OK OTC 901 2019 free printable template

Show details

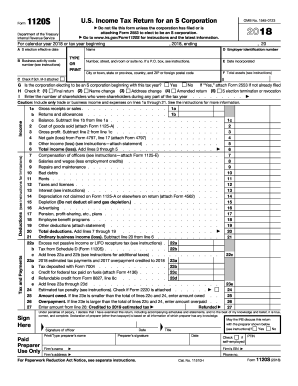

OTC 901 Tax Year 2019 Revised 11-2018 State of Oklahoma Business Personal Property Rendition Return to County Assessor - Filing Date January 1 - Delinquent Penalties after March 15 PP Part One Start Here RE Phone Number Email Address Owner/DBA Mailing Address City State ZIP Are you renting or leasing this business location Yes No If yes do you own any real estate improvements at this location When did you start business at this location Date // Report Only Tangible Assets FEIN Type of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK OTC 901

Edit your OK OTC 901 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK OTC 901 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OK OTC 901 online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit OK OTC 901. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK OTC 901 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OK OTC 901

How to fill out OK OTC 901

01

Obtain the OK OTC 901 form from the relevant regulatory body or their website.

02

Fill in your personal details, including your name, address, and contact information at the top of the form.

03

Provide the necessary identification information, such as your Social Security number or other relevant identifiers.

04

Detail the a clear description of the product or service involved in the transaction.

05

Specify the quantities and values of the items included in the transaction.

06

Indicate any applicable dates, such as the transaction date and delivery date.

07

Review all entries for accuracy and completeness.

08

Sign and date the form at the designated section.

09

Submit the completed form to the appropriate authority as required.

Who needs OK OTC 901?

01

Individuals or businesses that engage in over-the-counter (OTC) transactions that require reporting or compliance.

02

Regulated entities that need to document their OTC trades for transparency and regulatory oversight.

03

Financial advisors or accountants who assist clients in managing their OTC transactions.

Fill

form

: Try Risk Free

People Also Ask about

How do I fill form I-901 online?

Form I-901 Access form I-901 online. List your name exactly as it appears on your I-20 document. You will need the "School Code," which is also on your I-20. Check that the information is correct. Print at least 2 copies of the receipt. Keep your receipt with your other important immigration documents.

What is an I-901 form?

I-901, FEE REMITTANCE FOR CERTAIN F, J AND M NONIMMIGRANTS This form is used to pay the fee to support the F, M, and J nonimmigrant reporting system authorized by Public Law 104-208, Subtitle D, Section 641.

How long does it take to process I-901?

Payment of the fee is valid in the SEVIS database for a maximum of 12 months. Note: It can take from two to five weeks if paying by mail to process, so planning is essential, if this payment method is selected.

How much is form I-901?

Fee Amounts DescriptionAmountI-901 SEVIS Fee F or M visa applicants (full payment)$350I-901 SEVIS Fee J visa applicants (full payment)$220I-901 SEVIS Fee special J-visa categories (subsidized payment)$35I-901 SEVIS Fee government visitor (no payment)$0 Jan 7, 2021

How much is the I-901 fee?

Fee Amounts DescriptionAmountI-901 SEVIS Fee F or M visa applicants (full payment)$350I-901 SEVIS Fee J visa applicants (full payment)$220I-901 SEVIS Fee special J-visa categories (subsidized payment)$35I-901 SEVIS Fee government visitor (no payment)$0 Jan 7, 2021

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in OK OTC 901 without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit OK OTC 901 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for signing my OK OTC 901 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your OK OTC 901 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit OK OTC 901 on an Android device?

You can make any changes to PDF files, such as OK OTC 901, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is OK OTC 901?

OK OTC 901 is a regulatory form used for reporting over-the-counter transactions in the state of Oklahoma.

Who is required to file OK OTC 901?

Entities engaged in over-the-counter transactions that meet certain criteria set by state regulations are required to file OK OTC 901.

How to fill out OK OTC 901?

To fill out OK OTC 901, include the necessary transaction details, such as the parties involved, transaction amounts, and dates. Follow the specific instructions provided by the Oklahoma Tax Commission.

What is the purpose of OK OTC 901?

The purpose of OK OTC 901 is to ensure compliance with state regulations concerning over-the-counter transactions and to maintain accurate records for tax assessments.

What information must be reported on OK OTC 901?

OK OTC 901 requires reporting information such as transaction date, parties involved, transaction amounts, and any applicable tax details.

Fill out your OK OTC 901 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK OTC 901 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.