Get the free Property Tax Appeal Worksheet - Bloomfield Hills - bloomfieldhillsmi

Show details

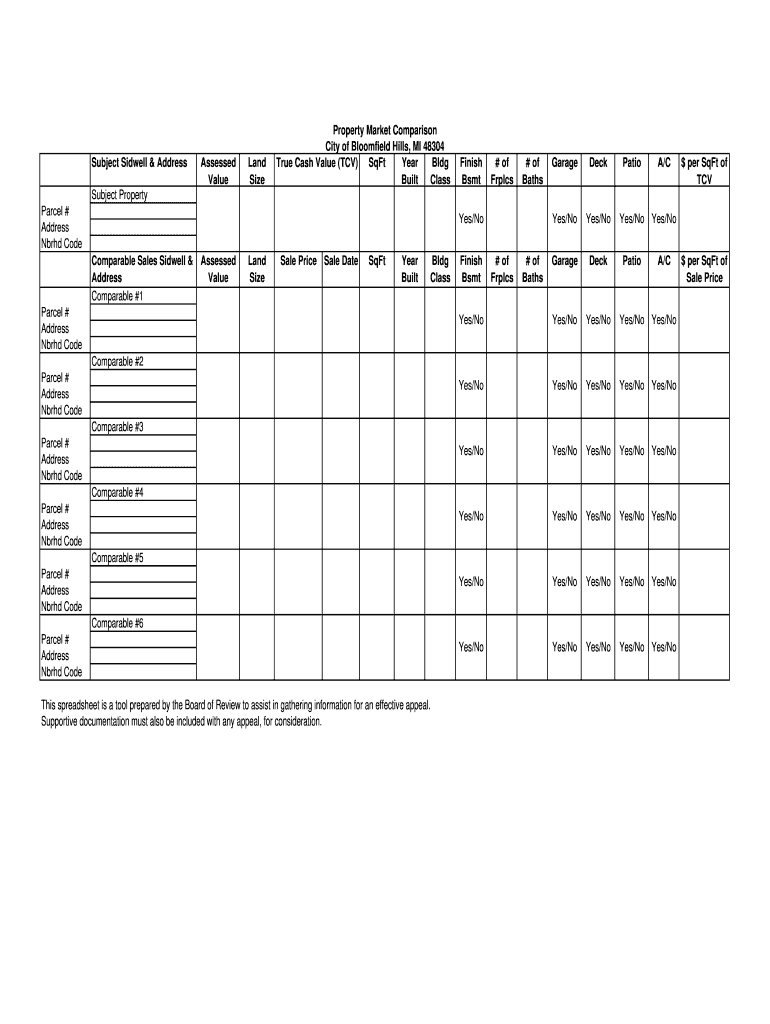

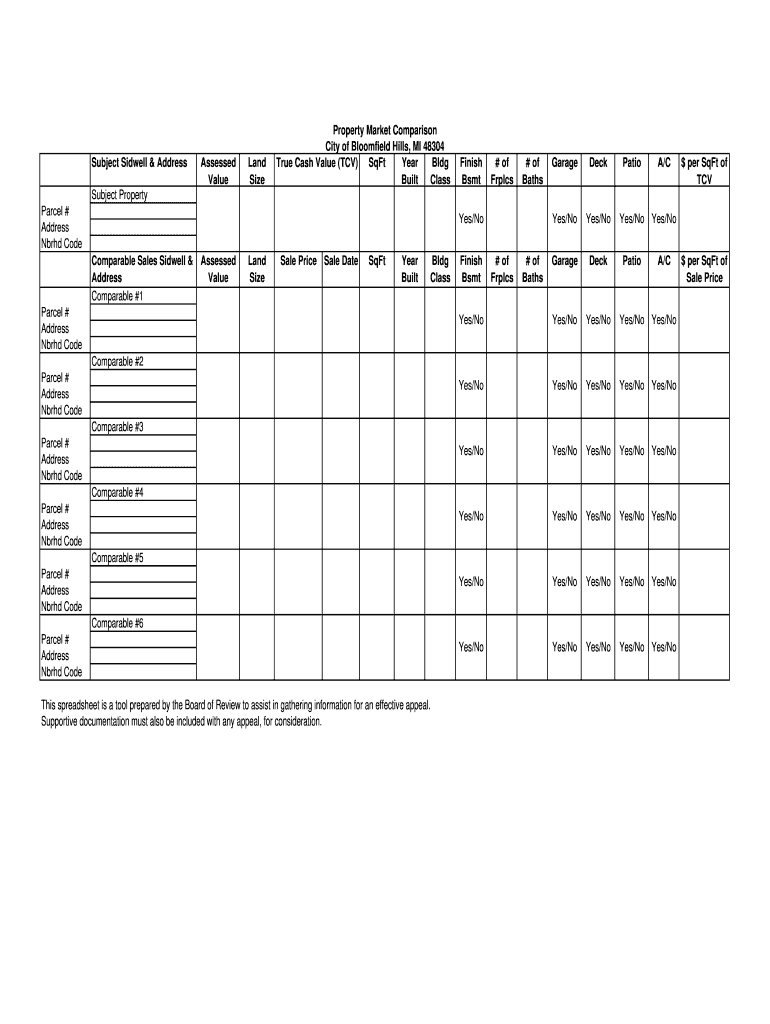

Deck Yes/No Yes/No Garage Deck Yes/No Yes/No Yes/No Yes/No Yes/No Yes/No Yes/No Yes/No Yes/No Yes/No Yes/No Yes/No Yes/No Yes/No Yes/No Yes/No Yes/No Yes/No Yes/No Yes/No Assessed Value Garage Yes/No

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property tax appeal worksheet

Edit your property tax appeal worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax appeal worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit property tax appeal worksheet online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit property tax appeal worksheet. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property tax appeal worksheet

How to fill out a property tax appeal worksheet:

01

Gather all the necessary information for the property tax appeal worksheet, including the property's address, assessors' valuation of the property, and any supporting documentation such as recent appraisals or sales data for similar properties in the area.

02

Review the instructions provided with the property tax appeal worksheet to understand the required format and specific details that need to be included.

03

Begin by filling out the basic information section of the worksheet, which typically includes the property's address, the owner's name, and contact information.

04

Move on to the valuation information section, where you will be asked to enter the assessors' valuation of the property. Double-check this figure to ensure accuracy.

05

Provide any supporting documentation required by the worksheet, such as recent property appraisals or sales data for similar properties. Make sure to attach or reference these documents as instructed.

06

Proceed to the section that allows you to present your reasons for appealing the property tax assessment. Clearly articulate your arguments, providing specific details or evidence to support your case.

07

Take extra care to complete all the required sections in the worksheet accurately and thoroughly. Double-check your entries to avoid any mistakes or omissions.

08

Once you have filled out the property tax appeal worksheet, review it for any errors or missing information. Make any necessary revisions or additions.

09

