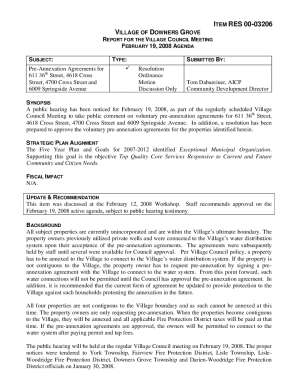

PA Business Tax Return - City of Monroeville 2017 free printable template

Show details

TAX

YEARMUNICIPALITY OF MONROEVILLE

BUSINESS TAX RETURN

ACCOUNT #

POST MARKED AT THE POST OFFICE BY APRIL 15TH*

(must be provided)

READ ALL INSTRUCTIONS BEFORE COMPLETING FORM2017IF YOU DO NOT HAVE

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA Business Tax Return - City

Edit your PA Business Tax Return - City form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA Business Tax Return - City form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA Business Tax Return - City online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit PA Business Tax Return - City. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA Business Tax Return - City of Monroeville Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA Business Tax Return - City

How to fill out PA Business Tax Return - City of Monroeville

01

Obtain the PA Business Tax Return form specific to the City of Monroeville.

02

Fill in your business name, address, and taxpayer identification number at the top of the form.

03

Report your gross receipts from all business activities for the tax year.

04

Deduct any allowable expenses to calculate your net income.

05

Apply the appropriate business tax rate to your net income to determine your tax liability.

06

If applicable, include any estimated tax payments made throughout the year.

07

Review and double-check all entries for accuracy.

08

Sign and date the form, ensuring all required signatures are provided.

09

Submit the completed form by the City of Monroeville's deadline, either online or by mail.

Who needs PA Business Tax Return - City of Monroeville?

01

Any business operating within the City of Monroeville that generates income or revenue is required to file a PA Business Tax Return.

Fill

form

: Try Risk Free

People Also Ask about

What time does the Monroeville tax office open?

Office Hours: Monday thru Friday 8:00 a.m-4:30 p.m.

What is the tax rate in Monroeville PA?

Millage Rates 20212022County:4.73004.7300Municipality:4.00004.0000School District:20.891421.7479

What is a business tax return?

A business tax return reports your company's income, tax deductions, and tax payments. All businesses must file tax returns. And, you are responsible for filing your return annually with the IRS to calculate your business's tax liability.

Will I get a tax return for my business?

Most small businesses don't receive IRS refunds because they don't pay taxes – at least not directly. Pass-through businesses, including sole proprietors, partnerships, LLCs and S corporations, may file tax returns, but taxable income passes through to the owner or shareholder's personal tax return.

Where can I get PA tax forms?

Many forms are available for download on the Internet. Order forms online to be mailed to you. You may call 1-888-PATAXES (1-888-728-2937) to leave a message to have forms mailed to you.

What is a tax return for a business called?

Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Your primary purpose for engaging in the activity is for income or profit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute PA Business Tax Return - City online?

Completing and signing PA Business Tax Return - City online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an electronic signature for signing my PA Business Tax Return - City in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your PA Business Tax Return - City directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Can I edit PA Business Tax Return - City on an Android device?

You can make any changes to PDF files, such as PA Business Tax Return - City, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is PA Business Tax Return - City of Monroeville?

The PA Business Tax Return for the City of Monroeville is a document that businesses operating within the city must file to report their income and calculate their tax liabilities.

Who is required to file PA Business Tax Return - City of Monroeville?

Any business entity operating within the City of Monroeville, including sole proprietorships, partnerships, corporations, and LLCs, is required to file the PA Business Tax Return.

How to fill out PA Business Tax Return - City of Monroeville?

To fill out the PA Business Tax Return, gather all necessary financial records, complete the form by entering your business income, deductions, and other required information, and submit it to the city's tax office by the designated deadline.

What is the purpose of PA Business Tax Return - City of Monroeville?

The purpose of the PA Business Tax Return is to ensure that businesses contribute to the local economy by reporting their earnings and paying the applicable taxes, thereby funding public services and infrastructure.

What information must be reported on PA Business Tax Return - City of Monroeville?

The PA Business Tax Return requires reporting information such as total gross income, allowable deductions, business expenses, and the resulting taxable income, along with any other relevant tax information specific to the business.

Fill out your PA Business Tax Return - City online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA Business Tax Return - City is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.