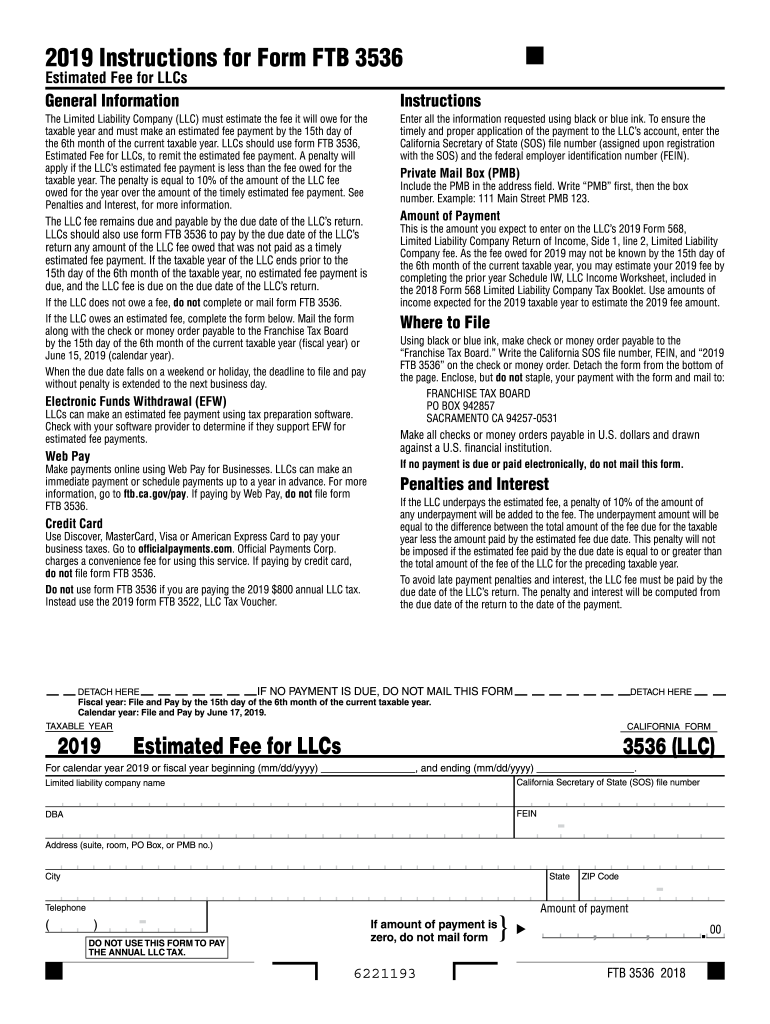

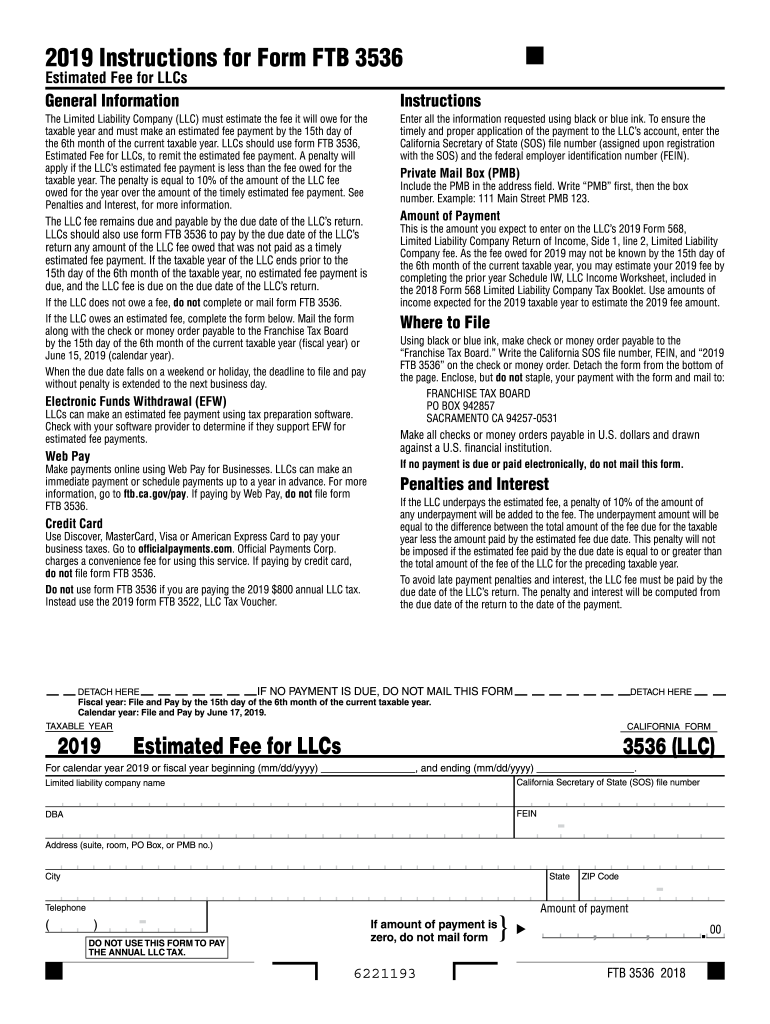

CA FTB 3536 2019 free printable template

Get, Create, Make and Sign CA FTB 3536

Editing CA FTB 3536 online

Uncompromising security for your PDF editing and eSignature needs

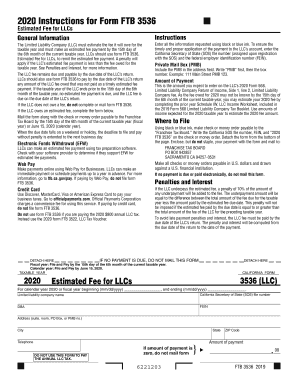

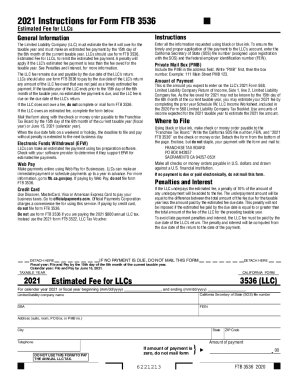

CA FTB 3536 Form Versions

How to fill out CA FTB 3536

How to fill out CA FTB 3536

Who needs CA FTB 3536?

Instructions and Help about CA FTB 3536

A couple more minutes but its fine you know go live peoples video peoples hello and we are going to have a shorter post show today I apologize for that ahead of time but Ive got a jet to the comedy film there its a podcast as soon as Im done that is a good excuse Tom I dont know how many times we have to tell you this podcasting thing is not gonna take off Tom like just give up yeah the good folks got extra pre-show to make up for it so if you are a good day Internet subscriber you can go do that yeah and then you know what I dont give creative a starts enough praise I know theres only like you know less than a hundred people that do it but he he goes and takes the good day internet audio marries it to the video and then uploads it privately and puts the link in the discord and on patreon so if people like oh but I want to listen to good day internet on YouTube they can yes and I get those notifications in my email and every day Im like thats a nice said a nice thing youre doing oh my informed daily digest has come in whats in my mailbox yeah its nothing good informed yeah its USPS well you know they send you an image of well your mail I like that service I love it its just a scan of the of the envelope the outside of the envelopes you can know I go its just junk mail today Im not gonna worry about it or like oh by my check is coming totally expecting something right thats what Im like okay theres that even you wont scan it but itll give you links to tracking numbers if youre getting a package well somebody else named ser Elena not me somebody in the UK apparently bought