Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 1040 printable form?

The 1040 printable form refers to Form 1040, which is a U.S. federal tax form used by taxpayers to report their annual income and calculate their federal income tax liability. It is the main form used by individuals to file their personal income tax returns. The form can be printed out and filled manually, or it can be filled electronically using tax preparation software or online services.

Who is required to file 1040 printable form?

Any individual who meets the eligibility criteria for filing a federal income tax return in the United States is required to file a Form 1040. This includes:

1. U.S. citizens and residents regardless of their income level.

2. Non-resident aliens who have income from U.S. sources.

3. Non-resident aliens who are married to U.S. citizens or residents and choose to be treated as resident aliens for tax purposes.

4. Certain dependents who have unearned income exceeding a specific threshold (e.g., children receiving investment income).

5. Individuals with self-employment income of $400 or more.

6. Individuals who owe any special taxes, such as the alternative minimum tax or household employment taxes.

7. Those who had a total payroll tax credit or a recapture tax on the earned income credit.

8. Individuals who received advanced premium tax credits under the Affordable Care Act.

9. Anyone who wishes to claim certain deductions, credits, or adjustments to their income.

10. Couples filing separately with combined incomes exceeding a specified threshold.

It is essential to review the IRS guidelines or consult a tax professional to determine if an individual needs to file a Form 1040 or any other tax form.

What is the purpose of 1040 printable form?

The purpose of the 1040 printable form is to report an individual’s personal income and file their federal income tax return with the Internal Revenue Service (IRS) in the United States. It is used to calculate and report an individual's total income, deductions, credits, and the amount of taxes they owe or are owed as a refund. The 1040 form is generally filed annually by taxpayers to fulfill their tax obligations to the government.

What information must be reported on 1040 printable form?

The following information is typically reported on Form 1040:

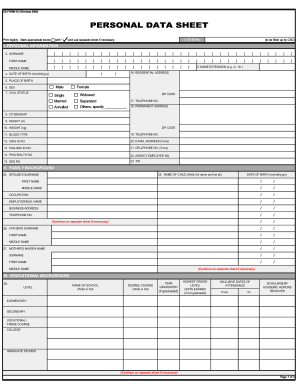

1. Personal information: Full name, address, and Social Security number (as well as spouse's information, if applicable).

2. Filing status: Indicate your filing status, such as Single, Head of Household, Married Filing Jointly, or Married Filing Separately.

3. Income: Report all sources of income, including wages, salaries, tips, self-employment income, rental income, interest, dividends, capital gains, pensions, and any other taxable income.

4. Adjustments to income: Report any deductions or adjustments to income, such as student loan interest, tuition and fees deduction, educator expenses, and contributions to retirement accounts.

5. Tax credits: Report any eligible tax credits, such as the child tax credit, earned income credit, education credits, and residential energy credits.

6. Taxes withheld: Report the amounts withheld from your income by your employer(s) for federal income tax, as well as any estimated tax payments made throughout the year.

