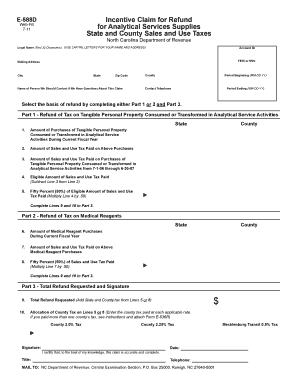

NC E-536R 2018 free printable template

Show details

E536R Weill 818 Account Schedule of County Sales and Use Taxes for Claims for Refund Period Ending (MIDDAY)County and CodeAlamance Alexander Allegheny Anson Ashe Avery Beaufort Bertie Blade Brunswick

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NC E-536R

Edit your NC E-536R form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC E-536R form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NC E-536R online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NC E-536R. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC E-536R Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC E-536R

How to fill out NC E-536R

01

Start by downloading the NC E-536R form from the official website.

02

Enter your personal information in the designated sections including name, address, and contact details.

03

Provide your Social Security number or taxpayer identification number as required.

04

Fill in the relevant tax year for which you are filing using the form.

05

Include details of your income sources as specified on the form.

06

If applicable, list any deductions or credits you are claiming.

07

Review all entries for accuracy and completeness before submission.

08

Sign and date the form where indicated.

09

Submit the completed form by the deadline outlined by the state.

Who needs NC E-536R?

01

Individuals who are residents of North Carolina and need to file their income tax return.

02

Taxpayers seeking to report their income and calculate their tax obligations.

03

Those who are applying for refunds or credits related to state taxes.

04

Anyone required to report other income such as self-employment or rental income within the state.

Fill

form

: Try Risk Free

People Also Ask about

What is NC d400?

2021 D-400 Individual Income Tax Return.

What is the NC sales tax rate for 2022?

North Carolina has a 4.75 percent state sales tax rate, a max local sales tax rate of 2.75 percent, and an average combined state and local sales tax rate of 6.98 percent. North Carolina's tax system ranks 11th overall on our 2022 State Business Tax Climate Index.

What state has a 7 percent sales tax?

The highest state-level sales tax in the USA is 7%, which is charged by five states - Indiana, Tennessee, New Jersey, Mississippi, and Rhode Island.

What is E 536 NC?

Form E-536, Schedule of County Sales and Use Taxes (October 2020 - September 2022) | NCDOR.

What is food tax in Wake County North Carolina?

A 2.00% local rate of sales or use tax applies to retail sales and purchases for storage, use, or consumption of qualifying food. The transit and other local rates do not apply to qualifying food.

Is NC sales tax 7%?

North Carolina sales tax details The North Carolina (NC) state sales tax rate is currently 4.75%. Depending on local municipalities, the total tax rate can be as high as 7.5%. County and local taxes in most areas bring the sales tax rate to 6.75%–7% in most counties but some can be as high as 7.5%.

Are taxes 7 percent?

Tax Districts The statewide tax rate is 7.25%. In most areas of California, local jurisdictions have added district taxes that increase the tax owed by a seller. Those district tax rates range from 0.10% to 1.00%. Some areas may have more than one district tax in effect.

What is the 7.25% tax in NC for?

The 7.25% sales tax rate in Raleigh consists of 4.75% North Carolina state sales tax, 2% Wake County sales tax and 0.5% Special tax. There is no applicable city tax. You can print a 7.25% sales tax table here.

What is NC sales tax rate 2022?

North Carolina sales tax details The North Carolina (NC) state sales tax rate is currently 4.75%. Depending on local municipalities, the total tax rate can be as high as 7.5%. County and local taxes in most areas bring the sales tax rate to 6.75%–7% in most counties but some can be as high as 7.5%.

What percentage is NC sales tax?

Retail sales of tangible personal property are subject to the 4.75% State sales or use tax. Items subject to the general rate are also subject to the 2.25% local rate of tax that is levied by all counties in North Carolina. Sales taxes are not charged on services or labor.

What is Wake County NC sales tax rate 2022?

The minimum combined 2022 sales tax rate for Wake County, North Carolina is 7.25%. This is the total of state and county sales tax rates. The North Carolina state sales tax rate is currently 4.75%.

What is the sales tax rate in Wake County NC?

The minimum combined 2022 sales tax rate for Wake County, North Carolina is 7.25%. This is the total of state and county sales tax rates. The North Carolina state sales tax rate is currently 4.75%.

What is a NC E 500?

Use Form E-500 to file and report your North Carolina State, local and transit sales and use taxes.

What is the sales tax rate for Raleigh NC?

What is the sales tax rate in Raleigh, North Carolina? The minimum combined 2022 sales tax rate for Raleigh, North Carolina is 7.25%. This is the total of state, county and city sales tax rates. The North Carolina sales tax rate is currently 4.75%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NC E-536R online?

Completing and signing NC E-536R online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I edit NC E-536R on an iOS device?

Create, modify, and share NC E-536R using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How can I fill out NC E-536R on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your NC E-536R from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is NC E-536R?

NC E-536R is a tax form used by certain businesses in North Carolina to report sales made to out-of-state purchasers.

Who is required to file NC E-536R?

Businesses that make sales of tangible personal property, digital property, or services to out-of-state purchasers are required to file NC E-536R.

How to fill out NC E-536R?

To fill out NC E-536R, businesses need to complete the required sections including business identification, sales details, and applicable taxes, ensuring all amounts are accurately calculated.

What is the purpose of NC E-536R?

The purpose of NC E-536R is to report sales that are exempt from North Carolina sales tax due to being shipped outside the state.

What information must be reported on NC E-536R?

Information that must be reported includes the seller's details, buyer's information, item descriptions, sale amounts, and any state tax exemption certificates.

Fill out your NC E-536R online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC E-536r is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.