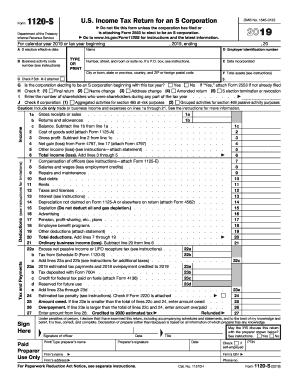

CA FTB 100S Schedule K-1 2018 free printable template

Show details

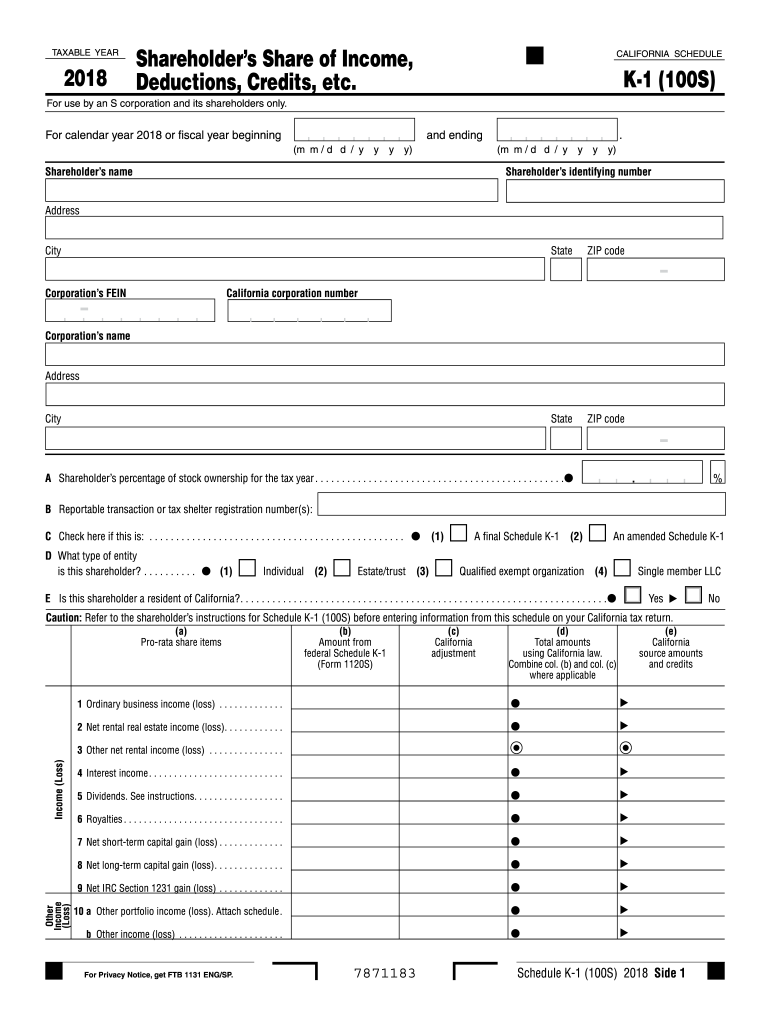

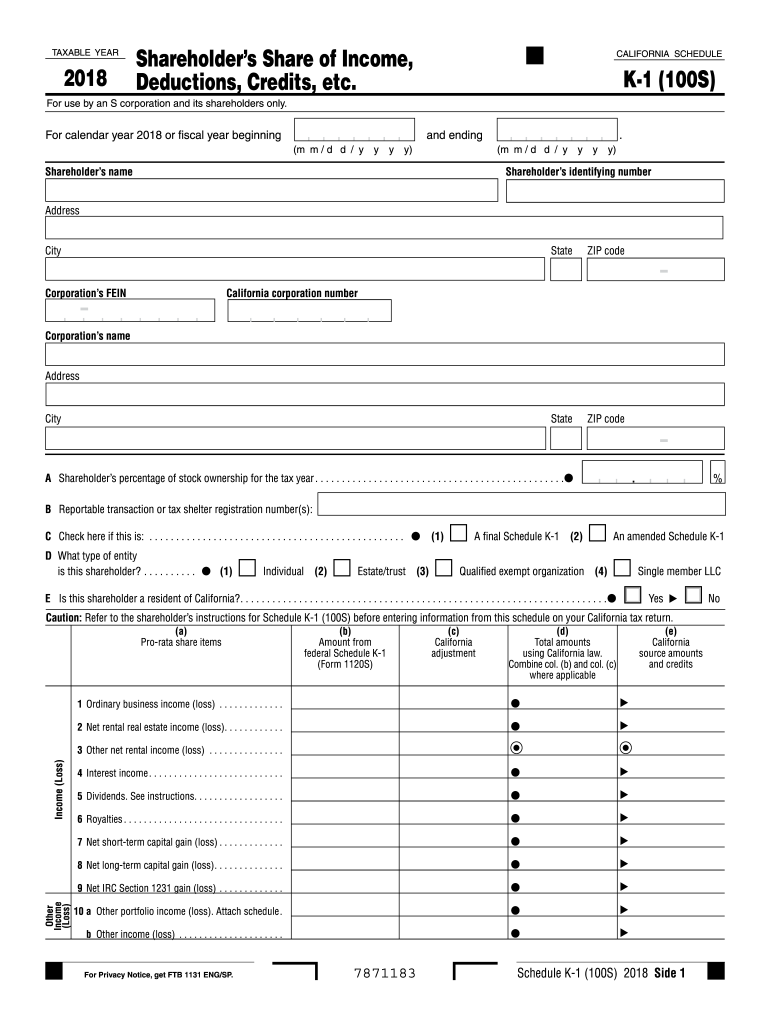

TAXABLE YEAR2018Shareholders Share of Income,

Deductions, Credits, etc. CALIFORNIA SCHEDULEK1 (100S)For use by an S corporation and its shareholders only. For calendar year 2018 or fiscal year beginning

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FTB 100S Schedule K-1

Edit your CA FTB 100S Schedule K-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 100S Schedule K-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA FTB 100S Schedule K-1 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA FTB 100S Schedule K-1. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 100S Schedule K-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 100S Schedule K-1

How to fill out CA FTB 100S Schedule K-1

01

Obtain a copy of CA FTB 100S Schedule K-1 from the California Franchise Tax Board website.

02

Fill in the entity's information at the top of the form, including the name, address, and tax identification number.

03

Enter the partner's identifying information, including their name, address, and taxpayer identification number.

04

Report the partner's share of income, deductions, and credits in the appropriate boxes. Use the K-1 instructions to identify what goes where.

05

If applicable, include any special allocations or adjustments related to the partner's share.

06

Sign and date the document to certify the information is accurate.

07

Distribute copies to each partner and retain a copy for the entity's records.

Who needs CA FTB 100S Schedule K-1?

01

California partnerships that file Form 100S and have partners.

02

Partners receiving income, deductions, or credits from the partnership need this form for their personal tax returns.

03

Entities that must report the distributive share of income and other attributes to their partners.

Instructions and Help about CA FTB 100S Schedule K-1

Fill

form

: Try Risk Free

People Also Ask about

What is Form 100 payments?

Purpose. Use Form 100-ES to figure and pay estimated tax for a corporation. Estimated tax is the amount of tax the corporation expects to owe for the taxable year.

Who must file California Form 100?

All corporations subject to the franchise tax, including banks, financial corporations, RICs, REITs, FASITs, corporate general partners of partnerships, and corporate members of LLCs doing business in California, must file Form 100 and pay at least the minimum franchise tax as required by law.

What is Form 100S Schedule K?

