MI DoT 4640 2018 free printable template

Show details

Reset Form

Michigan Department of Treasury

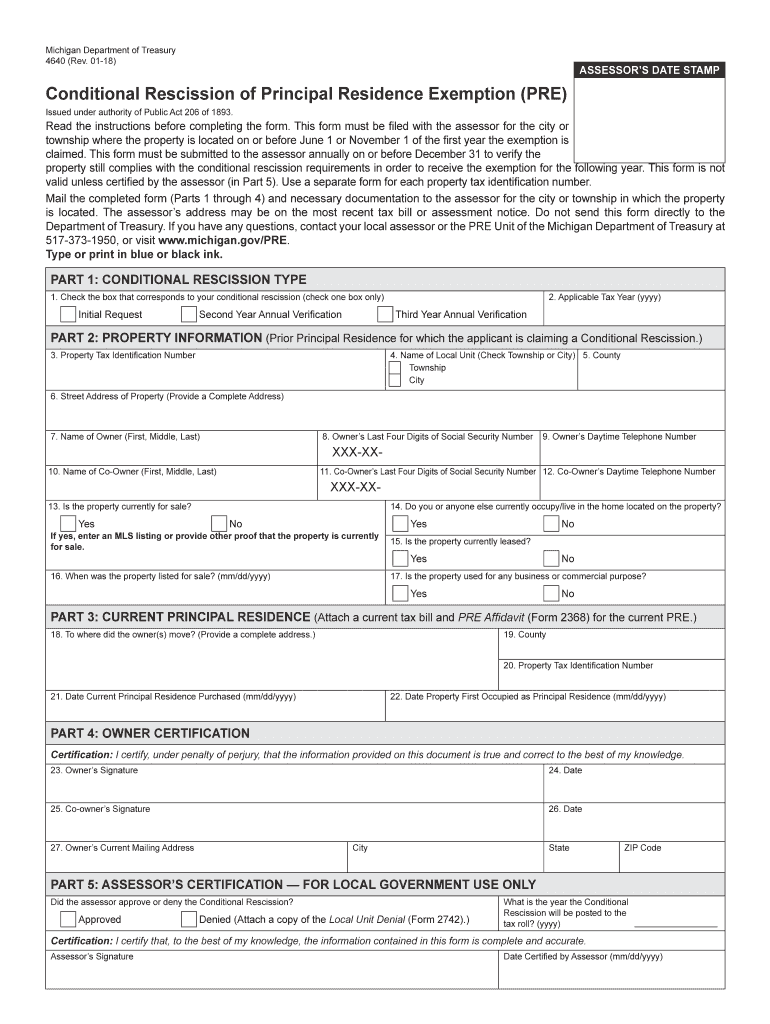

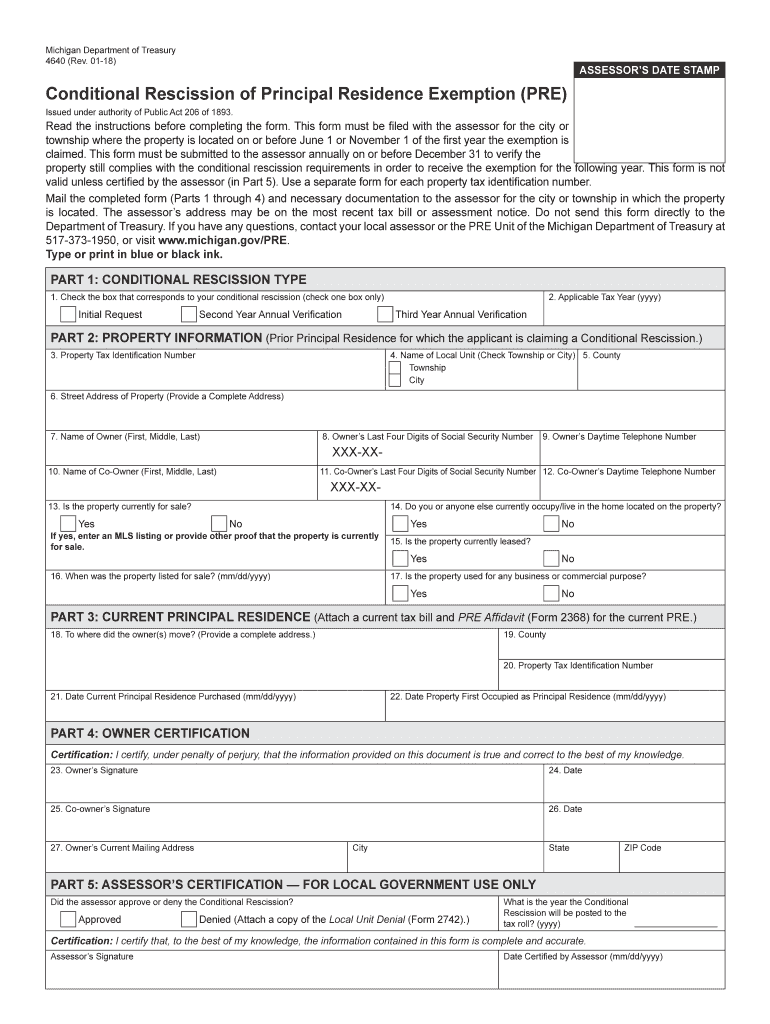

4640 (Rev. 0118)ASSESSORS DATE STAMPConditional Rescission of Principal Residence Exemption (PRE)

Issued under authority of Public Act 206 of 1893. Read

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI DoT 4640

Edit your MI DoT 4640 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI DoT 4640 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI DoT 4640 online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MI DoT 4640. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI DoT 4640 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI DoT 4640

How to fill out MI DoT 4640

01

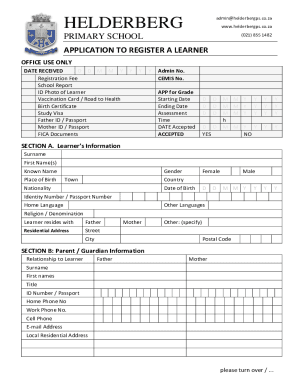

Obtain a copy of MI DoT 4640 form from the Michigan Department of Transportation website or your local office.

02

Read the instructions provided with the form carefully to understand the requirements.

03

Fill out your personal information section, including your name, address, and contact information.

04

Specify the purpose of the application at the designated section.

05

Complete the vehicle information section with details such as make, model, year, and Vehicle Identification Number (VIN).

06

Provide any additional information requested, such as lienholder information or insurance details, if applicable.

07

Review the filled form for accuracy and completeness before submission.

08

Sign and date the form as required.

09

Submit the completed form to the appropriate Michigan Department of Transportation office either in person or by mail.

Who needs MI DoT 4640?

01

Individuals applying for a vehicle registration or title in Michigan.

02

People who need to update their vehicle information with the Michigan Department of Transportation.

03

Owners of vehicles that require a new title or have undergone ownership transfer.

Fill

form

: Try Risk Free

People Also Ask about

What are the rules for homestead exemption in Michigan?

You were a resident of Michigan for at least six months during the year. You own or are contracted to pay rent and occupy a Michigan homestead on which property taxes were levied. If you own your home, your taxable value is $143,000 or less. Your total household resources are $63,000 or less.

How much is the principal residence exemption in Michigan?

