CO DoR 104PN 2018 free printable template

Show details

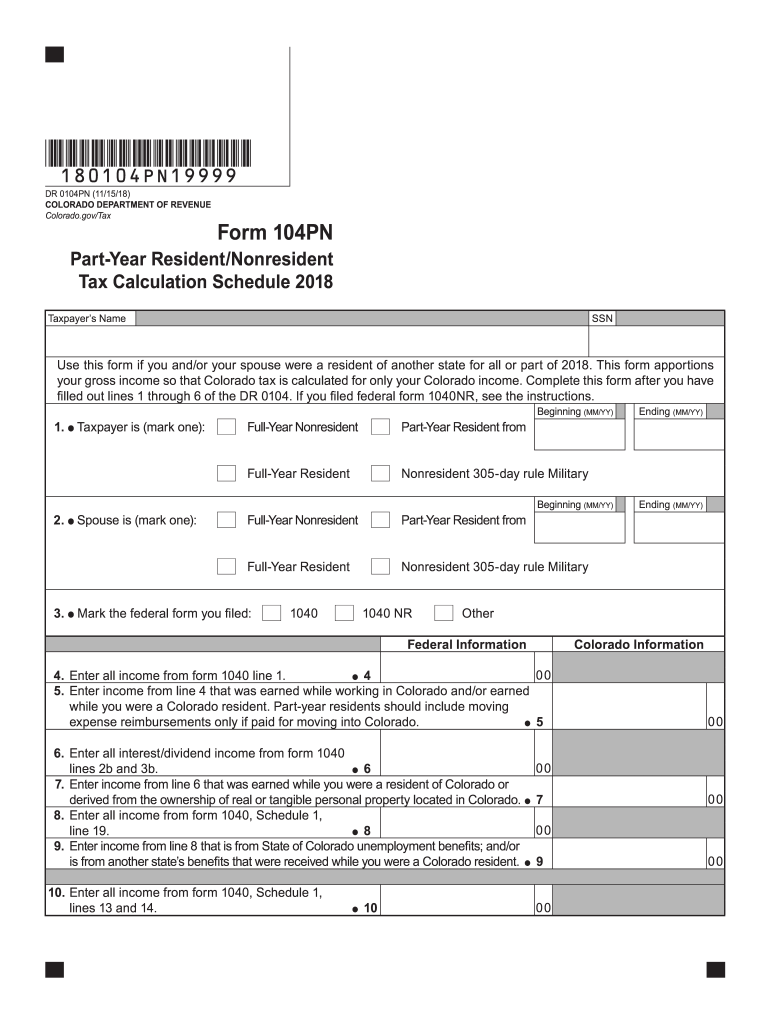

Subtract the amount on line 23 of Form 104PN from the amount on line 21 of Form 104PN. 25 26. Additions to Adjusted Gross Income. 180104PN19999 DR 0104PN 11/15/18 COLORADO DEPARTMENT OF REVENUE Colorado. gov/Tax Form 104PN Part-Year Resident/Nonresident Tax Calculation Schedule 2018 Taxpayer s Name SSN Use this form if you and/or your spouse were a resident of another state for all or part of 2018. This form apportions your gross income so that Colorado tax is calculated for only your Colorado...income. Complete this form after you have filled out lines 1 through 6 of the DR 0104. If you filed federal form 1040NR see the instructions. 1. Taxpayer is mark one 2. Spouse is mark one Beginning MM/YY Full-Year Nonresident Full-Year Resident Nonresident 305-day rule Military 3. Mark the federal form you filed 1040 NR Colorado Information 4. Enter all income from form 1040 line 1. 5. Enter income from line 4 that was earned while working in Colorado and/or earned while you were a Colorado...resident. Part-year residents should include moving expense reimbursements only if paid for moving into Colorado. 6. Enter all interest/dividend income from form 1040 lines 2b and 3b. derived from the ownership of real or tangible personal property located in Colorado. line 19. is from another state s benefits that were received while you were a Colorado resident. Ending MM/YY Other Federal Information lines 13 and 14. Name a Colorado resident and/or was earned on property located in Colorado....were a Colorado resident. 14. Enter all business and farm income from form 1040 Schedule 1 lines 12 and 18. 16. Enter all Schedule E income from form 1040 Schedule 1 line 17. and royalty income received or credited to your account during the part of the year you were a Colorado resident and/or partnership/S corporation/fiduciary income that is taxable to Colorado during the tax year. 18. Enter all other income from form 1040 Schedule 1 lines 10 11 and 21. List Type 20. Total Income. Enter amount...from form 1040 line 6. 21. Total Colorado Income. Enter the total from the Colorado column lines 5 7 9 11 13 15 17 and 19. 21 22. Enter all federal adjustments from form 23. Enter adjustments from line 22 as follows Educator expenses IRA deduction business expenses of reservists performing artists and fee-basis government officials health savings account deduction self-employment tax self-employed health insurance deduction SEP and SIMPLE deductions are allowed in the ratio of Colorado wages...and/or self-employment income to total wages and/or self-employment income. Student loan interest deduction alimony and tuition and fees deduction are allowed in the Colorado to federal total income ratio line 21 / line 20. Domestic production activities deduction is allowed in the Colorado to Federal QPAI ratio. Penalty paid on early withdrawals made while a Colorado resident. Moving expenses if you are moving into Colorado not if you are moving out. For treatment of other adjustments reported...on federal form 1040 Schedule 1 line 36 see FYI Income 6.

