reported on documentary stamp tax?

The information required to be reported on documentary stamp tax includes details of the document or transaction being taxed, the parties involved, and the amount of tax due.

Fill out your documentary stamp tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Documentary Stamp Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.