CA FTB 3805Z 2018-2025 free printable template

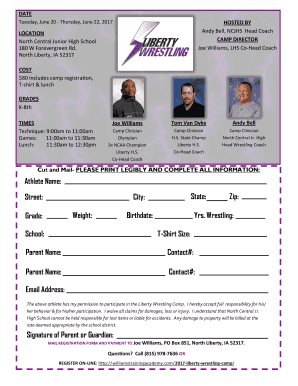

Get, Create, Make and Sign ca ftb 3805z form

Editing california 3805z online

Uncompromising security for your PDF editing and eSignature needs

CA FTB 3805Z Form Versions

How to fill out ca ftb enterprise summary fill form

How to fill out CA FTB 3805Z

Who needs CA FTB 3805Z?

Video instructions and help with filling out and completing california 3805z

Instructions and Help about form 3805z booklet

Music let me tell you why you need to attend this year's federal and California Techs update seminars as always were going to give you everything you need in one day to help your clients during filing season next year there are so many changes that have come down the pipeline because of tax reform were going to talk about issues like the 199 a deduction what's considered a service business we've had so many questions in that area well address alimony whether your clients are going to get a deduction for paying it whether the alimony they receive is going to be income to them were going to talk about California conformity to all of those new tax reform changes what we do and mostly what we don't conform to the fact that at this point we haven't seen any conformity legislation coming were going to talk about the new partnership audit rules the elections that your clients may need to make because of those new rules and then well also update you on any other changes that you need to know about before filing season comes

People Also Ask about 3805z booklet

What is California FTB 3544A?

When did the California Enterprise Zone Credit expire?

Is Form 3514 required?

What is California Form FTB 3544A?

What is CA Form 3514?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 3805z enterprise zone without leaving Google Drive?

How can I send zone credit summary booklet fillable to be eSigned by others?

How do I fill out the california credit summary booklet print form on my smartphone?

What is CA FTB 3805Z?

Who is required to file CA FTB 3805Z?

How to fill out CA FTB 3805Z?

What is the purpose of CA FTB 3805Z?

What information must be reported on CA FTB 3805Z?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.