IRS 1040 - Schedule 2 2021 free printable template

Show details

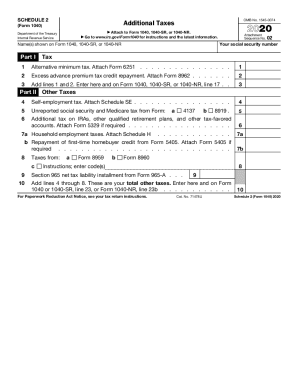

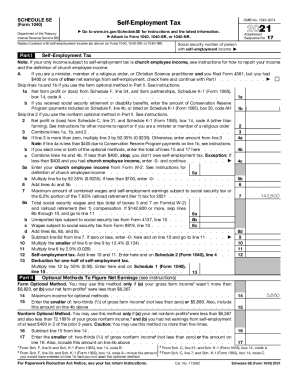

SCHEDULE 2OMB No. 15450074Tax(Form 1040) Department of the Treasury Internal Revenue Service Go3844 45 46 47Attachment Sequence No. 02 Your social security cumbersome(s) shown on Form 1040Tax2018

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1040 - Schedule 2

Edit your IRS 1040 - Schedule 2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1040 - Schedule 2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 1040 - Schedule 2 online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 1040 - Schedule 2. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1040 - Schedule 2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 1040 - Schedule 2

How to fill out IRS 1040 - Schedule 2

01

Obtain IRS Form 1040 and Schedule 2 from the IRS website or your tax professional.

02

Review your income sources to determine which sections apply to you.

03

Begin with Part I of Schedule 2, which covers additional taxes, and fill out any applicable lines based on the instructions.

04

Move on to Part II, which includes other payments and refundable credits. Fill in any relevant information.

05

Sum the amounts where indicated and ensure that they are accurately transferred back to your Form 1040.

06

Double-check your calculations and the consistency of information across your forms.

07

Sign and date your tax return, and keep a copy for your records.

Who needs IRS 1040 - Schedule 2?

01

Taxpayers who owe additional taxes such as self-employment tax, additional tax on IRAs, or household employment tax.

02

Individuals who are claiming specific credits that require reporting on Schedule 2.

03

Those who may need to report other payments related to health care coverage or farming income.

Fill

form

: Try Risk Free

People Also Ask about

What is the latest tax form 2022?

The due date for filing your tax return is typically April 15 if you're a calendar year filer. Generally, most individuals are calendar year filers. For individuals, the last day to file your 2022 taxes without an extension is April 18, 2023, unless extended because of a state holiday.

How do I get an IRS form?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

Who gives you a 1040 form?

How to get Form 1040. The IRS offers a PDF version of Form 1040 that you can download and fill out manually, but your best bet is probably using one of the popular tax software programs. The software will walk you through filling out the form, any necessary schedules that go with it, and help with the math.

Are forms from IRS free?

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free, enabling you to: Choose the income tax form you need.

What is an IRS form?

IRS forms are documents that individuals and businesses use to report all financial activities to the federal government for purposes of calculating their tax liability.

Where can I pick up a 1040 tax form?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

Where can I pick up Canadian income tax forms?

view, download, and print the package from canada.ca/taxes-general-package. order the package online at canada.ca/get-cra-forms. order a package by calling the CRA at 1-855-330-3305 (be ready to give your social insurance number)

What are the most common IRS forms?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What IRS means?

The Internal Revenue Service is the nation's tax collection agency and administers the Internal Revenue Code enacted by Congress.

What is the earliest you can file taxes for 2022?

2022 tax filing season begins Jan. 24; IRS outlines refund timing and what to expect in advance of April 18 tax deadline. Internal Revenue Service.

Why is it called the IRS?

Origin. The roots of IRS go back to the Civil War when President Lincoln and Congress, in 1862, created the position of commissioner of Internal Revenue and enacted an income tax to pay war expenses.

How do I get my tax forms mailed to me?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

How do I get my IRS 1040 form online?

These and other commonly used forms are available on the IRS Web site or by calling the IRS forms and publications order line at 800-TAX-FORM (800-829-3676).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS 1040 - Schedule 2 from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including IRS 1040 - Schedule 2. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send IRS 1040 - Schedule 2 for eSignature?

When you're ready to share your IRS 1040 - Schedule 2, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit IRS 1040 - Schedule 2 online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your IRS 1040 - Schedule 2 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

What is IRS 1040 - Schedule 2?

IRS 1040 - Schedule 2 is a form used by taxpayers to report certain additional taxes that cannot be entered directly on the main IRS Form 1040. It includes taxes such as the alternative minimum tax and additional taxes on IRAs.

Who is required to file IRS 1040 - Schedule 2?

Taxpayers who are subject to additional taxes, such as the alternative minimum tax, or other specific taxes that need to be reported separately must file IRS 1040 - Schedule 2.

How to fill out IRS 1040 - Schedule 2?

To fill out IRS 1040 - Schedule 2, taxpayers should obtain the form from the IRS website, complete the relevant sections for additional taxes applicable to their situation, and then attach it to their main Form 1040.

What is the purpose of IRS 1040 - Schedule 2?

The purpose of IRS 1040 - Schedule 2 is to report additional taxes that are not included directly on Form 1040, ensuring that taxpayers fulfill their reporting obligations for these specific tax scenarios.

What information must be reported on IRS 1040 - Schedule 2?

On IRS 1040 - Schedule 2, taxpayers must report any additional taxes such as the alternative minimum tax, excess advance premium tax credit repayments, or other specific taxes outlined in the form instructions.

Fill out your IRS 1040 - Schedule 2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1040 - Schedule 2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.