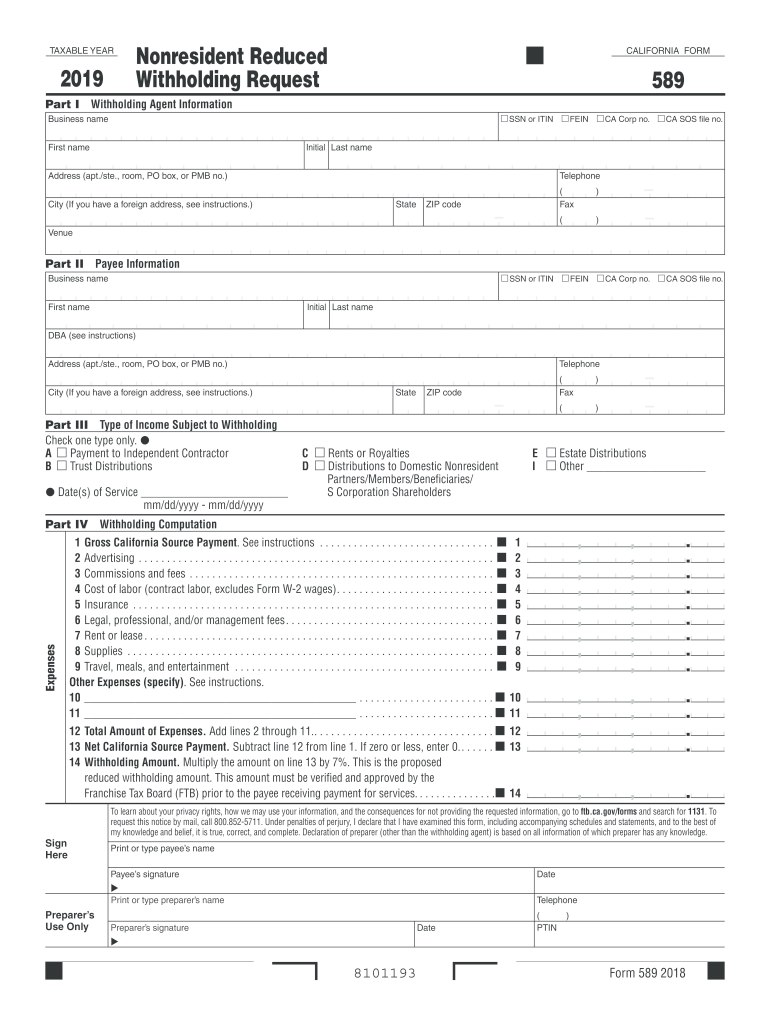

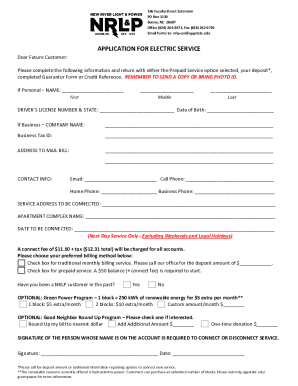

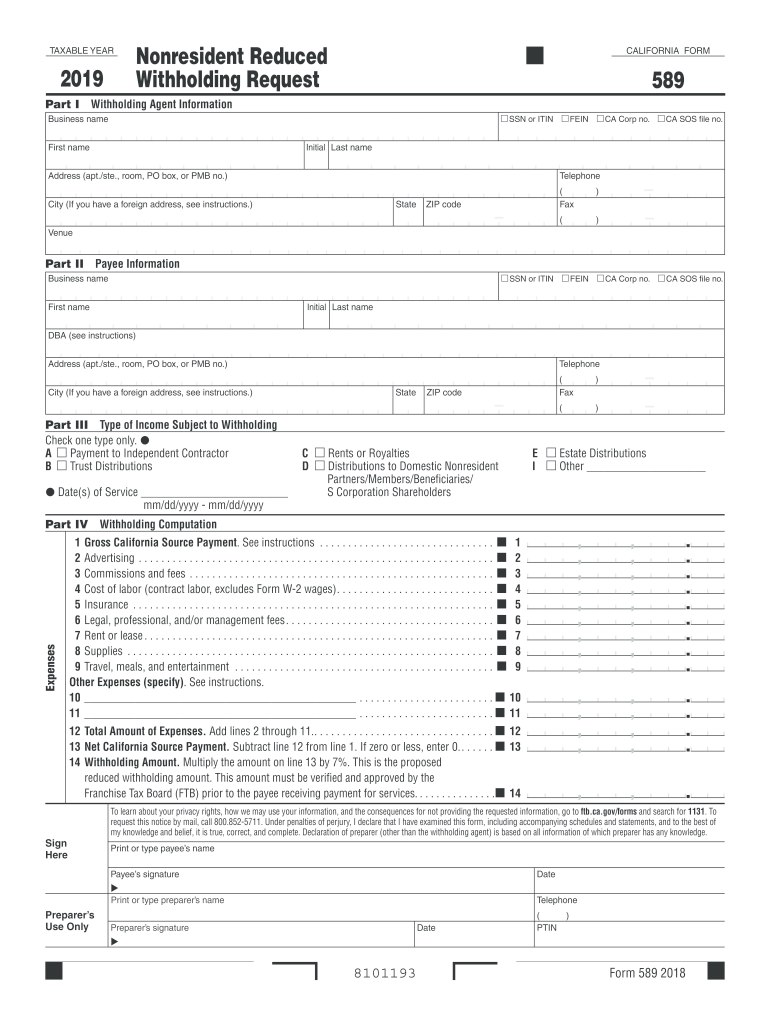

CA FTB 589 2019 free printable template

Get, Create, Make and Sign california state withholding form

Editing california state withholding form online

Uncompromising security for your PDF editing and eSignature needs

CA FTB 589 Form Versions

How to fill out california state withholding form

How to fill out CA FTB 589

Who needs CA FTB 589?

Instructions and Help about california state withholding form

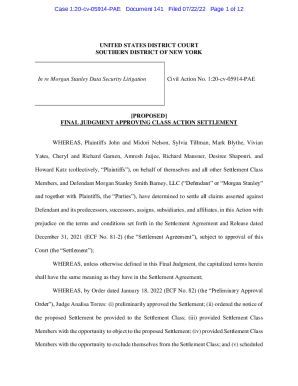

Hi everybody this is John from yes I'm on the welcome back, and thanks for watching if it's your first time on my channel welcome today I have another video today's video is about how to fill out from i-5 89 which is application for asylum and withholding for removal if it's something you want to know how to do then you come to the right place stay tuned you will see Funds try platform form i 589 the first thing you're going to be is to go to you ACS backup and click on forms and then scroll down, so you found form v i5 89 on i-5 adding application for asylum and for withholding of removal click on that form click on form and then here is this is the form you're going to fill out to apply for asylum so in the form you have a part one that's what you're going to start you start with Part A one of information about you so here you tap your phone number one you tap your alien registration number if you have one disagree number if you have one more chances that you don't have none of this stuff because you are known legally you are not permanent resident yet, so then you complete your last name first name middle name so over here if you have used a different name different from on the one you just happen then you have to write those name I'm a tap knows naming to all rich dance in the US, so you have to tap the address where you live here in your United States of America, so part serve what I mean number is the mailing address so if the mailing address is different from your physical address then you tap in here I'll move on to mine agenda you male female to check the correct box your