Get the free Rental Expense Form - Kerry Lynn Armstrong, CA

Show details

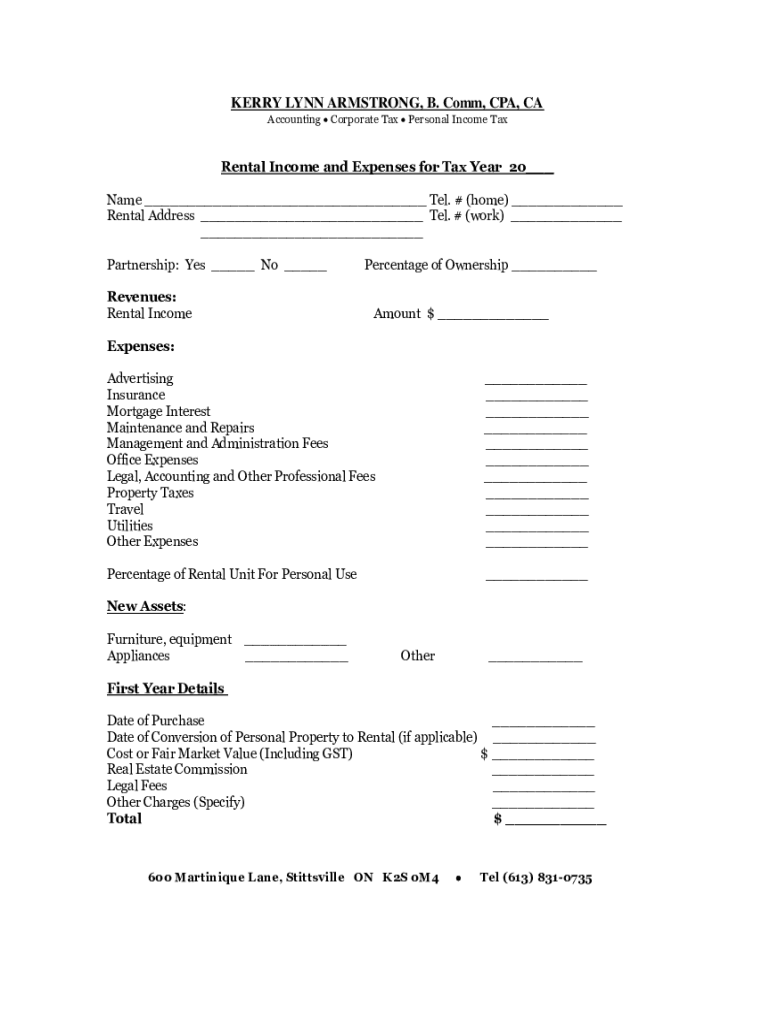

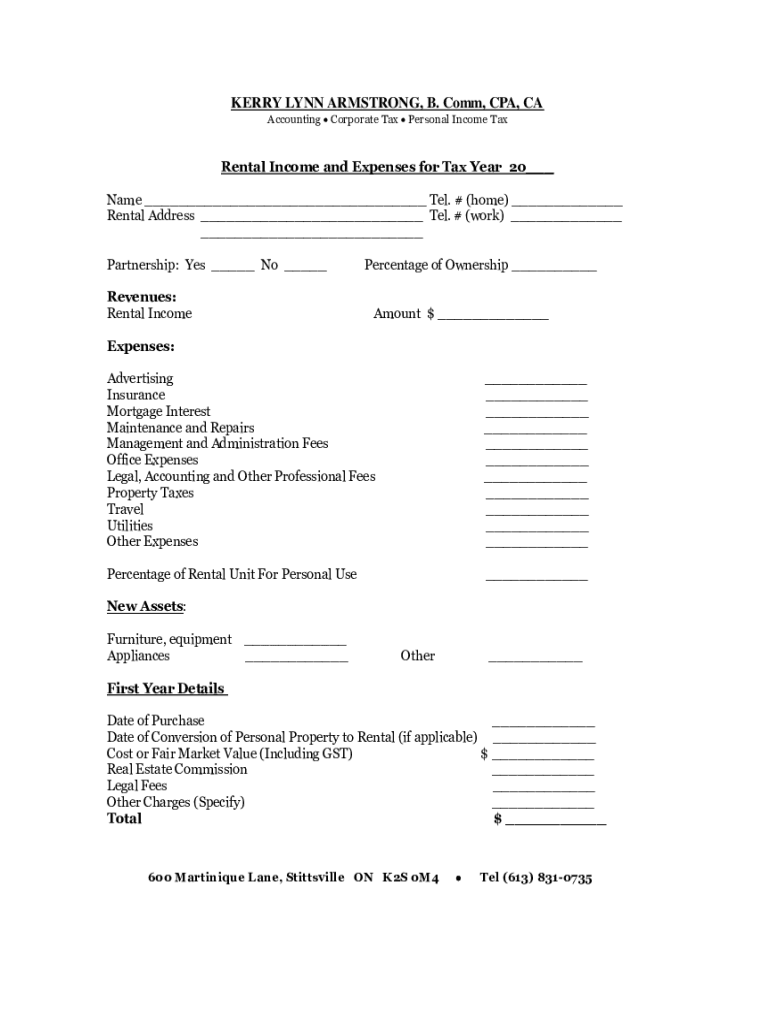

KERRY LYNN ARMSTRONG, B. Comm, CPA, CA Accounting Corporate Tax Personal Income Parental Income and Expenses for Tax Year 20 Name Tel. # (home) Rental Address Tel. # (work) Partnership: Yes No Revenues:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rental expense form

Edit your rental expense form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rental expense form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rental expense form online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit rental expense form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rental expense form

01

To fill out a rental expense form, start by gathering all relevant information about the rental property, such as the address, landlord's contact information, and the dates of your tenancy.

02

Next, make sure you have all the necessary financial documentation, including receipts, invoices, and bills related to the rental property. This can include expenses such as rent payments, utility bills, repairs, and maintenance costs.

03

Begin filling out the form by entering your personal information, such as your name, contact details, and social security number or tax identification number. This information is needed to identify you as the taxpayer claiming the rental expenses.

04

After providing your personal information, input the details of the rental property itself. This includes the property's address, the duration of your tenancy, and any relevant lease or rental agreement details.

05

List all the rental expenses you incurred during the specified period. This can include monthly rent payments, property taxes, insurance premiums, repairs, and maintenance costs. Make sure to accurately enter the dates, amounts, and descriptions of each expense.

06

Attach the necessary supporting documentation to validate your claimed expenses. This may include receipts, invoices, canceled checks, bank or credit card statements, and any other relevant records. Ensure that these documents are organized and easily accessible.

07

Double-check all the information you've entered on the form for accuracy and completeness. Any mistakes or missing information could delay the processing of your claim or even trigger an audit in some cases.

