Get the free RRSP to RRIF Conversion for the Elite or Elite XL Investment Program

Show details

RESP TO RIF CONVERSION FOR THE ELITE OR ELITE XL INVESTMENT PROGRAM

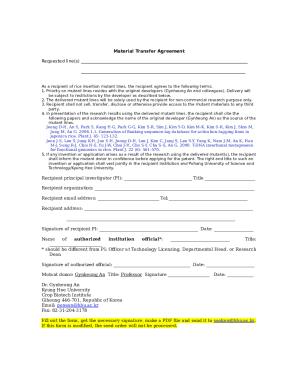

Throughout this form, Empire Life means The Empire Life Insurance Company.

This form may only be used to convert a registered Elite

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rrsp to rrif conversion

Edit your rrsp to rrif conversion form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rrsp to rrif conversion form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rrsp to rrif conversion online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit rrsp to rrif conversion. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rrsp to rrif conversion

How to fill out rrsp to rrif conversion

01

To fill out an RRSP to RRIF conversion, follow these steps:

1. Determine your eligibility: You must be at least 71 years old or have a spouse or common-law partner who is 71 or older to convert your RRSP to a RRIF.

02

Contact your financial institution: Speak with your financial institution or advisor to initiate the conversion process. They will provide you with the necessary forms and information.

03

Provide required information: Fill out the conversion form with accurate personal details, including your RRSP account information, proposed RRIF investment options, and any beneficiary information.

04

Choose your investments: Select the investment options that align with your retirement goals and risk tolerance. Consider diversifying your portfolio to minimize risk.

05

Complete and submit the form: Once you have filled out the conversion form, review it for accuracy and completeness. Sign the form and submit it to your financial institution for processing.

06

Understand withdrawal requirements: Familiarize yourself with the minimum withdrawal rules associated with RRIFs. These rules determine the minimum amount you must withdraw each year based on your age and the value of your RRIF.

07

Monitor your RRIF: Regularly review your RRIF investments and make necessary adjustments to ensure they continue to meet your financial objectives. Seek professional advice if needed.

Who needs rrsp to rrif conversion?

01

Individuals who have accumulated funds in an RRSP (Registered Retirement Savings Plan) and have reached the age of 71 or have a spouse or common-law partner who is 71 or older may need to convert their RRSP to a RRIF (Registered Retirement Income Fund).

02

RRSP to RRIF conversion is also suitable for individuals who want to start receiving regular retirement income from their accumulated savings while maintaining some flexibility in managing their investments.

03

Furthermore, those who want to defer taxes and continue to enjoy tax-efficient growth within their retirement savings can benefit from converting their RRSP to a RRIF.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my rrsp to rrif conversion in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your rrsp to rrif conversion as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send rrsp to rrif conversion to be eSigned by others?

Once your rrsp to rrif conversion is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I get rrsp to rrif conversion?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific rrsp to rrif conversion and other forms. Find the template you need and change it using powerful tools.

What is rrsp to rrif conversion?

RRSP to RRIF conversion refers to the process of converting funds from a Registered Retirement Savings Plan (RRSP) into a Registered Retirement Income Fund (RRIF) upon reaching a certain age.

Who is required to file rrsp to rrif conversion?

Individuals who have funds in an RRSP and reach a certain age where they are required to convert it to a RRIF are required to file the conversion.

How to fill out rrsp to rrif conversion?

To fill out RRSP to RRIF conversion, individuals need to contact their financial institution or RRSP provider to initiate the conversion process. The institution will help with the necessary paperwork and documentation.

What is the purpose of rrsp to rrif conversion?

The purpose of RRSP to RRIF conversion is to provide a steady stream of retirement income to the individual once they reach a certain age, as required by Canadian tax laws.

What information must be reported on rrsp to rrif conversion?

Information such as the amount being converted, the age of the individual, the financial institution handling the conversion, and any tax implications must be reported on RRSP to RRIF conversion.

Fill out your rrsp to rrif conversion online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rrsp To Rrif Conversion is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.