marital status check the correct box 11 date of birth your date of birth 12 city and country of birth so 13 prisons on Prison nationality, so you tap in your prisoners internationality o nationality of birth and at birth, so it happens if it's different from your prisoners variable most of the time you know people got they have same nationality because that's where the bond so if it's different it's a different one over here the race or ethnic or tribal group that's white happy here in 1516 religion 17, so you have to check the correct box here the first one a one say I've never been an immigration court proceeding, so you check the correct bus he okay you wait a B and C and check the correct bus 18 so 18 where did you last leave when did you last leave your country you tap in the date, so it's going to be mounted in a year, so basically they did you left your country that's what you're going to tap here what is your current an ID phone number, so it's going to up in your online phone number here because usually we have once you get to the port of entry they give you another five so that and I perform as a number that's the number you're going to tap in yeah okay see list each entry into the U.S. beginning with your most recent entry so if you United States and left in country come back again stuff like their real hard to tap in the date you come in the place you live...

People Also Ask about

Does California have mandatory tax withholding?

Does California require a tax withholding form?

Does California require tax withholding?

Does California have state withholding?

What is the CA FTB Form 4197?

Does California have a state withholding form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in california state withholding form without leaving Chrome?

Can I create an electronic signature for signing my california state withholding form in Gmail?

How do I edit california state withholding form on an Android device?

What is CA FTB 589?

Who is required to file CA FTB 589?

How to fill out CA FTB 589?

What is the purpose of CA FTB 589?

What information must be reported on CA FTB 589?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.