CA FTB Schedule CA (540) 2018 free printable template

Show details

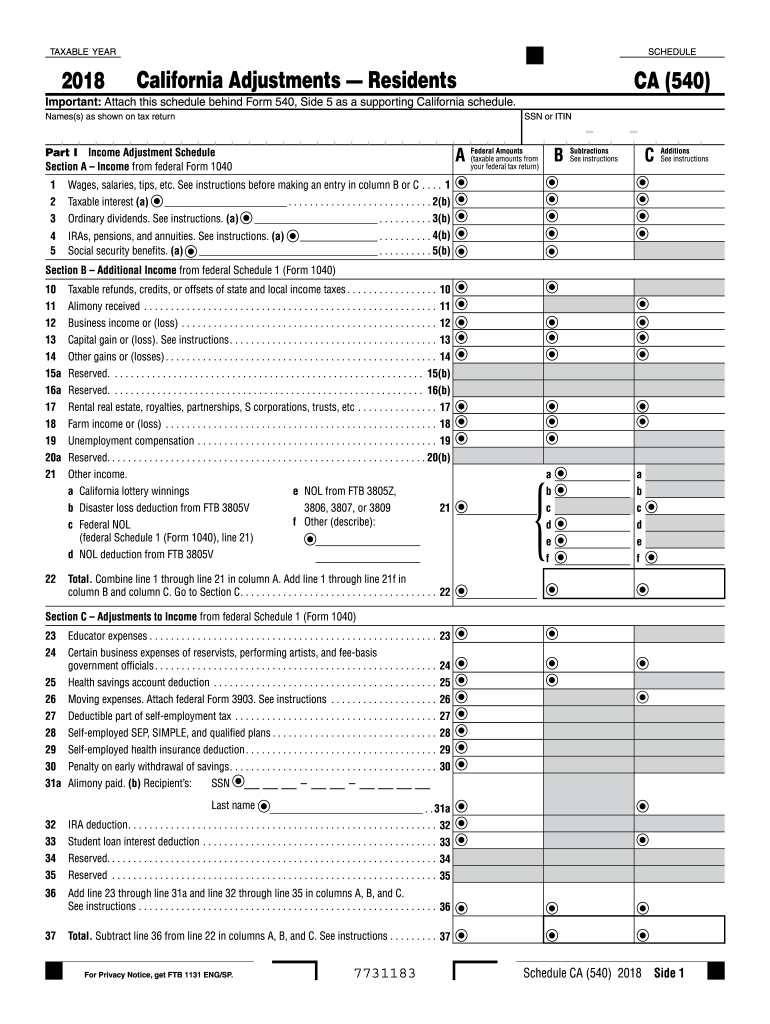

TAXABLE YEAR SCHEDULE California Adjustments Residents CA 540 Important Attach this schedule behind Form 540 Side 5 as a supporting California schedule. 7731183 Schedule CA 540 2018 Side 1 Part II Adjustments to Federal Itemized Deductions Check the box if you did NOT itemize for federal but will itemize for California. Yes. Complete the Itemized Deductions Worksheet in the instructions for Schedule CA 540 line 29. 29 30 Enter the larger of the amount on line 29 or your standard deduction...listed below Transfer the amount on line 30 to Form 540 line 18. Combine line 17 column A less column B plus column C. 18 Side 2 Schedule CA 540 2018 Job Expenses and Certain Miscellaneous Deductions 19 Unreimbursed employee expenses - job travel union dues job education etc. Attach federal Form 2106 if required. See instructions. Add line 18 and line 25. 26. 27 27 Other adjustments. See instructions. Specify. 28 Combine line 26 and line 27. 28 29 Is your federal AGI Form 540 line 13 more than...the amount shown below for your filing status Single or married/RDP filing separately. 18 19 Unemployment compensation. 19 21 Other income. a California lottery winnings b Disaster loss deduction from FTB 3805V c Federal NOL federal Schedule 1 Form 1040 line 21 e NOL from FTB 3805Z 3806 3807 or 3809 f Other describe d NOL deduction from FTB 3805V 22 Total. Combine line 1 through line 21 in column A. Names s as shown on tax return SSN or ITIN Amounts A Federal taxable amounts from B...Subtractions See instructions your federal tax return Part I Income Adjustment Schedule Section A Income from federal Form 1040. 3 b 10 Taxable refunds credits or offsets of state and local income taxes. 10 12 Business income or loss. 12 13 Capital gain or loss. See instructions. 13 14 Other gains or losses. 14 Wages salaries tips etc* See instructions before making an entry in column B or C. 1 2 Taxable interest a 3 Ordinary dividends. See instructions. a. 2 b 4 IRAs pensions and...annuities. See instructions. a 5 Social security benefits. a C Additions Section B Additional Income from federal Schedule 1 Form 1040 11 Alimony received. 11 15a Reserved*. 15 b 17 Rental real estate royalties partnerships S corporations trusts etc. 17 18 Farm income or loss. Add line 1 through line 21f in column B and column C. Go to Section C. 22 a b c d e f Section C Adjustments to Income from federal Schedule 1 Form 1040 23 Educator expenses. 23 24 Certain business expenses of...reservists performing artists and fee-basis government officials. 24 25 Health savings account deduction. 25 26 Moving expenses. Attach federal Form 3903. See instructions. 26 27 Deductible part of self-employment tax. 27 28 Self-employed SEP SIMPLE and qualified plans 28 30 Penalty on early withdrawal of savings. 30 31a Alimony paid* b Recipient s SSN Last name. 31a 32 IRA deduction. 32 33 Student loan interest deduction. 33 34 Reserved*. 34 36 Add line 23...through line 31a and line 32 through line 35 in columns A B and C.

