Franchise application form free printable template

Show details

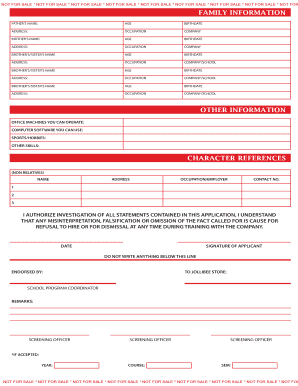

FRANCHISE APPLICATION FORM

DATE:

What Brand/s are

you applying for?

*Check all that applyJollibee

Choking

Greenwich

Many Nasal

Red Ribbon you have a

proposed site? Yes

Proposed

Corporate Name:

(Give

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign entities tribal form

Edit your irs landlords form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your phone irs number form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit phone irs number form online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit phone irs number form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out phone irs number form

How to fill out Franchise application form

01

Obtain the Franchise application form from the franchisor's website or office.

02

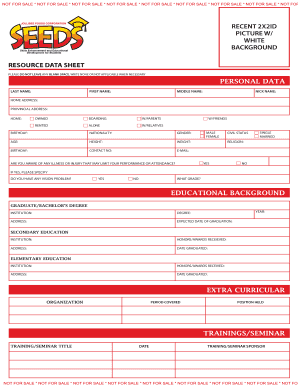

Start by filling in your personal details such as name, address, and contact information.

03

Provide your business background and relevant experience in the franchise sector.

04

Indicate your financial situation, including income, assets, and liabilities.

05

Answer questions regarding your motivation for seeking the franchise opportunity.

06

Disclose any legal issues or past bankruptcies, if applicable.

07

Review the form for accuracy and completeness.

08

Submit the application through the specified method (online, mail, or in-person).

Who needs Franchise application form?

01

Individuals or groups interested in starting a Franchise business.

02

Entrepreneurs looking to expand their existing business through franchising.

03

Businesses wanting to become franchisees of a particular brand.

04

Anyone seeking to invest in a proven business model with franchise support.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax ID number example?

An EIN is in the following format: xx-x. An ITIN is a nine-digit number that always begins with the number 9 and is in the following format: 9xx-xx-x.

How do I find my IRS number?

Your previously filed return should be notated with your EIN. Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at 800-829-4933.

How many digits is an IRS number?

It is a 9-digit number, beginning with the number "9", formatted like an SSN (NNN-NN-NNNN).

Is IRS number same as SSN?

The major difference between Social Security number (SSN) and any other tax id is that this number is primarily used by individuals for filing taxes while a tax ID number like EIN is used by businesses to file their taxes.

What is 9-digit IRS number?

An employer identification number (EIN) is a nine-digit number assigned by the IRS. It's used to identify the tax accounts of employers and certain others who have no employees. The IRS uses the number to identify taxpayers who are required to file various business tax returns.

Is my SSN my tax ID number?

A Social Security number (SSN) is a taxpayer identification number issued by the Social Security Administration. Individuals who are employed in the U.S. must have a Social Security number to file an income tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify phone irs number form without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your phone irs number form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I get phone irs number form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific phone irs number form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I fill out phone irs number form on an Android device?

On an Android device, use the pdfFiller mobile app to finish your phone irs number form. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is Franchise application form?

A Franchise application form is a document used by individuals or businesses to formally apply for a franchise opportunity, providing necessary information for the franchisor to evaluate the applicant.

Who is required to file Franchise application form?

Individuals or entities that wish to obtain and operate a franchise are required to file a Franchise application form with the franchisor.

How to fill out Franchise application form?

To fill out a Franchise application form, applicants should follow the instructions provided by the franchisor, ensuring all sections are completed accurately, and include any required documents or fees.

What is the purpose of Franchise application form?

The purpose of the Franchise application form is to gather essential information about the applicant, assess their suitability for the franchise opportunity, and initiate the franchise approval process.

What information must be reported on Franchise application form?

The Franchise application form typically requires information such as the applicant's personal details, business background, financial information, and any relevant experience related to the franchise industry.

Fill out your phone irs number form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Phone Irs Number Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.