CO DoR 104x 2018 free printable template

Instructions and Help about CO DoR 104x

How to edit CO DoR 104x

How to fill out CO DoR 104x

About CO DoR 104x 2018 previous version

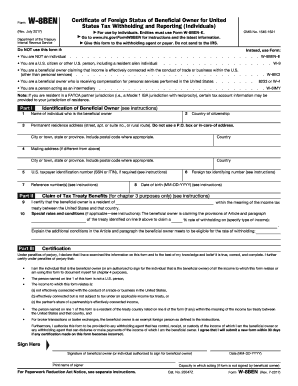

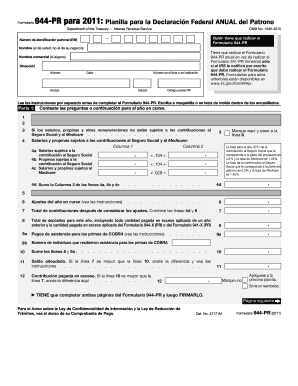

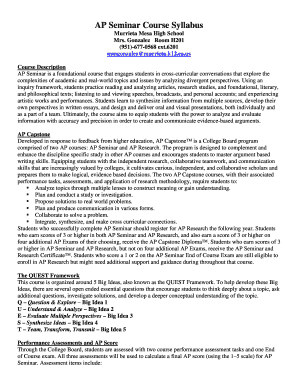

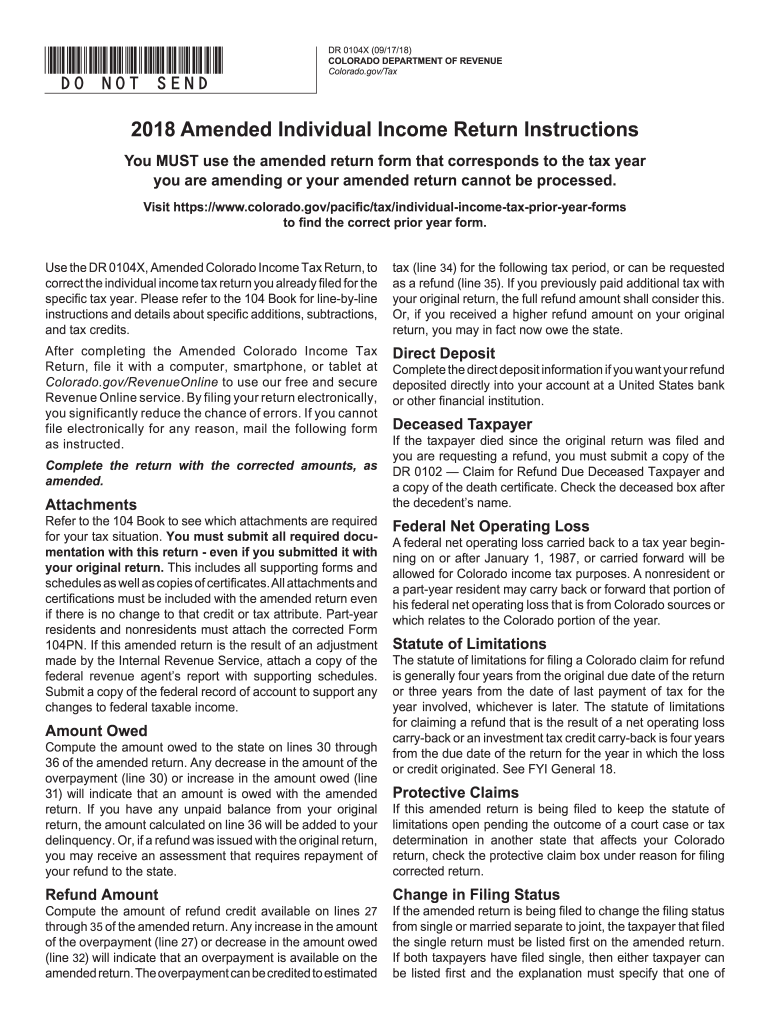

What is CO DoR 104x?

Who needs the form?

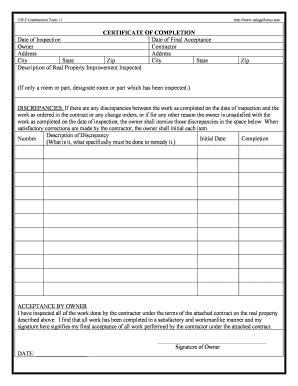

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about CO DoR 104x

What should I do if I realize I've made an error on my submitted form 104x colorado 2016?

If you've discovered an error on your submitted form 104x colorado 2016, you should file an amended return as soon as possible. Clearly indicate the amendments you are making, and include any additional documentation required to support the changes. It’s important to keep a copy of your amended form for your records.

How can I track the status of my form 104x colorado 2016 after submission?

To track the status of your form 104x colorado 2016 after submission, you can typically use the online status tracking service provided by the state revenue department. Be prepared to enter your personal information and the details of the submission for accurate tracking. If there are issues or delays, it may provide you with specific reasons or codes that can guide further actions.

Are there special considerations for nonresidents filing the form 104x colorado 2016?

Yes, nonresidents filing form 104x colorado 2016 may encounter unique requirements based on their specific situation, such as applicable tax treaties or sourcing rules for income earned in Colorado. It’s advisable to refer to the state guidelines or consult a tax professional to ensure compliance and maximize any potential adjustments.

What are some common errors people make when filing form 104x colorado 2016 and how can they avoid them?

Common errors when filing form 104x colorado 2016 often include incorrect Social Security numbers, missing signatures, and not double-checking figures added or subtracted. To avoid these mistakes, always review your form carefully before submission and consider using tax preparation software that can identify potential issues.

What should I do if I receive a notice related to my form 104x colorado 2016?

If you receive a notice regarding your form 104x colorado 2016, read it thoroughly to understand the nature of the inquiry or issue. Prepare any necessary documentation to respond and ensure you address the requirements stated in the notice within the timeframe provided to avoid penalties.