Get the free 1 if you don't have one text 2

Show details

Amended

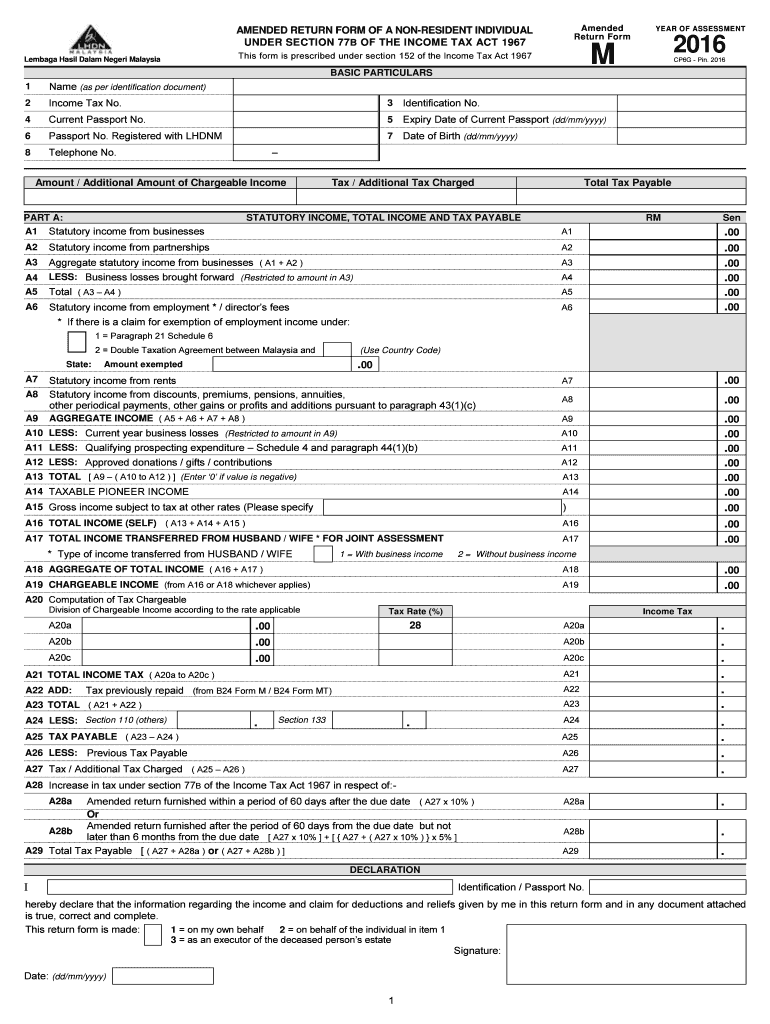

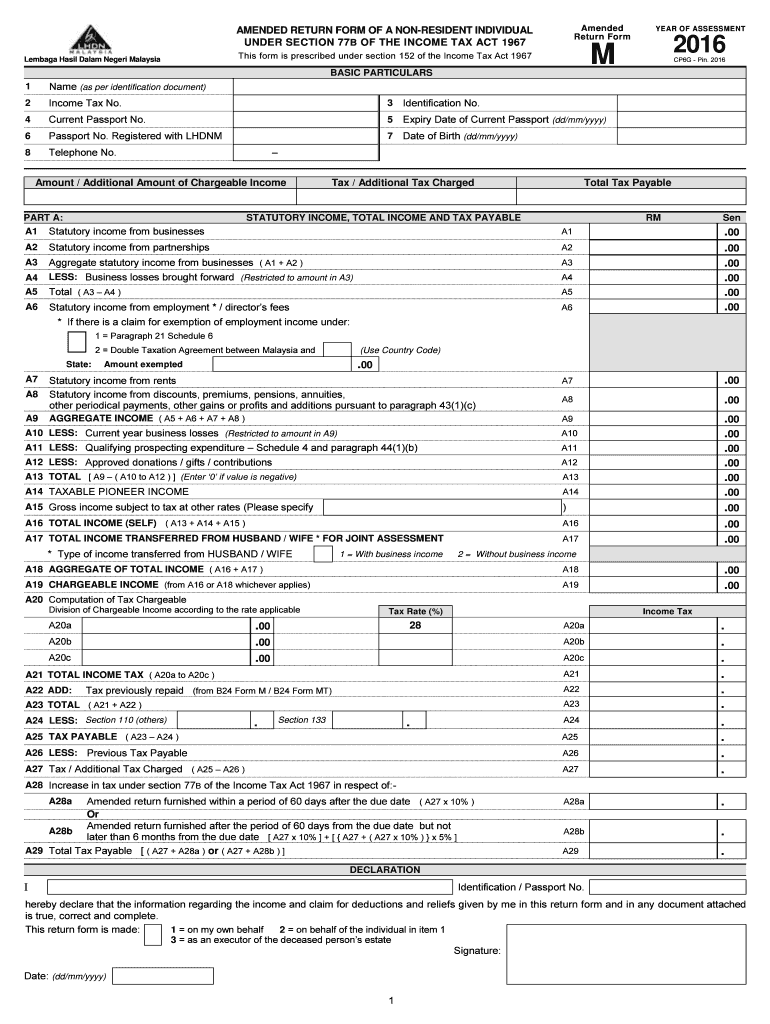

Return Commended RETURN FORM OF A NONRESIDENT INDIVIDUAL

UNDER SECTION 77B OF THE INCOME TAX ACT 19672016MThis form is prescribed under section 152 of the Income Tax Act 1967Lembaga Hail Daley

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign type text complete fillable fields insert images highlight fax or share your cp37d form via url msockid 294d50c19436625d0154465295056372

Edit your cp37 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to fill in cp37 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form cp37 online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cp37 form 2025. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cp37 form

01

The process of filling out or filling in involves providing information or completing a form, document, or questionnaire.

02

Individuals who need to complete any type of form, document, or questionnaire would require guidance on how to fill out or fill in.

03

This can include students filling out application forms for colleges or job seekers filling in employment applications.

04

Businesses may also need instructions on how to complete various forms such as tax forms or legal documents.

05

Additionally, individuals seeking government assistance or benefits may need assistance in filling out the relevant application forms.

06

It is important to provide clear and concise instructions on how to fill out or fill in, including what information to provide, where to write or input the information, and any specific formatting or guidelines to follow.

07

Providing examples or templates can also be helpful for those who need to fill out certain types of forms regularly.

08

Ultimately, anyone who needs to provide information or complete any type of form may require guidance on how to fill out or fill in.

Fill

borang cp37

: Try Risk Free

People Also Ask about how to fill in cp37 form withholding tax

What is the foreign withholding tax on dividends?

The U.S. withholding tax rate charged to foreign investors on U.S. dividends is 30%, but this amount is reduced to 15% for taxable Canadian investors by a tax treaty between the U.S. and Canada. 1 Source: MSCI, BlackRock, as of July 31, 2022.

How can I avoid foreign withholding tax?

Because the US and Canada have a tax treaty, foreign withholding taxes are exempt when you hold US dividend stocks in registered retirement accounts like RRSP and RRIF. The important thing to note is that this tax exemption does not apply to (when holding those same investments in either a) TFSA or RESP.

