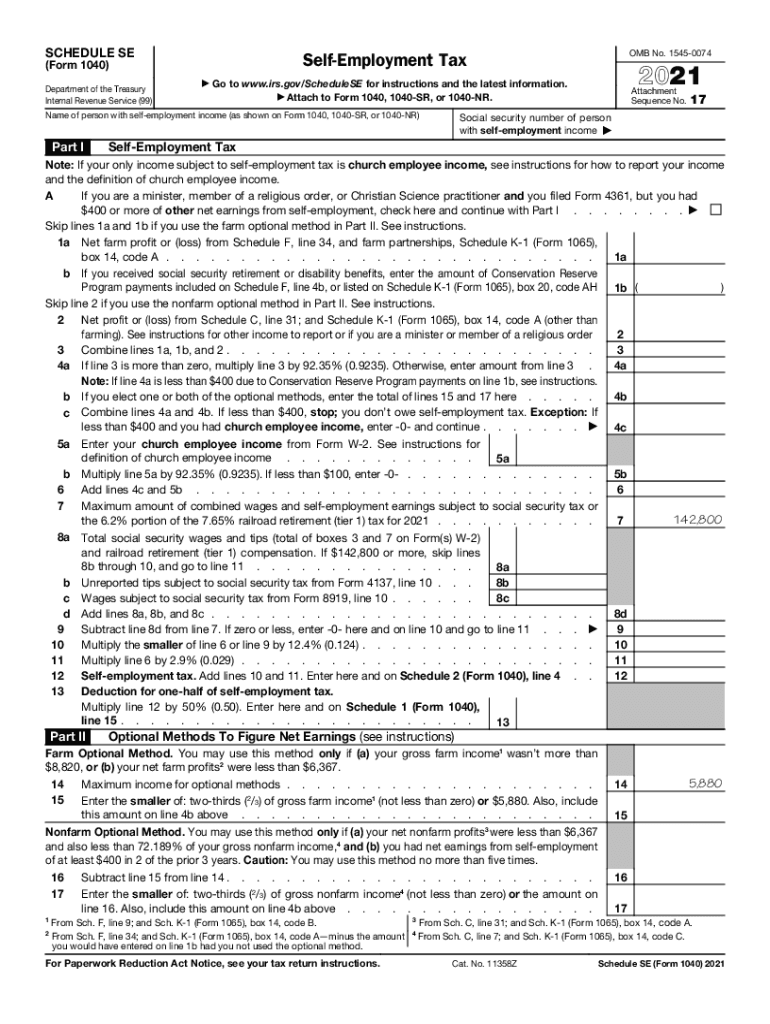

What is the Schedule SE?

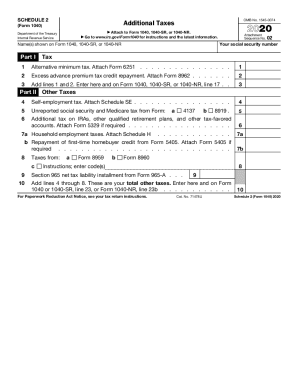

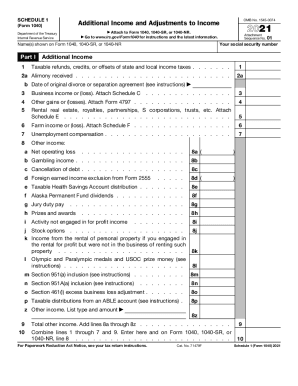

Form Schedule SE aims to help taxpayers calculate the tax due on net earnings from self-employment. The Social Security Administration needs information requested on the Schedule SE Form to establish the taxpayer’s social security benefits.

Who Fills out 1040 Schedule SE Tax Form?

The Internal Revenue Service expects taxpayers to file the report along with Form 1040 if:

- The taxpayer received net earnings exceeding $400 from self-employment (other than church employee income);

- The taxpayer received church employee income of $108.28 or more, other than from services performed as a minister or a member of a religious order.

An exception to filing Schedule SE: If you filed Form 4029 or Form 4361 and received IRS approval, you may not need to file Schedule SE.

Do any other Forms Accompany Schedule SE Tax Form?

This report serves as an attachment to the primary tax return Form 1040 or 1040NR and must be filed together with either document.

When is Schedule SE Due?

The deadline for Schedule SE submission coincides with the primary form’s due date it accompanies: Form 1040 or 1040NR. Therefore, most Americans must file their federal tax returns for the 2021 tax year by April 18, 2022.

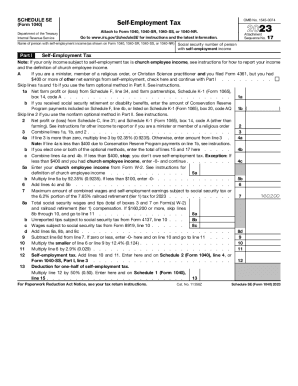

How do I Fill out Form 1040 Schedule SE?

The filer should get familiar with the document and prepare the required data to fill out the Self-Employment Tax Form. You can quickly download the fillable template from our website and review it online.

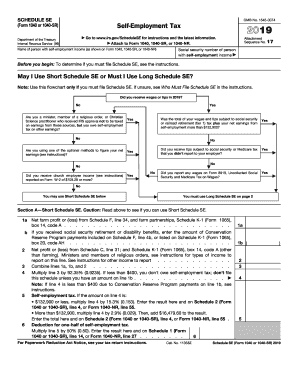

The document contains two options, with only one to be filed: a short and long version. A flowchart represents the taxpayer's circumstances to help decide which one is appropriate. You should complete only Schedule SE's first or second pages, whether a short or long copy is applicable.

The requested information varies, but all the fields include explanations on the form and in the Schedule SE Instructions.

Where do I Submit the Filled out Schedule SE Form?

You should deliver Form Schedule SE to the local IRS office with the primary tax return.