MS DoR 72-010 2018 free printable template

Show details

Form 72-010-18-3-1-000 Rev. 07/18 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 Mississippi 720101831000 SALES SPECIAL Tax Return 1a. TAX CODE - GENERAL SALES Name X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9X9 2a. Gross Income or Sales 9999999 Account ID 3a. Deductions From Schedule on Back Filing Period Ending 4a. Taxable Gross...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MS DoR 72-010

Edit your MS DoR 72-010 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MS DoR 72-010 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MS DoR 72-010 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MS DoR 72-010. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MS DoR 72-010 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MS DoR 72-010

How to fill out MS DoR 72-010

01

Obtain the MS DoR 72-010 form from the official website or designated office.

02

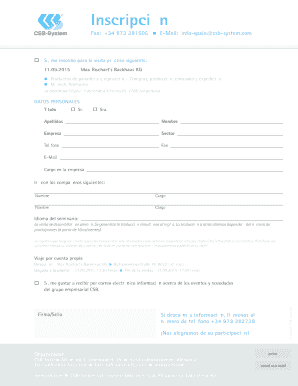

Start with providing your personal information including name, address, and contact number in the designated sections.

03

Fill out the date and time of the incident/event in the appropriate fields.

04

Describe the incident or event in detail, making sure to include all pertinent facts.

05

Attach any supporting documents or evidence, if necessary, in the specified sections.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form at the bottom.

Who needs MS DoR 72-010?

01

The MS DoR 72-010 form is needed by individuals or organizations involved in certain incidents or events requiring documentation for records or reporting purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between tax code 75 and 77 in Mississippi?

Code 75 is the general use tax code. Code 77 is the code that you want if you are filing a “sales tax” return as it is normally called. Code 75 is what we think of as “use tax”. Mississippi just uses slightly different language, but you will get used to it.

Do I need to collect sales tax in Mississippi?

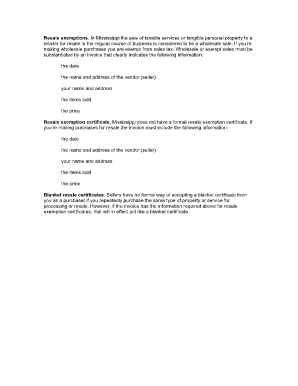

Yes, Mississippi imposes a tax on the sale of tangible personal property and various services. The general tax rate is 7%; however, there are reduced rates for certain sales and there are exemptions provided by law.

What has no sales tax in Mississippi?

The 2022 Sales Tax Holiday takes place between 12:01 a.m. Friday, July 29, and 12:00 Midnight Saturday, July 30. With inflation squeezing all our budgets, tax-free weekends can be a smart time to shop and save.

Does Mississippi have a state sales tax?

Sales Tax. All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax (7%) unless the law exempts the item or provides a reduced rate of tax for an item.

What state has no state sales tax?

The only five with no state sales tax are Alaska, Oregon, Montana, Delaware, and New Hampshire.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my MS DoR 72-010 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your MS DoR 72-010 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit MS DoR 72-010 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing MS DoR 72-010 right away.

Can I edit MS DoR 72-010 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign MS DoR 72-010 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is MS DoR 72-010?

MS DoR 72-010 is a form used for reporting specific tax-related information to the Mississippi Department of Revenue.

Who is required to file MS DoR 72-010?

Individuals or businesses that meet certain income thresholds or engage in specific transactions may be required to file MS DoR 72-010.

How to fill out MS DoR 72-010?

To fill out MS DoR 72-010, carefully follow the instructions provided with the form, including entering personal information, income details, and any applicable deductions.

What is the purpose of MS DoR 72-010?

The purpose of MS DoR 72-010 is to collect information necessary for the assessment and collection of state taxes.

What information must be reported on MS DoR 72-010?

The information that must be reported on MS DoR 72-010 includes the taxpayer's name, address, Social Security number or taxpayer identification number, total income, deductions, and any other relevant financial data.

Fill out your MS DoR 72-010 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MS DoR 72-010 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.