Purpose. The S corporation uses Schedule K-1 (100S) to report the shareholder's share of the S corporation's income, deductions, credits, etc. Information from the Schedule K-1 (100S) is used to complete your California tax return.

What is Form 100S form?

Form 100S is used if a corporation has elected to be a small business corporation (S corporation). All federal S corporations subject to California laws must file Form 100S and pay the greater of the minimum franchise tax or the 1.5% income or franchise tax. The tax rate for financial S corporations is 3.5%.

What is the instruction form 100S?

Form 100S is used if a corporation has elected to be a small business corporation (S corporation). All federal S corporations subject to California laws must file Form 100S and pay the greater of the minimum franchise tax or the 1.5% income or franchise tax. The tax rate for financial S corporations is 3.5%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my CA FTB 100S Schedule K-1 in Gmail?

CA FTB 100S Schedule K-1 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit CA FTB 100S Schedule K-1 in Chrome?

CA FTB 100S Schedule K-1 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I edit CA FTB 100S Schedule K-1 on an Android device?

You can make any changes to PDF files, such as CA FTB 100S Schedule K-1, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is CA FTB 100S Schedule K-1?

CA FTB 100S Schedule K-1 is a tax form used by California S corporations to report the income, deductions, and credits that are passed through to shareholders.

Who is required to file CA FTB 100S Schedule K-1?

S corporations doing business in California are required to file CA FTB 100S Schedule K-1 for each shareholder to report their respective share of the corporation's income, deductions, and credits.

How to fill out CA FTB 100S Schedule K-1?

To fill out CA FTB 100S Schedule K-1, enter the shareholder's name, address, and identification number, then report the shareholder’s share of income, deductions, and credits from the S corporation’s activities using the appropriate codes and amounts.

What is the purpose of CA FTB 100S Schedule K-1?

The purpose of CA FTB 100S Schedule K-1 is to provide shareholders with the information needed to report their share of the S corporation's tax attributes on their individual tax returns.

What information must be reported on CA FTB 100S Schedule K-1?

CA FTB 100S Schedule K-1 must report the shareholder's name, identification number, the amount of ordinary income, rental income, dividends, capital gains, deductions, and any other specific tax items related to the share of the S corporation's income.

Fill out your CA FTB 100S Schedule K-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 100s Schedule K-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.