Get the free pdffiller

Show details

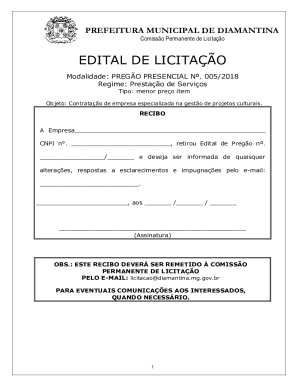

BOE-502-D (P1) REV. 06 (12-12) Sonoma County Assessor 585 Fiscal Dr. Room 104 Santa Rosa, CA 95403 (707) 565-1855 CHANGE IN OWNERSHIP STATEMENT DEATH OF REAL PROPERTY OWNER This notice is a request

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pdffiller form

Edit your pdffiller form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pdffiller form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit pdffiller form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pdffiller form

How to fill out change in ownership statement:

01

Begin by gathering all the necessary information and documents related to the change in ownership. This may include the original title or deed, identification documents of the parties involved, and any supporting legal documents.

02

Start by clearly identifying the property or asset subject to the change in ownership. Provide the full address, legal description, and any other relevant details to ensure accurate identification.

03

The next step is to provide the details of the previous owner(s). This includes their full legal names, addresses, and contact information. If applicable, include the previous owner's identification number (such as social security number or tax identification number).

04

Move on to the new owner(s) and provide their complete information, including full names, addresses, and contact details. Similarly, include the new owner's identification number, if necessary.

05

Clearly state the effective date of the change in ownership. This is the date from which the transfer of ownership takes place. Ensure accuracy to avoid any confusion or legal issues.

06

If there is any consideration involved in the transaction, such as a purchase price or value, clearly state it in the document. This helps in determining the transfer taxes and other financial aspects.

07

Include any specific terms or conditions of the change in ownership, if applicable. This could involve any agreements, restrictions, or covenants related to the property or asset.

08

If there are any liens, encumbrances, or mortgages on the property, disclose them in the statement. Provide details of the amount owed, name of the lien holder, and any other relevant information.

09

Finally, both the previous owner(s) and the new owner(s) must sign and date the change in ownership statement. This signifies their agreement and consent to the transfer of ownership.

Who needs a change in ownership statement?

01

Individuals or entities involved in the transfer of property or assets, such as buying or selling real estate, vehicles, or businesses, may need a change in ownership statement. This helps establish legal documentation and ownership rights.

02

Government agencies or departments responsible for maintaining official records of property ownership may require a change in ownership statement to update their records accurately.

03

Lenders or financial institutions may request a change in ownership statement as part of their due diligence process to ensure the transfer is proper and lawful.

04

Lawyers, attorneys, or legal professionals involved in the transfer of ownership transactions may advise their clients to complete a change in ownership statement for legal protection and compliance.

Note: The specific requirements for a change in ownership statement may vary depending on the jurisdiction and the nature of the transaction. It is recommended to consult with legal professionals or relevant authorities to ensure compliance with local laws and regulations.

Fill

form

: Try Risk Free

People Also Ask about

How do I remove a deceased spouse from my deed in California?

Most often, a copy of the deceased spouse's death certificate, the notarized death affidavit, and a legal description of the property are required. Once these steps are complete, your deceased spouse will have been removed and you will be the sole owner on the deed.

Can you remove a spouse from a deed in California?

In general, a person cannot be removed from a deed without his or her consent and signature on a deed.

How to fill out a preliminary change of ownership report in California?

0:13 8:38 California Preliminary Change of Ownership Report Instructions YouTube Start of suggested clip End of suggested clip Address. Then to the right which are going to be doing is you're going to be typing. The property'sMoreAddress. Then to the right which are going to be doing is you're going to be typing. The property's APN number that is located on the deed. So take a look at your deed.

How do I transfer a house title after death in California?

What are the requirements for a California TOD deed? Residential property only. Owner with legal capacity. Beneficiaries identified by name. Valid legal description. Signed, dated, notarized, and witnessed. Statutory form. California law does not allow just any deed form to qualify as a TOD deed. Record within 60 days.

How long do you have to transfer property after death in California?

At least 40 days have passed since the death of the decedent, as shown by the attached certified copy of the decedent's death certificate. 4. The current gross value of the decedent's real and personal property in California, excluding the property described in Probate Code § 13050, does not exceed $100,000.

How to change ownership of a death of real property owner in San Bernardino County?

You may notify the Assessor of death by completing a Change in Ownership Statement – Death of Real Property Owner. This form is required even if the decedent held property in a trust. This form does not remove or change the current title and is used for assessment purposes only.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit pdffiller form on an iOS device?

Create, modify, and share pdffiller form using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How can I fill out pdffiller form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your pdffiller form. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I fill out pdffiller form on an Android device?

Complete your pdffiller form and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is change in ownership statement?

The change in ownership statement is a document that records any changes in ownership of a property.

Who is required to file change in ownership statement?

Property owners or individuals who have recently acquired or sold a property are required to file a change in ownership statement.

How to fill out change in ownership statement?

The change in ownership statement can be filled out online or submitted in paper form. It typically requires details such as the property address, owner information, and details of the ownership change.

What is the purpose of change in ownership statement?

The purpose of the change in ownership statement is to update the property records with accurate ownership information.

What information must be reported on change in ownership statement?

The change in ownership statement typically requires information on the property address, owner details, and details of the ownership change.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.