pdfFiller is not affiliated with any government organization

Instructions and Help about CA FTB Schedule CA 540

How to edit CA FTB Schedule CA 540

How to fill out CA FTB Schedule CA 540

Instructions and Help about CA FTB Schedule CA 540

How to edit CA FTB Schedule CA 540

To edit the CA FTB Schedule CA 540, you can utilize pdfFiller's editing tools. Start by uploading the form to the platform, where you can make changes directly. After editing, save your changes and ensure the document is ready for submission.

How to fill out CA FTB Schedule CA 540

To fill out the CA FTB Schedule CA 540, begin by gathering all necessary tax documents, including income statements and prior tax returns. Use the following steps:

01

Obtain a copy of the Schedule CA 540 form from the California Franchise Tax Board (FTB) website.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Report your total income as well as any adjustments to income as specified in the form.

04

Calculate your total taxable income and accompanying deductions as outlined on the form.

05

Review all entries for accuracy before saving or printing.

About CA FTB Schedule CA previous version

What is CA FTB Schedule CA 540?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CA FTB Schedule CA previous version

What is CA FTB Schedule CA 540?

CA FTB Schedule CA 540 is a state tax form used by California residents to report their income and calculate their taxable income for state income tax purposes. This form is specifically designed for taxpayers filing Form 540, which is the California Resident Income Tax Return.

What is the purpose of this form?

The purpose of CA FTB Schedule CA 540 is to adjust federal income calculations to meet California’s tax laws. It accounts for differences between federal and state deductions and credits. By completing this form, taxpayers ensure an accurate assessment of their state tax liabilities.

Who needs the form?

California residents who are filing a Form 540 must complete CA FTB Schedule CA 540. This includes individuals who receive income from various sources, such as wages, self-employment, rental properties, or investments. Additionally, those who need to make adjustments to federal income for state tax purposes must also use this form.

When am I exempt from filling out this form?

You may be exempt from filling out CA FTB Schedule CA 540 if your total income is below a certain threshold defined by the California Franchise Tax Board, or if you do not have any adjustments to report. Specific exemptions apply to certain types of income and filing statuses, so it is essential to review these criteria on the FTB website.

Components of the form

CA FTB Schedule CA 540 is comprised of several key components, including sections for reporting your total income, deductions, credits, and other relevant tax information. Specific areas require details about adjustments made to federal adjusted gross income, as well as applicable California tax credits.

Due date

The due date for submitting CA FTB Schedule CA 540 typically aligns with the California state income tax returns deadline. Generally, this deadline is April 15th for most taxpayers, unless it falls on a weekend or holiday, in which case it extends to the next business day. Ensure to verify the specific due date for the tax year you are filing.

What are the penalties for not issuing the form?

Failure to file CA FTB Schedule CA 540 can result in penalties from the California Franchise Tax Board. These may include late filing fees and interest on unpaid taxes. Additionally, failing to report all income can trigger audits or other compliance issues.

What information do you need when you file the form?

When filing CA FTB Schedule CA 540, you will need the following information:

01

Your full name and Social Security number.

02

Details of all income earned during the tax year.

03

Any federal tax forms that impact your California tax filing.

04

Records of deductions, credits, and any applicable adjustments.

Is the form accompanied by other forms?

CA FTB Schedule CA 540 is typically submitted alongside Form 540 when filing your California state income tax return. Depending on your financial situation, you might also need to include other supporting forms, such as additional schedules or tax credits.

Where do I send the form?

You should send CA FTB Schedule CA 540 to the address specified in the instructions for Form 540. The correct address may vary depending on whether you are enclosing a payment or not. Always check the latest submission guidelines from the California Franchise Tax Board.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Excellent product and excellent customer service team.

Excellent product of easy manipulation with expected result. They have an excellent customer service team. I recommend!!

good service

good service,but expensive.

See what our users say