Get the free governments fiscal year that ended June 30, 2017 - www2 census

Show details

2017

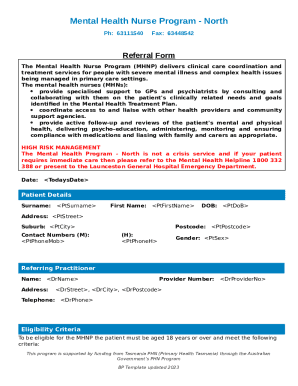

F65(ASU2)STATE OF ARIZONAFORM

(11152017)2017 SURVEY OF LOCAL

GOVERNMENT FINANCESARIZONA MUNICIPALITIES

FOR FISCAL YEAR THAT ENDED

June 30, 2017,

In completing this report, please provide data

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign governments fiscal year that

Edit your governments fiscal year that form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your governments fiscal year that form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing governments fiscal year that online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit governments fiscal year that. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out governments fiscal year that

How to fill out governments fiscal year that

01

To fill out the government's fiscal year, follow these steps:

02

Determine the start and end dates of the fiscal year. This is usually set by the government or regulatory authorities.

03

Gather all financial documents and records related to the government's activities, including income, expenses, and assets.

04

Prepare the income statement, also known as the profit and loss statement, which shows the revenue and expenses incurred during the fiscal year.

05

Prepare the balance sheet, which provides an overview of the government's assets, liabilities, and equity at the end of the fiscal year.

06

Calculate the net income or loss by subtracting the total expenses from the total revenue in the income statement.

07

Analyze the financial statements and identify any financial trends or areas that require attention.

08

Prepare any additional reports or disclosures required by the government or regulatory authorities.

09

Review and reconcile the financial statements to ensure accuracy and completeness.

10

Submit the completed financial statements and reports to the relevant government departments or agencies by the designated deadline.

11

Keep copies of all financial records and statements for future reference and auditing purposes.

12

Remember to consult with accounting professionals or follow specific guidelines provided by the government to ensure compliance and accuracy in filling out the government's fiscal year.

Who needs governments fiscal year that?

01

The government's fiscal year is needed by various stakeholders, including:

02

- Government officials: They need the fiscal year information to assess the financial health and performance of different government departments or agencies.

03

- Taxpayers: The fiscal year helps determine tax liabilities and filing deadlines for individuals and businesses.

04

- Investors and creditors: They use fiscal year data to assess the government's creditworthiness and make investment or lending decisions.

05

- Researchers and analysts: They rely on fiscal year data to study economic trends, government spending patterns, and policy impacts.

06

- Audit and regulatory authorities: The fiscal year data is essential for conducting audits, ensuring compliance with financial regulations, and detecting fraud or financial mismanagement.

07

- General public: The fiscal year information is often made accessible to the public and helps promote transparency and accountability in government finances.

08

Overall, the government's fiscal year is crucial for financial planning, decision-making, and monitoring of government activities at various levels.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my governments fiscal year that in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign governments fiscal year that and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I edit governments fiscal year that from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like governments fiscal year that, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I edit governments fiscal year that on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign governments fiscal year that right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is governments fiscal year that?

The government's fiscal year is typically from October 1st to September 30th.

Who is required to file governments fiscal year that?

All government agencies and departments are required to file their fiscal year.

How to fill out governments fiscal year that?

Government agencies can fill out their fiscal year by submitting financial reports and budget information.

What is the purpose of governments fiscal year that?

The purpose of the government's fiscal year is to track and manage finances in an organized manner.

What information must be reported on governments fiscal year that?

Information such as income, expenses, budget allocations, and financial goals must be reported on the government's fiscal year.

Fill out your governments fiscal year that online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Governments Fiscal Year That is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.