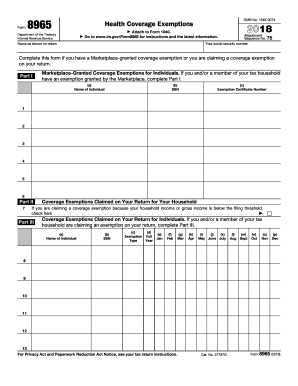

IRS Instructions 8965 2018-2025 free printable template

Get, Create, Make and Sign IRS Instructions 8965

How to edit IRS Instructions 8965 online

Uncompromising security for your PDF editing and eSignature needs

IRS Instructions 8965 Form Versions

How to fill out IRS Instructions 8965

How to fill out IRS Instructions 8965

Who needs IRS Instructions 8965?

Video instructions and help with filling out and completing 8965

Instructions and Help about IRS Instructions 8965

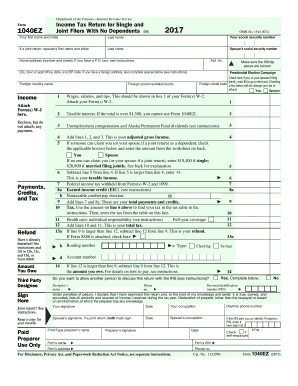

What we're going to talk about today is the Affordable Care Act we just got the software released, and we've been receiving questions all summer about how is this going to be implemented what's it going to look like how do we complete the form, and so we just wanted to take a quick minute talk quickly just a real quick recap on the Affordable Care Act and then what is it going to look like in the software how to complete that form, so we all know the Affordable Care Act is mandatory legislation that every taxpayer in the country is supposed to have minimum essential health care coverage we're not going to go into detail is this what that means, but basically you're supposed to have health care qualifying health plan that gives you these minimal things if you do not then you are subject to an additional tax and for 2014 the tax is the greater of a one percent of your income net of specified deduction so one percent of your income less a handful of things that you could take off of your income or be 95 dollars per adult plus forty-seven fifty forty-seven dollars and fifty cents per child up to a maximum of two hundred eighty-five dollars per family and however the penalty is capped at the average cost of a bronze level health plan so if you're 1 exceeds that 285 they're obviously going to go with that in but that that is even capped at a certain level so if you are a high income person here it's not going to bleed you for your entire income amount so how do you calculate this penalty if you do not have the coverage so the first thing in the software when you're going through a basic return it's going to pop up the health care question full year minimum essential health care did you have essential health care coverage for yourself your spouse of filing jointly in anyone you could or did claim as a dependent for every month of 2014 so is everybody in your household covered yes or no if you say no it immediately attaches a form to your tax return 89 65 health coverage exemptions responsibility payment menu so down here this is where you start with your penalty your shared responsibility payment and this is head love how they term that, but this is your additional tax right now, so we haven't specified who in the household had coverage and who didn't have coverage and for how long, so it's a kind of prorated fine or prorated tax based on how long you had coverage for that year and so let's take a look at this real quick tells us our household income these are for exemptions if you did not have coverage for a specified reason and there's a number of them I don't have them in front of me but hardship you didn't think you could afford it you had religious differences that didn't you don't believe it you know you're a Mennonite or Amish or one of those religions then you can actually get an exemption so that you don't have to pay the penalty down here this is really what we want to focus on the shared responsibility payment, and we have our three...

People Also Ask about

Do I have to pay the shared responsibility payment?

What is IRS Form 8965 health coverage exemptions?

What is exemption G on form 8965?

What type of exemption is form 8965?

What is Form 8965 used for?

What is the 8965 form for 2014?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS Instructions 8965 for eSignature?

How do I edit IRS Instructions 8965 online?

Can I sign the IRS Instructions 8965 electronically in Chrome?

What is IRS Instructions 8965?

Who is required to file IRS Instructions 8965?

How to fill out IRS Instructions 8965?

What is the purpose of IRS Instructions 8965?

What information must be reported on IRS Instructions 8965?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.