IRS 1040 - Schedule SE 2020 free printable template

Show details

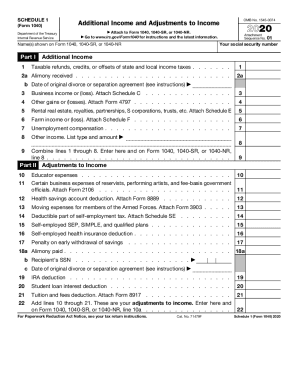

SCHEDULE SE Department of the Treasury Internal Revenue Service (99)2020Go to www.irs.gov/ScheduleSE for instructions and the latest information. Attach to Form 1040, 1040SR, or 1040NR. Name of person

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040 - Schedule SE

How to edit IRS 1040 - Schedule SE

How to fill out IRS 1040 - Schedule SE

Instructions and Help about IRS 1040 - Schedule SE

How to edit IRS 1040 - Schedule SE

Use pdfFiller to easily edit the IRS 1040 - Schedule SE form by uploading a blank copy, making necessary changes, and saving your updated document. This tool enables users to fill in personal details, adjust income sections, and more without hassle.

How to fill out IRS 1040 - Schedule SE

To fill out the IRS 1040 - Schedule SE form, follow these steps:

01

Download the form from the IRS website or use pdfFiller to access it directly.

02

Gather relevant tax documents, including records of income and business expenses.

03

Complete the identification section at the top of the form with your name and Social Security number.

04

Fill in the applicable income sections based on your earnings from self-employment.

05

Calculate your self-employment tax using the provided worksheets in the form.

About IRS 1040 - Schedule SE 2020 previous version

What is IRS 1040 - Schedule SE?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040 - Schedule SE 2020 previous version

What is IRS 1040 - Schedule SE?

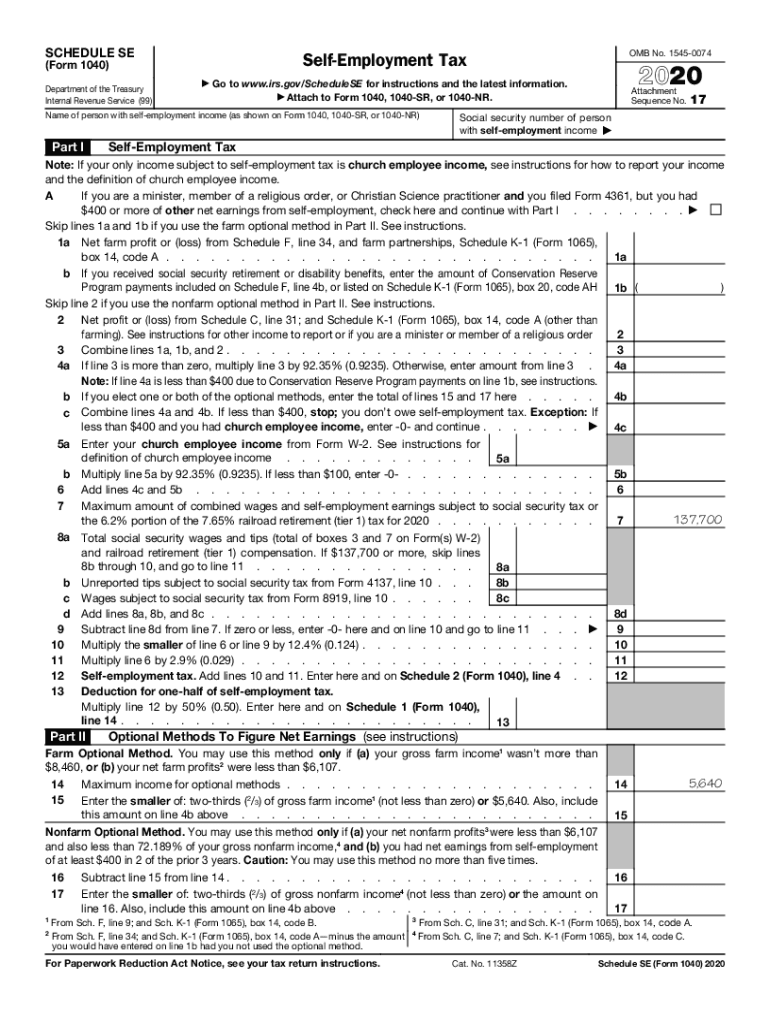

IRS 1040 - Schedule SE is a tax form used by self-employed individuals to calculate their self-employment tax. This form is required for reporting income earned from self-employment and for establishing eligibility for Social Security benefits.

What is the purpose of this form?

The purpose of IRS 1040 - Schedule SE is to compute the self-employment tax owed by individuals who earn income through business activities or freelance work. The self-employment tax comprises Social Security and Medicare taxes, which fund federal programs that provide benefits for retired and disabled individuals.

Who needs the form?

Individuals who have net earnings of $400 or more from self-employment activities need to file IRS 1040 - Schedule SE. This includes sole proprietors, independent contractors, and members of LLCs or partnerships who receive income from self-employment.

When am I exempt from filling out this form?

You may be exempt from filing IRS 1040 - Schedule SE if your net earnings from self-employment are below $400. Additionally, some individuals engaged in certain religious occupations may also qualify for exemptions based on their beliefs.

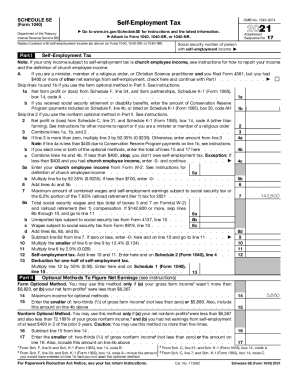

Components of the form

The IRS 1040 - Schedule SE consists of several parts, including the calculation of self-employment income, adjustments for expenses, and the computation of the self-employment tax. The form is divided into two sections, with Part I typically for those with earnings from self-employment, and Part II for church employees who may have different tax rules.

What are the penalties for not issuing the form?

Failing to file IRS 1040 - Schedule SE when required can lead to penalties, which may include fines based on the unpaid amount and interest charges. Continued failure to comply can lead to additional penalties and complications with future tax filings.

What information do you need when you file the form?

When filing the IRS 1040 - Schedule SE, you will need details regarding your self-employment income. This includes gross receipts, any expenses related to the business, and relevant tax documents. Accurate bookkeeping throughout the year is essential for correctly completing this form.

Is the form accompanied by other forms?

IRS 1040 - Schedule SE is typically included with Form 1040, the U.S. Individual Income Tax Return. Filers may also need to use other schedules and forms to report additional types of income or deductions depending on their specific tax situation.

Where do I send the form?

Forms submitted that include IRS 1040 - Schedule SE need to be mailed to the designated IRS address based on your location and whether you are including a payment. For e-filers, the form can be submitted electronically as part of the overall tax return through IRS-approved software.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Great so far. Confused a bit as to the # of documents that I can store versus folders.

Love being able to fill out forms on computer vs printing out and handwriting in info that is sloppy and messy.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.