Get the free Retirement Savings Plan - BorgWarner

Show details

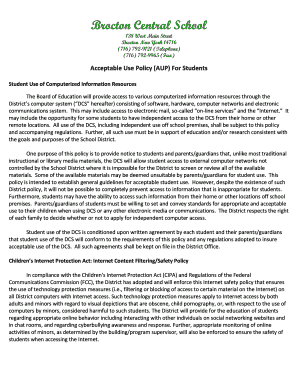

FOREWARNED INC.COMPREHENSIVE MEDICAL BENEFITS Divested Retiree B&B Hourly Medicare Plan EFFECTIVE DATE: January 1, 2016ASO114 IND8M 3207248This document printed in July 2016 takes the place of any

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retirement savings plan

Edit your retirement savings plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retirement savings plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit retirement savings plan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit retirement savings plan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out retirement savings plan

How to fill out retirement savings plan

01

To fill out a retirement savings plan, follow these steps:

02

Start by gathering all your financial information, including your current income, expenses, assets, and debts.

03

Determine how much money you will need for your retirement by considering factors like your desired lifestyle, expected expenses, and healthcare costs.

04

Calculate your current savings and investments that will contribute towards your retirement fund.

05

Set realistic goals for your retirement savings, taking into account your age, time horizon, and risk tolerance.

06

Research and choose the appropriate retirement savings plan, such as an IRA (Individual Retirement Account) or a 401(k) plan offered by your employer.

07

Understand the contribution limits and tax implications associated with the chosen retirement savings plan.

08

Allocate your savings among different investment options based on your risk profile and investment preferences.

09

Regularly review and update your retirement savings plan to ensure it aligns with your changing financial circumstances.

10

Consider seeking professional financial advice to help optimize your retirement savings strategy.

11

Monitor and track the progress of your retirement savings plan regularly and make adjustments as needed.

Who needs retirement savings plan?

01

A retirement savings plan is beneficial for individuals who:

02

- Want to secure their financial future and maintain a comfortable lifestyle after retirement.

03

- Aim to accumulate enough money to cover living expenses, healthcare, and other costs during retirement.

04

- Have long-term financial goals and are proactive about saving for retirement.

05

- Wish to take advantage of tax benefits and potential investment growth offered by retirement savings plans.

06

- Do not have access to employer-sponsored retirement plans and need alternative options to save for retirement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit retirement savings plan from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including retirement savings plan, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make changes in retirement savings plan?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your retirement savings plan to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit retirement savings plan in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing retirement savings plan and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is retirement savings plan?

A retirement savings plan is a financial plan designed to help individuals save and invest for their retirement.

Who is required to file retirement savings plan?

Employers are typically required to file retirement savings plan on behalf of their employees.

How to fill out retirement savings plan?

Retirement savings plan can be filled out by providing information about the contributions made, investment options chosen, and any other relevant details.

What is the purpose of retirement savings plan?

The purpose of a retirement savings plan is to help individuals save and invest for their retirement, ensuring financial security in their later years.

What information must be reported on retirement savings plan?

Information such as contributions made, investment options selected, and account balances must typically be reported on a retirement savings plan.

Fill out your retirement savings plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retirement Savings Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.