CA FTB 100X 2018 free printable template

Show details

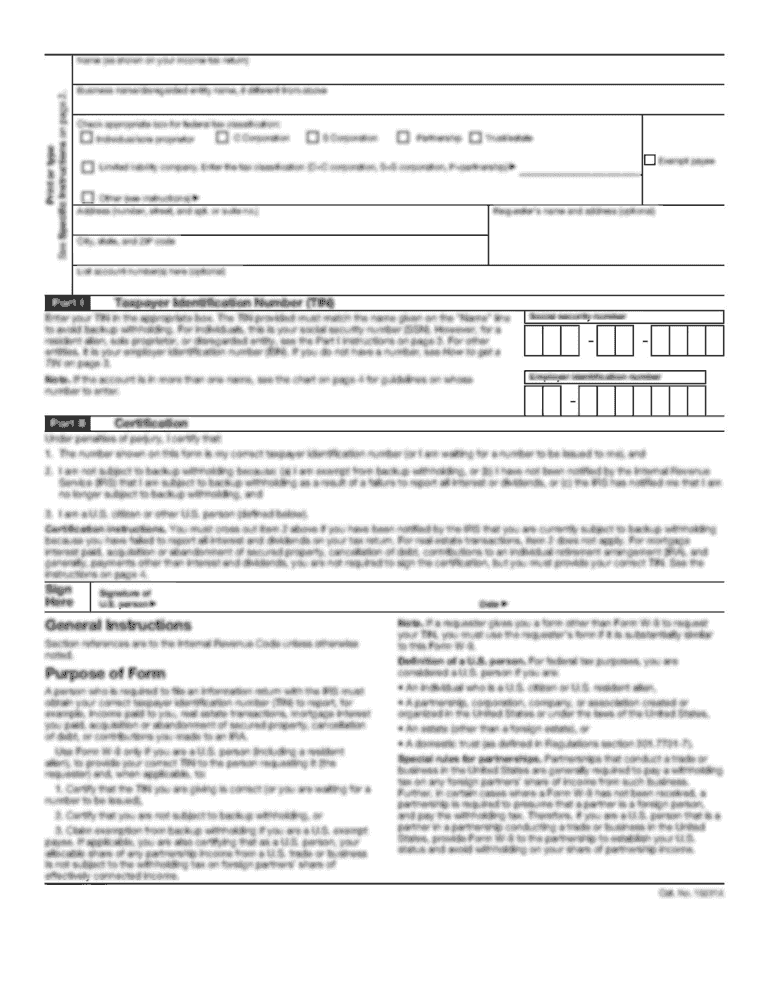

TAXABLE YEARAmended Corporation Franchise or Income Tax Returner calendar year or fiscal year beginning (mm/dd/YYY)CALIFORNIA FORM100X, and ending (mm/dd/YYY). Corporation name California corporation

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FTB 100X

Edit your CA FTB 100X form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 100X form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA FTB 100X online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CA FTB 100X. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 100X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 100X

How to fill out CA FTB 100X

01

Obtain the CA FTB 100X form from the California Franchise Tax Board website.

02

Fill in the identification section with your name, Social Security Number (SSN) or Employer Identification Number (EIN), and the tax year.

03

Complete the section for the original return information if applicable.

04

Provide the corrected figures for your income, deductions, credits, and other relevant information.

05

Ensure you include any necessary documentation to support the changes.

06

Review the form for accuracy and completeness.

07

Sign and date the form.

08

Mail the completed form to the address indicated in the instructions.

Who needs CA FTB 100X?

01

Taxpayers who need to correct errors on their California Form 100 corporate tax return.

02

Businesses that have previously filed Form 100 and need to amend their tax information.

03

Corporations that need to change their tax liability due to adjustments or corrections in income or deductions.

Fill

form

: Try Risk Free

People Also Ask about

Who must file a California nonresident return?

Visit 540NR Booklet for more information. A nonresident return is required when a resident spouse and a nonresident spouse wish to file a joint return.

Who Must file form 100 California?

All corporations subject to the franchise tax, including banks, financial corporations, RICs, REITs, FASITs, corporate general partners of partnerships, and corporate members of LLCs doing business in California, must file Form 100 and pay at least the minimum franchise tax as required by law.

What is FTB form 100W?

General Information. C corporations filing on a water's-edge basis are required to use Form 100W to file their California tax returns. In general, water's-edge rules provide for an election out of worldwide combined reporting.

Which forms Cannot be electronically filed?

In addition, some Forms 1040, 1040-A, 1040-EZ, and 1041 cannot be e-filed if they have attached forms, schedules, or documents that IRS does not accept electronically.

Who must file form 100 California?

All corporations subject to the franchise tax, including banks, financial corporations, RICs, REITs, FASITs, corporate general partners of partnerships, and corporate members of LLCs doing business in California, must file Form 100 and pay at least the minimum franchise tax as required by law.

Can form 100X be filed electronically?

The Franchise Tax Board (FTB) offers e-filing for corporations filing Form 100X.

Can I fill out tax forms electronically?

Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer, and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.

Can I file form 100 online?

Accepted forms Forms you can e-file for business: California Corporation Franchise or Income Tax Return (Form 100) California S Corporation Franchise or Income Tax Return (Form 100S)

What is form form 100 100S 100W or 100X?

Form 100S California S Corporation Franchise or Income Tax Return. Form 100-W Corporation Franchise or Income Tax Return—Water's-Edge Filers. Form 100-WE Water's-Edge Election. Form 100-X Amended Corporation Franchise or Income Tax Return.

What is Form 100 payments?

Use Form 100-ES to figure and pay estimated tax for a corporation. Estimated tax is the amount of tax the corporation expects to owe for the taxable year.

What is California form 100X?

A claim for refund of an overpayment of tax should be made by filing Form 100X. If the corporation is filing an amended tax return in response to a billing notice the corporation received, the corporation will continue to receive billing notices until the amended tax return is accepted.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find CA FTB 100X?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific CA FTB 100X and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit CA FTB 100X in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing CA FTB 100X and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I sign the CA FTB 100X electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your CA FTB 100X in minutes.

What is CA FTB 100X?

CA FTB 100X is a tax form used by California corporations to amend their previously filed California Corporation Franchise or Income Tax Return.

Who is required to file CA FTB 100X?

Any corporation that has already filed a California Corporation Franchise or Income Tax Return and needs to make corrections or report changes to that return must file CA FTB 100X.

How to fill out CA FTB 100X?

To fill out CA FTB 100X, corporations must provide their original return information, indicate the changes being made, and provide any necessary supporting documentation or explanations for those changes.

What is the purpose of CA FTB 100X?

The purpose of CA FTB 100X is to allow corporations to correct errors or provide additional information regarding their previously filed California tax returns.

What information must be reported on CA FTB 100X?

Corporations must report the original tax return information, the changes being made, and any reasons for those changes, including any impacts on tax liability, on CA FTB 100X.

Fill out your CA FTB 100X online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 100x is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.