What is the Michigan Principal Residence Exemption? In Michigan, the PRE is a reduction of 18 mils each year on your property taxes on your primary residence. A mil is defined as $1 of tax per $1,000 of Taxable Value. Millage data can be found on the State of Michigan site here.

What is the homeowners exemption in Michigan?

Homeowners may be granted a full (100%) or partial (50%) exemption from their property taxes. Each applicant must own and occupy the property as his/her primary homestead as of December 31, 2021, and meet specific income requirements.

At what age do you stop paying property taxes in Michigan?

Applicant or spouse of applicant must reach age 65 by December 31 of the tax year.

How do you prove homestead in Michigan?

To claim a PRE, the property owner must submit a Principal Residence Exemption (PRE) Affidavit, Form 2368, to the assessor for the city or township in which the property is located.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get MI DoT 4640?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the MI DoT 4640. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for the MI DoT 4640 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your MI DoT 4640 in minutes.

How do I complete MI DoT 4640 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your MI DoT 4640. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is MI DoT 4640?

MI DoT 4640 is a form used by the Michigan Department of Transportation to report various transportation-related data.

Who is required to file MI DoT 4640?

Individuals, companies, or organizations that are involved in transportation operations and meet specific criteria set by the Michigan Department of Transportation are required to file MI DoT 4640.

How to fill out MI DoT 4640?

To fill out MI DoT 4640, follow the instructions provided on the form, including entering the required information accurately and completely. It may also be helpful to consult the guidance provided by the Michigan Department of Transportation.

What is the purpose of MI DoT 4640?

The purpose of MI DoT 4640 is to collect data for transportation planning and management, ensuring compliance with state transportation regulations.

What information must be reported on MI DoT 4640?

MI DoT 4640 requires reporting information such as vehicle usage, transportation operations, environmental impact data, and other relevant metrics as specified by the Michigan Department of Transportation.

Fill out your MI DoT 4640 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI DoT 4640 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.