pdfFiller is not affiliated with any government organization

Instructions and Help about CO DoR 104PN

How to edit CO DoR 104PN

How to fill out CO DoR 104PN

Instructions and Help about CO DoR 104PN

How to edit CO DoR 104PN

To edit the CO DoR 104PN, you can download the form from the Colorado Department of Revenue’s website. Once it's downloaded, you can use pdfFiller to edit the form directly in your web browser. This tool allows for easy text modifications, which ensure that all the details are accurate before submission.

How to fill out CO DoR 104PN

Filling out the CO DoR 104PN involves several key steps. First, ensure you have all necessary information on hand, including your personal details and the relevant financial data. Next, begin entering the information in the corresponding sections of the form. It is crucial to double-check the data entered for accuracy, as errors can lead to delays or penalties. Finally, once completed, save the document using pdfFiller and follow the provided guidance for submission.

About CO DoR 104PN 2018 previous version

What is CO DoR 104PN?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CO DoR 104PN 2018 previous version

What is CO DoR 104PN?

CO DoR 104PN is the Colorado Department of Revenue's form used for declaring income tax payments and purchases. This form plays a vital role in ensuring the correct reporting of taxable transactions. Understanding this form is essential for compliance with Colorado state tax regulations.

What is the purpose of this form?

The purpose of the CO DoR 104PN is to report specific financial activities to the Colorado Department of Revenue. This includes documenting sales tax collected by businesses or reporting other taxable transactions. Accurate submission of this form impacts a taxpayer's financial reporting and compliance status.

Who needs the form?

Individuals and businesses that engage in taxable sales transactions within the state of Colorado are required to use the CO DoR 104PN. This includes retailers, service providers, and anyone else responsible for collecting sales tax. If you fall into one of these categories, ensure you are familiar with the requirements for filing this form.

When am I exempt from filling out this form?

You may be exempt from filling out the CO DoR 104PN if your business does not engage in taxable sales or if your total taxable sales fall below the state’s set threshold for reporting. Certain exempt organizations, such as nonprofits, may also not need to file this form. It’s important to confirm your specific situation against state guidelines to avoid unnecessary filing.

Components of the form

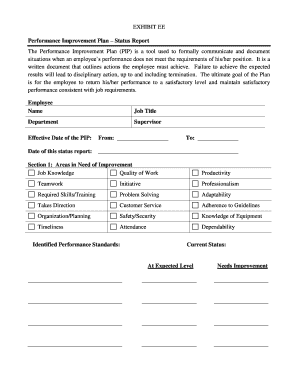

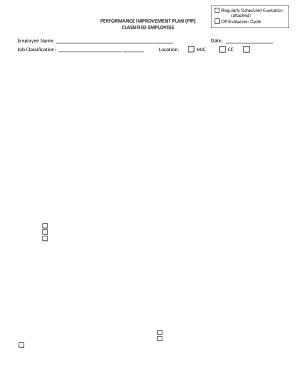

The CO DoR 104PN consists of several critical components that must be completed. These include the filer’s identification information, transaction summary, and a detailed breakdown of sales tax collected. Each section must be filled out accurately to ensure compliance with reporting requirements.

What are the penalties for not issuing the form?

Failing to issue the CO DoR 104PN can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits by the Colorado Department of Revenue. It is essential to comply with all filing requirements to avoid these consequences.

What information do you need when you file the form?

To file the CO DoR 104PN, you will need the following information: your business name and address, sales tax identification number, details of the transactions being reported, and any applicable deductions. Gather all necessary documents prior to starting the form to streamline the process.

Is the form accompanied by other forms?

Typically, the CO DoR 104PN may need to be accompanied by additional forms related to specific transactions or reports. Depending on your business activities, you might also need to file supplementary tax schedules or exemption certificates. Always check the current requirements for comprehensive compliance.

Where do I send the form?

The completed CO DoR 104PN should be submitted to the Colorado Department of Revenue. You can either mail the form or, if available, submit it electronically. Check the Colorado Department of Revenue’s website for exact mailing addresses and submission options.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

It has been GREAT lots of forms to choose from and easy to fill out.

It works great, and here is all I neeed for my job. GOD BLESS YOU ALL. GOOD WOEK

See what our users say