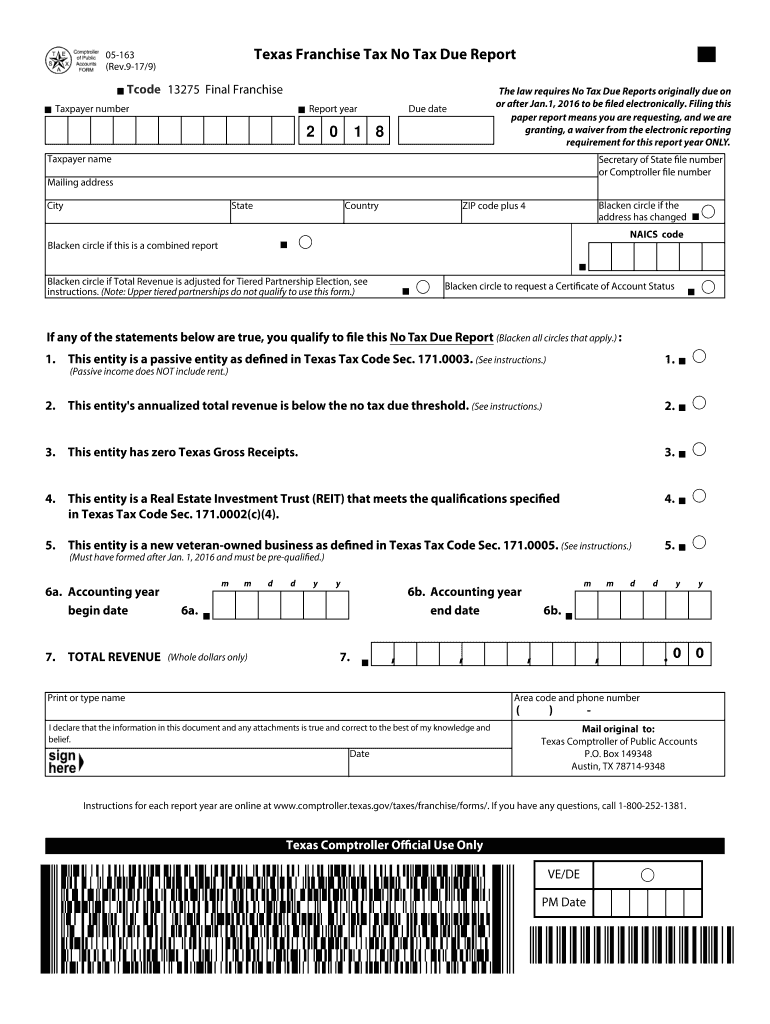

Who needs a 05-163 form?

This form is used by the entities in Texas which are not subject to franchise tax. The entities which are not subject to this tax are listed in the form. Among these are passive entities; entities with a total annualized revenue less than or equal to the no tax threshold; entities with a zero Texas gross receipts; entities that are Real Estate Investment Trust meeting the qualifications in Texas Code Section.

What is the 05-163 form for?

This is a franchise tax form. It serves as an information report for the business entities which don’t have to pay franchise tax. This data is forwarded to the Texas Comptroller’s Field area.

What documents must accompany the 05-163 form?

The taxpayer has to submit all the necessary tax forms together with this report.

When is the 05-163 form due?

Texas 05-163 form is due on the 15th of May and covers the period of the previous calendar year. It won’t take much time to complete.

What information should be provided in the 05-163 form?

While completing the form, the taxpayer must type:

- The taxpayer number

- Taxpayer name

- Mailing address

- City, state, coin? Ry, ZIP Code

- SIC and NAILS codes

- Blacken the circles with the appropriate statements

- Accounting year begin date and end date

- Total revenue sum

- Phone number of the taxpayer

- Date of completing the report

What do I do with the form after its completion?

Once the report is completed and signed, it should be forwarded to the Texas Comptroller of Public Accounts, P.O. Box 149348, Austin, TX 78714-9348