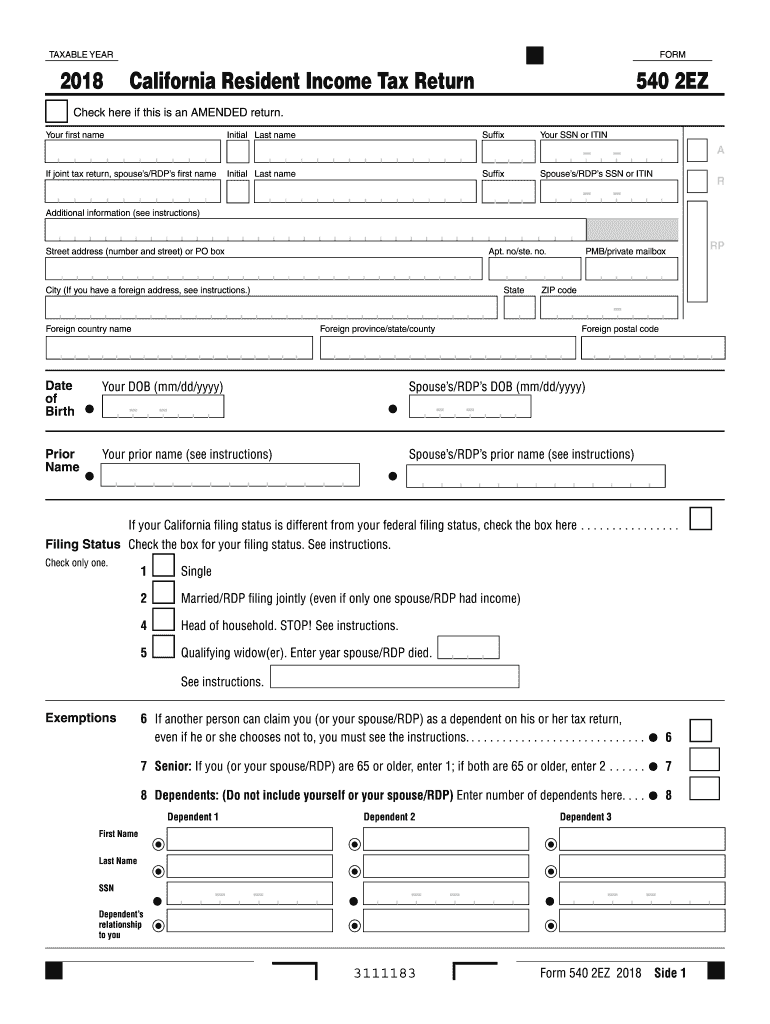

CA FTB 540 2EZ 2018 free printable template

Instructions and Help about CA FTB 540 2EZ

How to edit CA FTB 540 2EZ

How to fill out CA FTB 540 2EZ

About CA FTB 540 2EZ 2018 previous version

What is CA FTB 540 2EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about CA FTB 540 2EZ

What should I do if I made a mistake on my CA FTB 540 2EZ after submission?

If you discover an error after submitting your CA FTB 540 2EZ, you should file an amended return as soon as possible. You can use form 540X for this purpose. Ensure that you clearly indicate the corrections and provide any necessary documentation to support your changes.

How can I check the status of my CA FTB 540 2EZ filing?

To verify the status of your CA FTB 540 2EZ, visit the California FTB website and use their online services for tracking your tax return. You will need your social security number, the exact amount of the refund, or the amount paid, to access specific information regarding your filing.

Are there any common errors I should be aware of when filing the CA FTB 540 2EZ?

Yes, common mistakes include incorrect calculations, entering Social Security numbers inaccurately, and missing signatures. Double-check all figures and ensure everything is filled out completely to minimize errors when filing your CA FTB 540 2EZ.

What should I do if my e-filed CA FTB 540 2EZ is rejected?

If your e-filed CA FTB 540 2EZ is rejected, you will receive an error code outlining the issue. Review the error message, correct the mistake, and attempt to resubmit your filing. Be sure to check for any specific requirements related to the error for a smooth resubmission.

How long should I retain my records related to CA FTB 540 2EZ?

It's recommended that you retain records related to your CA FTB 540 2EZ for at least four years from the date of filing. This includes all supporting documents, as they may be needed for future reference or in case of an audit.

See what our users say