Sign and date the worksheet as required, acknowledging that the information provided is truthful and accurate to the best of your knowledge.

10

Keep a copy of the completed property tax appeal worksheet for your records.

Who needs a property tax appeal worksheet?

01

Property owners who believe their property has been overvalued by the assessors or who disagree with their property tax assessment.

02

Individuals who have supporting evidence or documentation to support their claim that the assessed value of their property is too high.

03

Property owners who are willing to put in the time and effort to prepare a comprehensive appeal to challenge their property tax assessment.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my property tax appeal worksheet in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign property tax appeal worksheet and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I create an electronic signature for signing my property tax appeal worksheet in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your property tax appeal worksheet and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out property tax appeal worksheet on an Android device?

Complete property tax appeal worksheet and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is property tax appeal worksheet?

The property tax appeal worksheet is a form used to appeal the assessed value of a property for tax purposes.

Who is required to file property tax appeal worksheet?

Property owners who believe the assessed value of their property is too high or incorrect are required to file a property tax appeal worksheet.

How to fill out property tax appeal worksheet?

To fill out a property tax appeal worksheet, property owners must provide information about the property, current assessed value, and reasons for the appeal.

What is the purpose of property tax appeal worksheet?

The purpose of the property tax appeal worksheet is to request a review of the assessed value of a property and potentially lower the property tax burden.

What information must be reported on property tax appeal worksheet?

Property owners must report accurate information about the property, including its location, size, condition, and any relevant sales or market data.

Fill out your property tax appeal worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax Appeal Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.