Get the free Enterprise Investment Scheme &

Show details

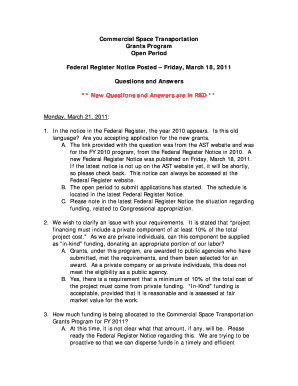

Enterprise Investment Scheme & Seed Enterprise Investment Scheme Application Form×Please 4 tick which Deep bridge EIS/SEES proposition this application form is for: Please note: This form should

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign enterprise investment scheme amp

Edit your enterprise investment scheme amp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your enterprise investment scheme amp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing enterprise investment scheme amp online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit enterprise investment scheme amp. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out enterprise investment scheme amp

How to fill out enterprise investment scheme amp

01

To fill out the Enterprise Investment Scheme (EIS) amp, follow these steps:

02

Gather all the necessary information, including the company's name, registration number, and contact details.

03

Fill out the basic details section, which includes information about the investor, the amount of investment, and the share issue date.

04

Provide details about the tax relief sought, such as income tax relief, capital gains tax deferral, or loss relief.

05

Fill in the section regarding the Certificates and Declarations, ensuring all the relevant certifications are provided.

06

Review and double-check all the information entered before submitting the form.

07

Sign and date the form to confirm its accuracy and completion.

08

Submit the completed form to the appropriate authority or organization that handles EIS applications.

09

Await confirmation or further instructions regarding the status of the application.

10

Keep a copy of the filled-out form for future reference or auditing purposes.

Who needs enterprise investment scheme amp?

01

Any individual or organization that meets the following criteria may need the Enterprise Investment Scheme (EIS) amp:

02

- Companies seeking investment for growth and expansion.

03

- Investors looking for tax incentives and relief opportunities while supporting early-stage businesses.

04

- High net-worth individuals or sophisticated investors interested in potential higher returns through investments in qualifying companies.

05

- Startups or smaller enterprises seeking funding to develop new products, services, or technologies.

06

- UK taxpayers who want to reduce their income tax liability by claiming EIS relief.

07

- Individuals or companies interested in benefiting from capital gains tax deferral by reinvesting eligible gains into EIS qualifying investments.

08

It is important to consult with a financial advisor or tax professional to determine if the EIS amp is suitable and beneficial for individual circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my enterprise investment scheme amp in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign enterprise investment scheme amp and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit enterprise investment scheme amp on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign enterprise investment scheme amp right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I fill out enterprise investment scheme amp on an Android device?

Complete your enterprise investment scheme amp and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is enterprise investment scheme amp?

Enterprise Investment Scheme Advance Assurance (EIS AA) is a process by which companies can obtain advance assurance from HM Revenue & Customs that their proposed share issue will qualify for EIS tax reliefs.

Who is required to file enterprise investment scheme amp?

Companies seeking to issue shares under the Enterprise Investment Scheme (EIS) are required to file EIS AA.

How to fill out enterprise investment scheme amp?

To fill out EIS AA, companies must submit a detailed application to HM Revenue & Customs outlining the proposed share issue and how it meets the eligibility criteria for EIS tax reliefs.

What is the purpose of enterprise investment scheme amp?

The purpose of EIS AA is to provide companies with certainty that their share issue will qualify for EIS tax reliefs, making it more attractive to potential investors.

What information must be reported on enterprise investment scheme amp?

Information such as company details, proposed share issue details, proposed use of funds, and confirmation of eligibility for EIS tax reliefs must be reported on EIS AA.

Fill out your enterprise investment scheme amp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Enterprise Investment Scheme Amp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.