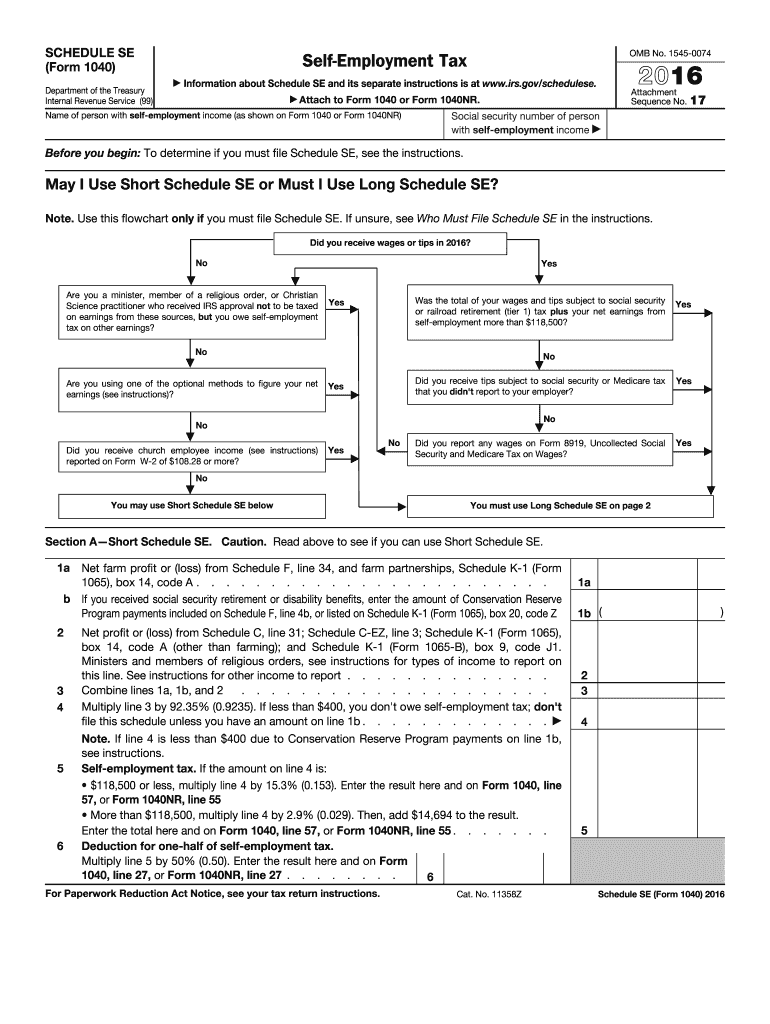

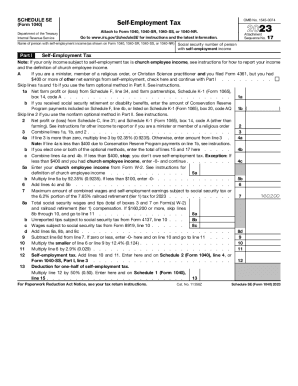

7. Other taxes: Report any additional taxes owed, such as self-employment tax, alternative minimum tax, or household employment taxes.

8. Payments and refunds: Report any refund received from the previous year, as well as any tax payments made with extensions or estimated payments.

9. Signature and date: Sign and date the form to certify that the information provided is accurate and complete.

Note: Depending on your specific circumstances, additional forms and schedules may need to be attached to Form 1040, such as Schedule C for self-employment income, Schedule A for itemized deductions, Schedule B for interest and dividends, or Schedule D for capital gains and losses.

When is the deadline to file 1040 printable form in 2023?

The deadline to file a 1040 printable form in 2023 is typically April 17th. However, please note that tax deadlines can sometimes be adjusted due to holidays or other circumstances. It is always recommended to confirm the exact deadline with the IRS or consult a tax professional.

What is the penalty for the late filing of 1040 printable form?

The penalty for late filing of the 1040 printable form (individual income tax return form) can vary depending on the circumstances.

If you fail to file your tax return by the deadline (usually April 15th), the penalty is usually calculated based on a percentage of the unpaid taxes. The penalty is generally 5% of the unpaid tax amount per month or part of a month the return is late, up to a maximum of 25% of the unpaid tax.

There is also a minimum penalty, which is the lesser of $435 or 100% of the unpaid tax, for returns filed more than 60 days late.

Keep in mind that if you are due a refund, there is no penalty for filing your return late. However, it is still in your best interest to file your tax return on time to avoid any potential penalties and to ensure timely receipt of any refunds.

How to fill out 1040 printable form?

To fill out a 1040 printable form, follow these steps:

1. Gather all necessary documents: W-2s or 1099s for income, receipts for deductions, Social Security numbers for yourself and any dependents, and any other relevant forms or documents.

2. Download and print the 1040 form from the official IRS website or use a tax software program that provides a printable version of the form.

3. Fill in your personal information at the top of the form, including your name, address, and Social Security number.

4. Provide information about your filing status in the appropriate section of the form.

5. Enter your income information in the designated sections, such as wages, salaries, tips, or any other income. Make sure to include all relevant forms and attachments as required.

6. Report any deductions or credits you are eligible for in the appropriate sections. This may include deductions for expenses such as medical expenses, mortgage interest, or student loan interest.

7. Calculate your taxable income by subtracting above-the-line deductions or adjustments from your total income.

8. Determine your tax liability using the tax tables or charts provided in the instructions. Or use tax software to calculate it automatically.

9. If you have already made tax payments throughout the year, such as through withholding or estimated tax payments, enter those amounts on the form.

10. Calculate the difference between your tax liability and the payments made. If you have overpaid, you will be eligible for a refund. If you owe more, you will need to make a payment.

11. Sign and date the form. If filing jointly, both spouses must sign.

12. Make a copy of the completed form and any supplemental documents for your records.

13. Mail the form to the appropriate IRS address, which can be found in the instructions. It is recommended to use certified mail or a reputable tax filing service for added security.

Note: The above steps are a general overview, and it is strongly advised to consult the official IRS instructions for the specific tax year you are filing. Additionally, if you have complex tax situations or are unsure about any information, it is advisable to seek guidance from a tax professional.

How do I edit 2016 1040 printable form straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit 2016 1040 printable form.

How do I edit 2016 1040 printable form on an iOS device?

Create, modify, and share 2016 1040 printable form using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I complete 2016 1040 printable form on an Android device?

Use the pdfFiller mobile app and complete your 2016 1040 printable form and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.