UK HMRC Form IC1 2018-2025 free printable template

Show details

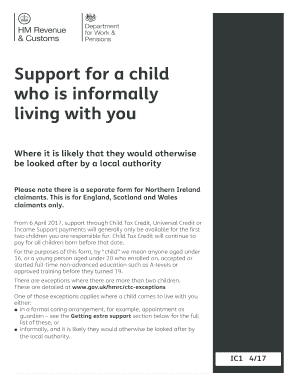

Support for a child who is informally living with you Where it is likely that they would otherwise be looked after by a local authority Please note there is a separate form for Northern Ireland claimants. This form is for England Scotland and Wales claimants only. From 6 April 2017 support through Child Tax Credit Universal Credit or Income Support payments will generally only be available for the first two children you are responsible for. In general you will continue to receive a child...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form ic1

Edit your hmrc ic1 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hmrc support child form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing united kingdom majesty revenue customs online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit united kingdom hmrc support form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC Form IC1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form ic1 form

How to fill out UK HMRC Form IC1

01

Obtain the HMRC Form IC1 from the official HMRC website or through your tax office.

02

Fill in your personal details, including your name, address, and National Insurance number.

03

Indicate the reason for filling out the form by selecting the relevant option.

04

Provide details about your previous income and any applicable tax reliefs.

05

Ensure you have the necessary supporting documents ready, such as payslips or tax returns.

06

Double-check all information for accuracy before submitting the form.

07

Sign and date the form to certify that the information provided is true and correct.

08

Submit the completed form either online or by post according to the instructions provided.

Who needs UK HMRC Form IC1?

01

Individuals who need to claim a tax refund due to overpaid taxes.

02

People who have had changes in their circumstances affecting their tax status.

03

Anyone seeking to rectify their tax position with HMRC after receiving incorrect information.

Fill

form ic1 print

: Try Risk Free

People Also Ask about form ic1 download

Who gets Child Benefit in shared custody UK?

Shared custody If you share custody of a child it is the person with 'main responsibility' who is normally eligible to claim Child Benefit, Child Tax Credit or the Universal Credit child element for that child.

Can a non British citizen claim Child Benefit?

If you're not a UK citizen You can only get Child Benefit if your immigration status lets you claim public funds. In some situations you also need a 'right to reside'. You can claim public funds if you have any of the following: British or Irish citizenship.

Is there a form for Child Tax Credit?

How to Claim This Credit. You can claim the Child Tax Credit by entering your children and other dependents on Form 1040, U.S. Individual Income Tax Return, and attaching a completed Schedule 8812, Credits for Qualifying Children and Other Dependents.

Can you claim UK Child Benefit if you live abroad?

If you and your partner live in different countries you may qualify for Child Benefit or its equivalent in both. The country the child lives in will usually pay the benefit. If the benefit is more in the other country, that country will pay you extra.

Who is eligible for Child Benefit in UK?

You normally qualify for Child Benefit if you're responsible for a child under 16 (or under 20 if they stay in approved education or training) and you live in the UK.

How do I get Child Tax Credit UK?

You can only make a claim for Child Tax Credit if you already get Working Tax Credit. If you cannot apply for Child Tax Credit, you can apply for Universal Credit instead. You might be able to apply for Pension Credit if you and your partner are State Pension age or over.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my uk ic1 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your hmrc ic1 edit and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Can I edit hmrc ic1 living on an Android device?

You can edit, sign, and distribute hmrc ic1 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I fill out form ic1 blank on an Android device?

Complete your uk form ic1 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is UK HMRC Form IC1?

UK HMRC Form IC1 is a form used to report information about the inheritance tax chargeable on the transfer of assets.

Who is required to file UK HMRC Form IC1?

Individuals who have transferred assets that may be subject to inheritance tax are required to file UK HMRC Form IC1.

How to fill out UK HMRC Form IC1?

To fill out UK HMRC Form IC1, you need to provide personal details, information about the deceased, details of the assets and their values, and any relevant exemptions or reliefs.

What is the purpose of UK HMRC Form IC1?

The purpose of UK HMRC Form IC1 is to declare the value of the estate and calculate any inheritance tax due on the transfer of assets.

What information must be reported on UK HMRC Form IC1?

Information that must be reported on UK HMRC Form IC1 includes the deceased person's name, date of death, details of the estate, asset valuations, and any gifts made in the seven years prior to death.

Fill out your ic1 form 2018-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hmrc Form ic1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.