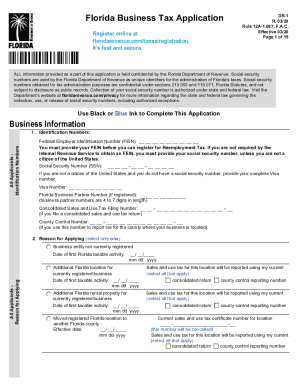

FL DoR DR-1 2018 free printable template

Get, Create, Make and Sign FL DoR DR-1

Editing FL DoR DR-1 online

Uncompromising security for your PDF editing and eSignature needs

FL DoR DR-1 Form Versions

How to fill out FL DoR DR-1

How to fill out FL DoR DR-1

Who needs FL DoR DR-1?

Instructions and Help about FL DoR DR-1

Hi everyone and welcome to my channel my name is Jeanette Cabrera, and I am the CEO of virtual business tutorials today we will be completing the online application for sales facts and a state unemployment tax if you like the video give it a thumbs up if you do not like it please comment down below what didn't you like so that we can address it in future videos don't forget to subscribe and turn on the notification, so you don't miss on my new videos and without further ado lets jump into the action lets go to the Florida Department of Revenue website were going to choose the general tax tab and then select register to collect and pay taxes were going to choose that again register to collect and pay taxes or fees here we will select the option that applied to us in this case we are applying because we just open in your business so let's select that option and click Next and here we will select our business activities so read through all the options on select yes for all those that fit your business or no for the rest this section has three pages, so after you are done click Next and continue selecting whether any of these options apply to your business and when complete it click Next again continue selecting and click Next so notice that on this section we say if we will employ personnel and if you wish to file an eternally this is very important because depending whether you choose to employ or not well have to complete the application for the Florida unemployment this case we wish to find on the trailer, so we tell that yes and click Next now well also let our business structure this is the for me shows when opening your business in this case the business is a corporation, but we will file form 2553 to a lettuce and escort so here we will select S corporation when done click Next this is cream the system will let you know the determination or determinations in our case we are only required to register for the unemployment tax this type of business is not eligible for sales tax however if your business is it will tell you remember this is based on your responses so make sure you read everything thoroughly the system will guide you so let's continue and click Next note that when you get to the Florida Department of Revenue website you should have already applied for a federal employer identification number so lets go ahead and fill out the information requested and click Next Parents page as This contains your recovery ID in the case something happens to your connection or your browser closes unexpectedly you can go back and resume the application click Next in this section we are going to enter the date we began all will begin doing business in Florida if you had already started your business month ago enter the date of initiation otherwise enter the day you plan to start your business or today's date next well, well provide the fiscal year and in date which the Mayer of the time is December 31st then we have to provide a corporate document...

People Also Ask about

How do I get a Florida tax registration number?

Do I need to register to collect sales tax in Florida?

How do I register to collect sales tax in Florida?

Do I need to register with the Florida Department of Revenue?

Do you need a sales tax license to sell in Florida?

How do I set up a sales tax account in Florida?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in FL DoR DR-1?

How can I edit FL DoR DR-1 on a smartphone?

How do I edit FL DoR DR-1 on an iOS device?

What is FL DoR DR-1?

Who is required to file FL DoR DR-1?

How to fill out FL DoR DR-1?

What is the purpose of FL DoR DR-1?

What information must be reported on FL DoR DR-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.