KS K-BEN 32 2018 free printable template

Show details

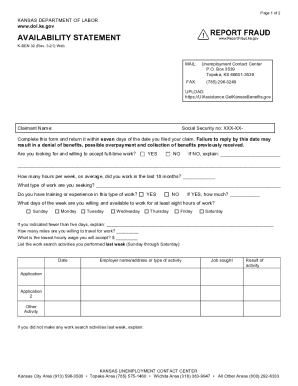

Page 1 of 2KANSAS DEPARTMENT OF LABOR

www.dol.ks.govAVAILABILITY STATEMENT

BEN 32 (Rev. 918)MAIL:Unemployment Contact Center

P.O. Box 3539

Topeka, KS 666013539FAX:(785) 2963249EMAIL*: IDOL.ICC×ks.gov×See

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS K-BEN 32

Edit your KS K-BEN 32 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS K-BEN 32 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KS K-BEN 32 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit KS K-BEN 32. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS K-BEN 32 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS K-BEN 32

How to fill out KS K-BEN 32

01

Obtain the KS K-BEN 32 form from the appropriate authority or website.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information: name, address, and identification details.

04

Provide relevant tax identification information as required.

05

Indicate the type of income or services for which the form is being submitted.

06

Sign and date the form in the designated area.

07

Review all entries for accuracy before submission.

08

Submit the completed form to the correct office or authority as indicated.

Who needs KS K-BEN 32?

01

Individuals or businesses receiving certain types of income.

02

Taxpayers needing to report their income to the tax authorities.

03

Entities requiring certification of their tax status for compliance purposes.

Fill

form

: Try Risk Free

People Also Ask about

How do I know if my unemployment claim was approved?

You can check your claim status online at Unemployment Benefits Services or call Tele-Serv at 800-558-8321.

How do I talk to a live person at the Kansas unemployment office?

Unemployment Contact Centers Kansas City (913) 596-3500. Topeka (785) 575-1460. Wichita (316) 383-9947. Toll-Free (800) 292-6333.

Does Kansas unemployment back pay?

Yes, you should file a claim each week as long as you remain unemployed. If your case is cleared for payment and you have met all eligibility requirements, you'll get back payments for any weeks you claimed and were eligible to receive, in one lump sum.

How do I apply for unemployment benefits?

How Do I Apply? You should contact your state's unemployment insurance program as soon as possible after becoming unemployed. Generally, you should file your claim with the state where you worked. When you file a claim, you will be asked for certain information, such as addresses and dates of your former employment.

How do I know if my unemployment claim was approved in Kansas?

You can obtain information concerning the status of your claim anytime online by selecting the CHECK YOUR CLAIM STATUS option, or by selecting option "1" through the weekly claim phone line. You will be able to get information about: The last three weeks you claimed.

How do I appeal unemployment?

You have the right to appeal the EDD's decision to reduce or deny you benefits. You must submit your appeal in writing within 30 days of the mailing date on the Notice of Determination and/or Ruling (DE 1080CZ) or Notice of Overpayment (DE 1444).

What is the phone number for GetKansasBenefits?

If you are still having issues after trying these troubleshooting options, please call the KDOL Unemployment Contact Center at 1-800-292-6333. The busiest days to call are Monday and Tuesday.

What is the 800 number for Kansas unemployment?

If you need information or have questions not covered on our website, please use one of the phone numbers below to contact the Unemployment Contact Center. Speech and/or hearing disabled Kansans can access the Kansas Relay Center by calling toll-free 800-766-3777.

How do I know if my il unemployment claim was approved?

Within 7-10 days of filing your claim, you will receive a UI Finding letter in the mail. The UI Finding letter will tell you whether you are monetarily eligible for benefits, meaning you have earned sufficient wages in your base period.

How long does an employer have to respond to an unemployment claim in NY?

Respond within 10 calendar days of the date on the notice if the wages shown are incorrect or you know of any reason the claimant should not collect benefits.

What disqualifies you from unemployment in California?

"An individual is disqualified for unemployment compensation benefits if the director finds that he or she left his or her most recent work voluntarily without good cause or that he or she has been discharged for misconduct connected with his or her most recent work."

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my KS K-BEN 32 directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your KS K-BEN 32 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit KS K-BEN 32 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign KS K-BEN 32 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete KS K-BEN 32 on an Android device?

Use the pdfFiller Android app to finish your KS K-BEN 32 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is KS K-BEN 32?

KS K-BEN 32 is a tax form used in the state of Kansas for reporting certain tax-related information.

Who is required to file KS K-BEN 32?

Individuals or entities doing business in Kansas that meet specific criteria for tax reporting must file KS K-BEN 32.

How to fill out KS K-BEN 32?

To fill out KS K-BEN 32, you need to provide your identifying information, report relevant income and deductions, and ensure all fields are completed accurately.

What is the purpose of KS K-BEN 32?

The purpose of KS K-BEN 32 is to collect information for state tax compliance and to ensure accurate reporting of income and deductions.

What information must be reported on KS K-BEN 32?

KS K-BEN 32 requires reporting of personal or business identifying information, income details, deduction claims, and any relevant tax credits.

Fill out your KS K-BEN 32 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS K-BEN 32 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.