Get the free CT41G New Company Details - RHK

Show details

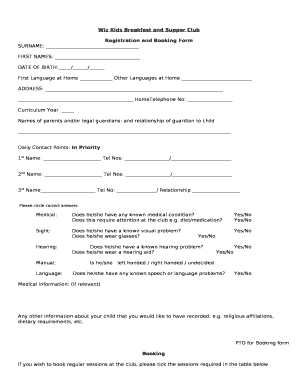

Corporation Tax New Company Details Issued by Telephone number Date of issue Reference Only use this form if the company is active please read the Notes For New Companies Please complete this form

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ct41g new company details

Edit your ct41g new company details form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct41g new company details form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ct41g new company details online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ct41g new company details. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ct41g new company details

How to fill out CT41G new company details:

01

Begin by accessing the CT41G form, which can typically be found on the website of your country's tax authority or by contacting the appropriate tax office.

02

Provide the necessary information on the form, starting with the basic details of your company such as its legal name, address, and contact information. This section usually includes fields for the registered office, trading address, telephone number, and email address.

03

Fill in the information about the nature of your business. This may include selecting the appropriate industry code or providing a brief description of your company's activities.

04

Enter the date when your company commenced business operations. This is typically the date of incorporation or when the company actually started trading.

05

Specify the type of accounting period your company follows. This could be either a calendar year or a different fiscal year-end.

06

If your company is part of a group, provide details of the group structure if required. This may include the names and registration numbers of other group companies.

07

If applicable, indicate whether your company is involved in any partnerships or joint ventures, and provide the necessary details.

08

Disclose any previous tax registration details, including any previous tax reference numbers or VAT registration numbers that may have been issued to your company.

09

Sign and date the form, certifying that the information provided is accurate and complete to the best of your knowledge.

Who needs CT41G new company details:

01

Any newly established company that intends to engage in business activities and is required to register for tax purposes.

02

Companies that are changing their registered office or contact information.

03

Businesses that are part of a group structure and need to provide information about their affiliated companies.

04

Companies involved in partnerships or joint ventures that require registration for taxation purposes.

05

Entities that have undergone mergers, acquisitions, or restructures, and need to update their tax registration details.

Remember to verify the specific requirements of your country's tax authority regarding the submission of CT41G new company details, as the process may vary.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get ct41g new company details?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific ct41g new company details and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for signing my ct41g new company details in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your ct41g new company details and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit ct41g new company details on an iOS device?

You certainly can. You can quickly edit, distribute, and sign ct41g new company details on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is ct41g new company details?

The ct41g new company details refer to the form that new companies in some jurisdictions are required to file to provide information such as company name, address, directors, shareholders, etc.

Who is required to file ct41g new company details?

New companies in certain jurisdictions are required to file ct41g new company details.

How to fill out ct41g new company details?

One can fill out the ct41g new company details form by providing accurate information about the company name, address, directors, shareholders, etc.

What is the purpose of ct41g new company details?

The purpose of ct41g new company details is to make sure that the relevant authorities have up-to-date information about new companies in the jurisdiction.

What information must be reported on ct41g new company details?

The information reported on ct41g new company details may include company name, address, directors, shareholders, etc.

Fill out your ct41g new company details online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ct41g New Company Details is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.