India SBI NRI-18.5 2018 free printable template

Show details

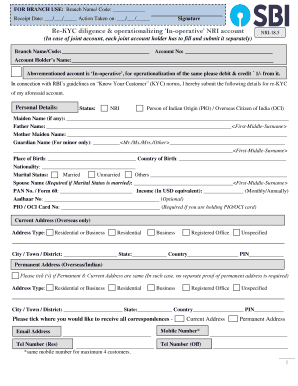

FOR BRANCH USE: Branch Name/ Code: Receipt Date: / / Action Taken on: / / SignatureReKYC diligence & operationalizing Inoperative NRI accountNRI18.5(In case of joint account, each joint account holder

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign India SBI NRI-185

Edit your India SBI NRI-185 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your India SBI NRI-185 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit India SBI NRI-185 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit India SBI NRI-185. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

India SBI NRI-18.5 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out India SBI NRI-185

How to fill out India SBI NRI-18.5

01

Gather all necessary personal and financial documents.

02

Visit the official SBI website or nearest SBI branch.

03

Download the NRI-18.5 form or request a physical copy.

04

Fill in your personal details including name, address, and contact information.

05

Provide your NRI status and country of residence.

06

Include details of your overseas bank account and income sources.

07

Sign the declaration and date the form.

08

Submit the completed form along with the required documents.

09

Keep a copy of the submitted form for your records.

10

Follow up with SBI to ensure processing of your application.

Who needs India SBI NRI-18.5?

01

NRI (Non-Resident Indians) who wish to maintain a bank account in India.

02

Individuals looking to invest or manage their financial assets from abroad.

03

NRIs requiring a structured banking and investment service from SBI.

Fill

form

: Try Risk Free

People Also Ask about

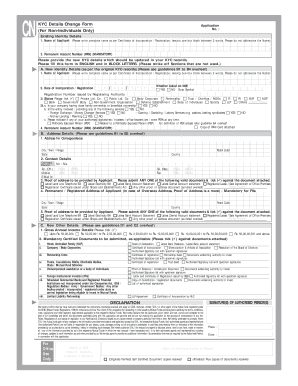

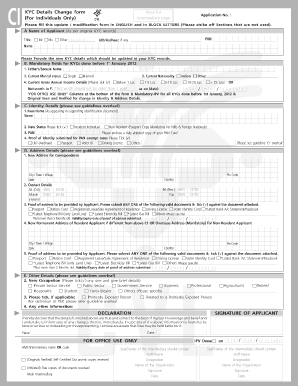

How do I update my KYC for NRI account?

NRI KYC online form is available online on the websites of KYC Registration Agencies (KRAs). This form needs to be duly filled and submitted in person to such agencies. NRIs can also fill in the details and courier the form if the In-person verification (IPV) is complete.

Is KYC required for NRI account?

So, KYC for NRI account gets required. These details of KYC for NRI account include in-person verification (IPV), identity and address verification, financial status, occupation, and other personal details as may be deemed necessary.

What documents are required for KYC for NRI account?

account opening purpose” on the document itself: a) Government issued National Identity Card at the country of residence. b) Driving License issued abroad. c) Utility Bill (Electricity, Telephone, Gas) d) Original copy of latest overseas bank account or existing NRE / NRO account.

How can I update my SBI KYC online for NRI?

The best way to modify Sbi kyc form for nri online Register and log in to your account. Sign in to the editor using your credentials or click Create free account to examine the tool's features. Add the Sbi kyc form for nri for redacting. Alter your file. Finish redacting the form.

What are the KYC documents for NRI account?

account opening purpose” on the document itself: a) Government issued National Identity Card at the country of residence. b) Driving License issued abroad. c) Utility Bill (Electricity, Telephone, Gas) d) Original copy of latest overseas bank account or existing NRE / NRO account.

Is KYC required for NRI account?

In order to invest in India, a non-resident Indian (NRI) or person of Indian origin (PIO) must be KYC (know your customer) compliant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send India SBI NRI-185 for eSignature?

When you're ready to share your India SBI NRI-185, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I execute India SBI NRI-185 online?

pdfFiller has made filling out and eSigning India SBI NRI-185 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I sign the India SBI NRI-185 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your India SBI NRI-185.

What is India SBI NRI-18.5?

India SBI NRI-18.5 is a specific form used by Non-Resident Indians (NRIs) to report their financial accounts held outside India, particularly for compliance with the Foreign Account Tax Compliance Act (FATCA) and other tax regulations.

Who is required to file India SBI NRI-18.5?

NRIs who have legal financial accounts in India or hold certain types of investments and assets outside India are required to file India SBI NRI-18.5.

How to fill out India SBI NRI-18.5?

Filling out India SBI NRI-18.5 involves providing personal identification details, financial account information, and ensuring that all data aligns with the financial institutions where accounts are held. All relevant personal and financial documentation should be consulted.

What is the purpose of India SBI NRI-18.5?

The purpose of India SBI NRI-18.5 is to ensure compliance with Indian tax regulations and international agreements, thereby aiding in the accurate reporting of global income and assets held by NRIs.

What information must be reported on India SBI NRI-18.5?

The form requires reporting personal identification details, account numbers, financial institutions involved, types of accounts, and the total balance for the reporting period.

Fill out your India SBI NRI-185 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

India SBI NRI-185 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.