08

If you are unsure about any specific entries or require professional advice, consult a tax professional or accountant who specializes in rental property tax matters. They can provide guidance and ensure compliance with any applicable tax laws or regulations.

Who needs a rental expense form:

01

Individuals who own or rent out residential or commercial properties and wish to claim tax deductions for the related expenses.

02

Freelancers or self-employed individuals who operate their businesses from rented spaces.

03

Sublessors or tenants who are required to pay for and maintain certain costs related to the rented property, such as utilities or repairs.

Remember, filling out a rental expense form accurately and thoroughly is essential for ensuring that you claim all eligible deductions and comply with tax regulations. Always consult with a tax professional or accountant to clarify any doubts and maximize the benefits available to you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit rental expense form on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit rental expense form.

How do I fill out the rental expense form form on my smartphone?

Use the pdfFiller mobile app to fill out and sign rental expense form on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit rental expense form on an Android device?

You can make any changes to PDF files, like rental expense form, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is rental expense form?

The rental expense form is a document used to report expenses related to rental properties.

Who is required to file rental expense form?

Individuals who own or manage rental properties are required to file rental expense form.

How to fill out rental expense form?

To fill out the rental expense form, individuals must report all expenses related to operating their rental properties.

What is the purpose of rental expense form?

The purpose of the rental expense form is to accurately report expenses associated with rental properties for tax purposes.

What information must be reported on rental expense form?

Information such as maintenance costs, property management fees, utilities, and mortgage interest must be reported on the rental expense form.

Fill out your rental expense form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rental Expense Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.