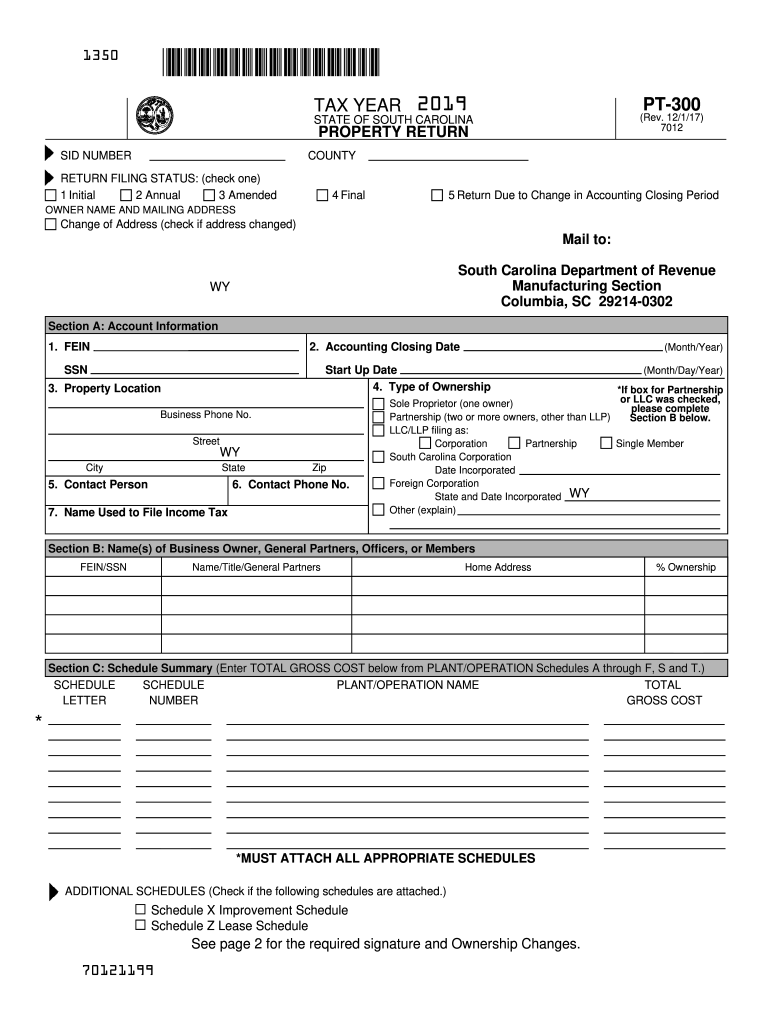

SC DoR PT-300 2019 free printable template

Show details

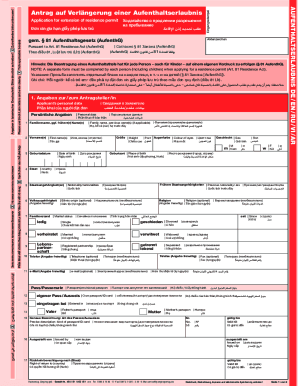

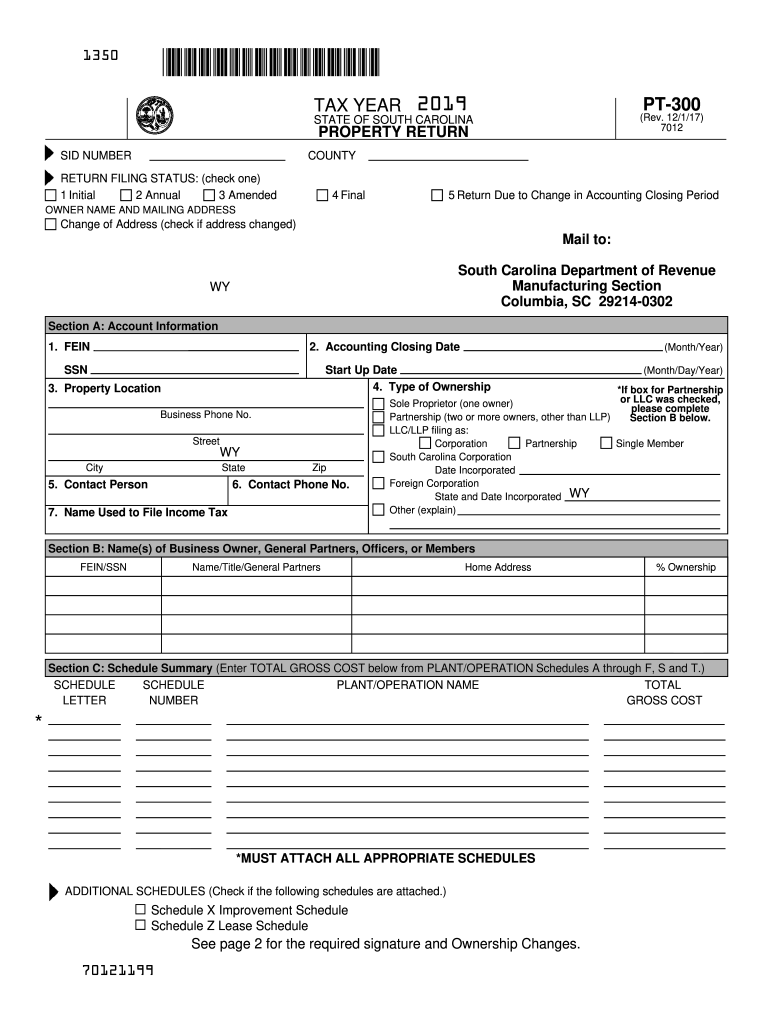

Print Form Reset Form TAX YEAR 2019 PT-300 Rev. 12/1/17 STATE OF SOUTH CAROLINA PROPERTY RETURN SID NUMBER COUNTY RETURN FILING STATUS check one 1 Initial 2 Annual 3 Amended 4 Final 5 Return Due to Change in Accounting Closing Period OWNER NAME AND MAILING ADDRESS Change of Address check if address changed Mail to South Carolina Department of Revenue Manufacturing Section Columbia SC 29214-0302 WY Section A Account Information 1. A properly executed Department of Revenue form PT-444 must be...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC DoR PT-300

Edit your SC DoR PT-300 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR PT-300 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SC DoR PT-300 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit SC DoR PT-300. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR PT-300 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC DoR PT-300

How to fill out SC DoR PT-300

01

Gather all necessary documentation required for filling out SC DoR PT-300.

02

Begin by filling in the applicant's personal information such as name, address, and contact details.

03

Provide information regarding the purpose of the application.

04

Input the relevant financial details as required in the form.

05

Review the completed form for accuracy and completeness.

06

Sign and date the application where indicated.

07

Submit the form to the appropriate authority or office.

Who needs SC DoR PT-300?

01

Individuals applying for specific benefits or services.

02

Businesses seeking permits or registrations.

03

Non-profit organizations requesting funding or grants.

Fill

form

: Try Risk Free

People Also Ask about

What tax breaks do seniors get in South Carolina?

2023 Standard Tax Deduction for Seniors Over 65 Years of Age with the Standard Deduction Increase*: Filing Status2023 Standard Deduction Under 65 Years of Age2023 Additional Standard Deduction Over 65 Years of AgeSurviving Spouses$27,700$3,000Head of Household$20,800$1,8503 more rows

What age are you exempt from property taxes in SC?

The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

How do I get a 4% property tax in South Carolina?

To qualify for the special 4% property tax assessment ratio, the owner of the property must have actually owned and occupied the residence as his legal residence and been occupying that address for some period during the applicable tax year. Only an owner-occupant is eligible to apply for the 4% special assessment.

What is the SC resident tax exemption?

The Homestead Exemption Program is a State funded program authorized under Section 12-37-250 of the South Carolina Code of Laws. The program exempts the first $50,000 fair market value of primary residence from all property taxes.