some ceramic pots and she was informed via my email that the pots are on their way so so this is a very annoying thing the show heard Roger get so many ok so its bad enough in box but I cant even register for like the DMV site using my email because someone used it already and now its been banned or suspended because of something that I dont know what because that wasnt me who signed up with that email yeah I got a make up a different account or something there was and Ive complained about this before just just you gotta call my name youre gonna get other peoples emails but theres a its like swimming lessons in North Carolina one of the Carolinas and I kept getting these invoices like youve been invoiced on square I was like you know Im kind of looking at Mike okay I dont see a transaction but I kept emailing them like am I being charged for something like Ive never even been to that state I dont know how to swim like for sure for sure not me you know and the woman kept ready back like so strange Im sorry Ill make sure that this gets fixed you know what I was because when its money based youre like lets just make sure this isnt right coming out of anything that actually belongs to me and so and then she I mean this was this has been going on for well over a year and she finally got really annoyed with me like Im like okay but whoever youre trying to charge could you stop stop...

People Also Ask about

What happens if you don't pay $800 California LLC tax?

What happens if you don't pay CA franchise tax?

What is the IRS form 3536?

What is the penalty for late payment of form 3536?

What is the difference between 3536 and 3522?

What is form 3536 estimated fee for LLCs?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete CA FTB 3536 online?

How do I make changes in CA FTB 3536?

How do I complete CA FTB 3536 on an iOS device?

What is CA FTB 3536?

Who is required to file CA FTB 3536?

How to fill out CA FTB 3536?

What is the purpose of CA FTB 3536?

What information must be reported on CA FTB 3536?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.