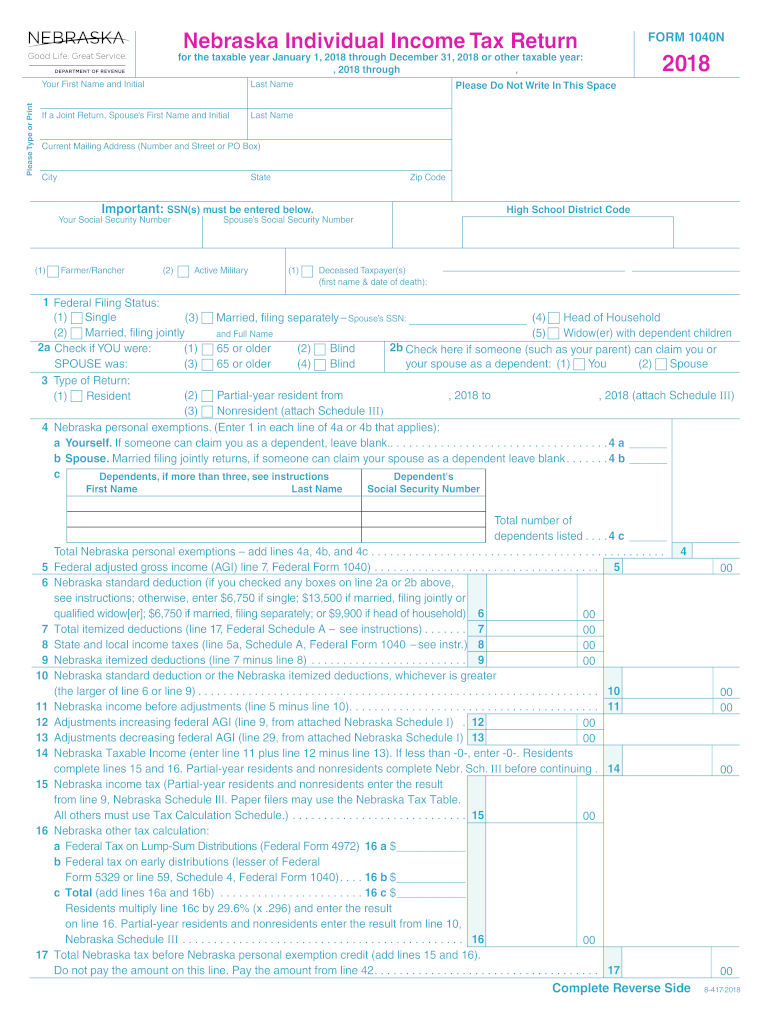

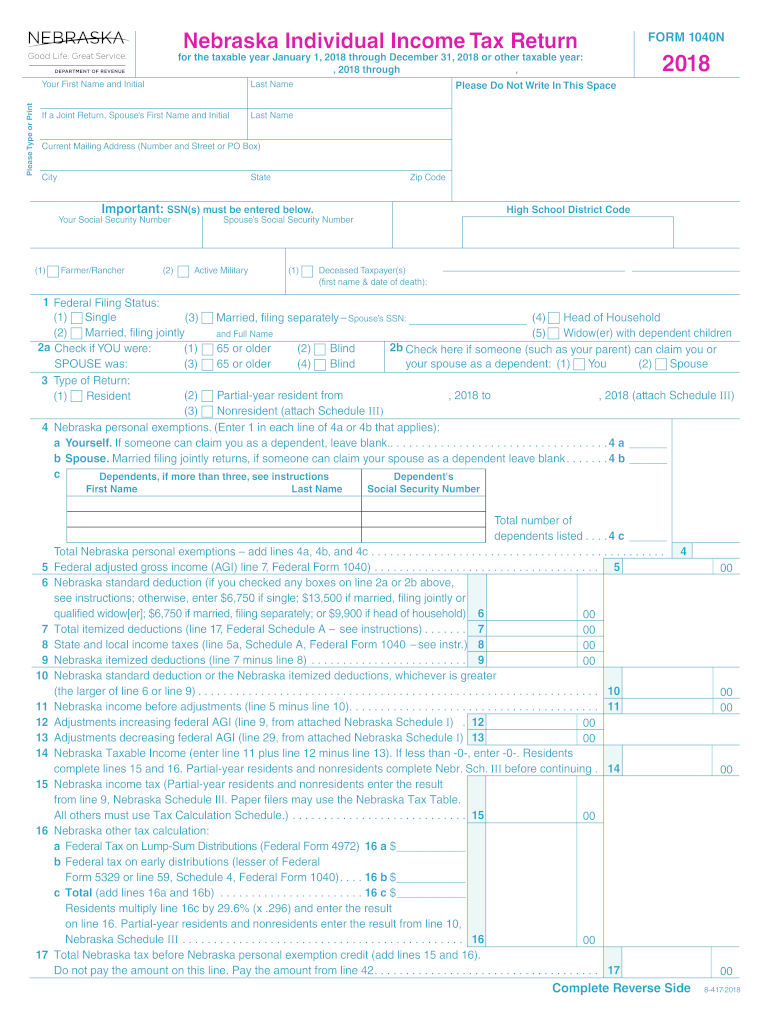

NE DoR 1040N 2018 free printable template

Get, Create, Make and Sign NE DoR 1040N

Editing NE DoR 1040N online

Uncompromising security for your PDF editing and eSignature needs

NE DoR 1040N Form Versions

How to fill out NE DoR 1040N

How to fill out NE DoR 1040N

Who needs NE DoR 1040N?

Instructions and Help about NE DoR 1040N

Hi this is Joe from Haney form an LLC org and today were going to form an LLC the state of Nebraska now to get started you want if you're watching this on YouTube you want to click on the link rate description, so you can get caught up with us and the first thing that were going to do is chances are you probably have the name in your mind of the LLC you want to make, so we want to check to make sure that the LLC name is available, so before we get ahead of ourselves were going to go the Nebraska LLC search which is right on our website you just click the link wait a few seconds, and we have a web page that works with the Nebraska Secretary of State, and you'll be able to search your LLC the big white window down here in just a second there are loads and what you do it is just go with click one of these buttons search for corporation entity name starts with would probably be the best one, and you just click in here type what it is type in the CAPTCHA and you can search so once you do that you can go back, and we can start the process in Nebraska they still do paper filings which is fine which just means that we have to fill out the Nebraska articles of organization, so you just click that link right there and till bring you to the PDF page for the articles of organization for the state and what you do is you just fill it right in name of the limited liability company just type it in the name period of duration chances are on that year LCS not going to have an update, so you just leave this blank purpose for which its organized and all the way down the line its very easy questions