What is the $800 tax rebate in SC?

Rebates are based on your 2021 tax liability, up to a cap. The rebate cap – the maximum rebate amount a taxpayer can receive – is $800. If your tax liability is less than $800, your rebate will be the same amount as your tax liability. If your tax liability is over the $800 cap, you will receive a rebate for $800.

At what age do you stop paying property taxes in South Carolina?

What is the Homestead Exemption benefit? The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

What is property tax exempt in South Carolina?

Most property tax exemptions are found in South Carolina Code Section 12-37-220. For any real property exemptions taxation is a year in arrears, meaning to be exempt for the current year, you must be the owner of record and your effective date of disability must be on or before December 31 of the previous year.

How long do you have to pay property taxes in SC?

Property tax rolls are open by September 30 for payments to be made to the County Treasurer. Taxes for the current year must be paid by January 15 of the following year. Payments made after January 15 will incur a 3% penalty. Payments made after February 1 will incur a 10% penalty.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my SC DoR PT-300 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign SC DoR PT-300 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I create an electronic signature for signing my SC DoR PT-300 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your SC DoR PT-300 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I complete SC DoR PT-300 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your SC DoR PT-300. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is SC DoR PT-300?

SC DoR PT-300 is a specific form used for reporting information related to certain tax obligations in South Carolina.

Who is required to file SC DoR PT-300?

Entities and individuals engaged in business activities that meet specific criteria set by the South Carolina Department of Revenue must file SC DoR PT-300.

How to fill out SC DoR PT-300?

To fill out SC DoR PT-300, gather all necessary financial documents, follow the instructions provided by the South Carolina Department of Revenue, ensuring accurate reporting of the required information.

What is the purpose of SC DoR PT-300?

The purpose of SC DoR PT-300 is to collect and report financial data to the South Carolina Department of Revenue, facilitating the assessment of appropriate taxes.

What information must be reported on SC DoR PT-300?

The SC DoR PT-300 requires reporting of income, expenses, tax calculations, and any other relevant financial information as specified by the state guidelines.

Fill out your SC DoR PT-300 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR PT-300 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.