What is the foreign withholding tax?

Federal Withholding Tax and Tax Treaties In most cases, a foreign national is subject to federal withholding tax on U.S. source income at a standard flat rate of 30%.

How to submit CP37 in Malaysia?

You must submit the CP37 withholding tax report to the Inland Revenue Board of Malaysia and the foreign business partners within thirty days of the payment made. You can use the Run Statutory Reports app to generate the CP37 withholding tax report.

How do I claim withholding tax?

You must make your request in writing and attach evidence to support your application. Complete the application form online (it can be saved to your computer). When you have completed the application, you can lodge it online by logging into Online services for business.

What is the penalty for late payment of withholding tax in Malaysia?

The penalties and consequences are the same for all types of withholding tax. You can be charged a penalty of 10% or more on unpaid taxes due to non-deduction or non-remittance. There could also be interest on any unpaid taxes due to non-deduction or non-remittance.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cp37d to be eSigned by others?

When your 1 if you dont is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit 1 if you dont in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your 1 if you dont, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I complete 1 if you dont on an Android device?

Use the pdfFiller mobile app to complete your 1 if you dont on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is how to fill in?

How to fill in refers to the instructions or steps required to complete a specific form or document accurately.

Who is required to file how to fill in?

Individuals or entities specified by law or regulation that must complete the document are required to file how to fill in.

How to fill out how to fill in?

To fill out how to fill in, follow the instructions provided, ensuring that all required fields are completed accurately and truthfully.

What is the purpose of how to fill in?

The purpose of how to fill in is to guide individuals in completing the documentation correctly to ensure compliance with legal or organizational requirements.

What information must be reported on how to fill in?

The information that must be reported on how to fill in typically includes personal identification details, financial information, and other relevant data as mandated by the form's purpose.

Fill out your 1 if you dont online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1 If You Dont is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.