that they ask you and if you have any questions about you can just well let you know what they're really asking if you don't understand, and you sign right now to check for a filing fee for a hundred dollars, and you want to mail it go back to once you fill this all out you want to save it and then print it and mail to this address that we have right here again along with a hundred dollars now in the state of Nebraska right when you get your LLC back you will have to issue public notice of your new company which means you will have to place an ad in the newspaper that will have to run at least once per week for three consecutive weeks and I know that sounds like a doozy but if you just call up the daily reporter at this number they make it really, really easy for you till probably just be a publication fee and either the newspaper or they'll, they'll send you what's called an affidavit of publication which proves your public announcement and once you get this back from the newspaper you had to send it back to the Secretary of States office at this address and that's it you're good you made an LLC in the state of Nebraska now while you're going to have a little of time waiting on your LLC and doing a few other things if you're looking to make a bank account with your LLC which I would assume that you are you're going to need to get a tax ID number for it see this is what...

People Also Ask about

What is exempt from Nebraska sales tax?

What is the W 4 form used for?

What is Nebraska Form 20?

What is Nebraska Form 501N?

What is a Nebraska Form 10?

Who needs to file a Nebraska state tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NE DoR 1040N from Google Drive?

How do I edit NE DoR 1040N online?

How do I fill out NE DoR 1040N using my mobile device?

What is NE DoR 1040N?

Who is required to file NE DoR 1040N?

How to fill out NE DoR 1040N?

What is the purpose of NE DoR 1040N?

What information must be reported on NE DoR 1040N?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.