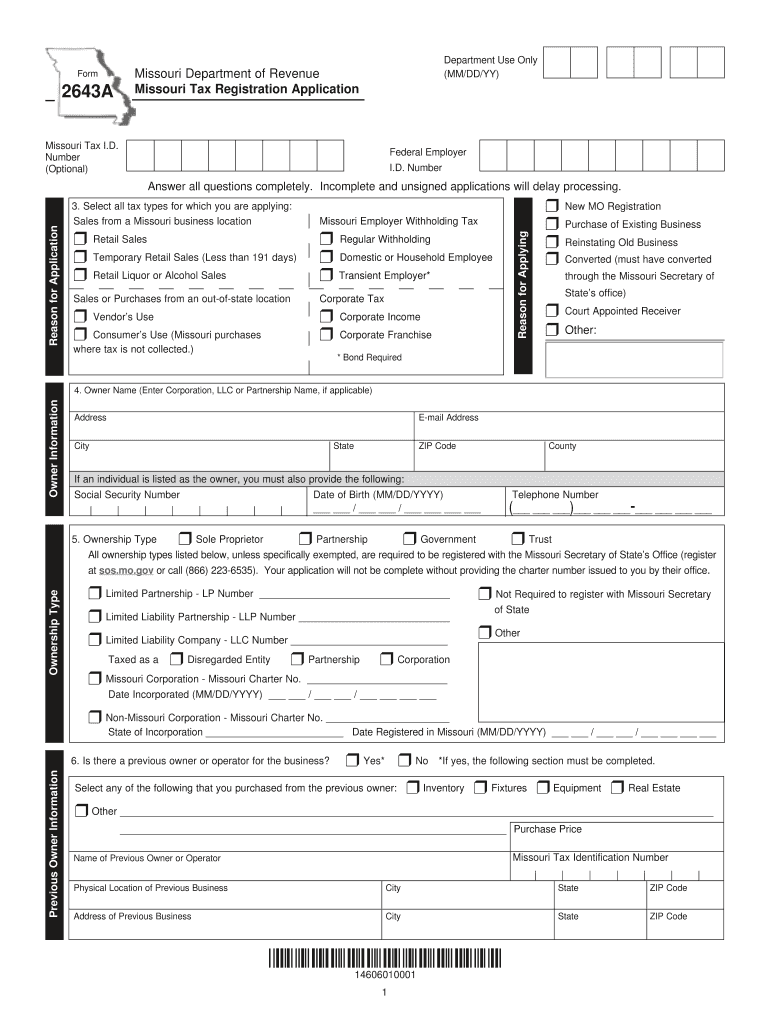

MO 2643A 2018 free printable template

Get, Create, Make and Sign MO 2643A

How to edit MO 2643A online

Uncompromising security for your PDF editing and eSignature needs

MO 2643A Form Versions

How to fill out MO 2643A

How to fill out MO 2643A

Who needs MO 2643A?

Instructions and Help about MO 2643A

To order a complete battery replacement kit. Please visit our website at NewPower99.comNewPower99.com Giving New Life To Your Old Stoughton To Replace Your Apple iPhone 5s A1530 Battery Begin By using the special tool provided in your kit from NewPower99.combo remove the two screws at the bottom of your iPhone 5sUse the included suction cup to carefully apply upward pressure on the screen until you are able to insert the shim tool as shown. Be sure to avoid to pulling the screen more than 1 inch from the iPhone body as there is a ribbon cable that connects the fingerprint reader to the screen. Opening the iPhone too far at this point may cause damage to the phone. Use the shim tool to gradually separate the screen from the back of the iPhone. Remove the metal fingerprint connector cover and the ribbon cable connector as shown. Pull back the screen and remove the four screws securing the metal connector cover. Carefully dislodge the three connector tabs and set the screen aside. Remove the two screws in the battery connector cover as shown. Lift out the battery connector tab. Gradually work the original battery loose and Pry out the adhesive is especially strong, Use a hairdryer on the back side of the iPhone to loosen it. Be careful not to apply too much heat. Place a new extended life battery from NewPower99.com into your iPhone 5sPosition your new battery and attach the connector. Replace the battery connector cover and the two screws to hold it in place. Carefully position the screen and replace the three connector tabs. Replace the metal cover and the four screws. Replace the ribbon cable and cover as shown. Replace the screen top first and snap into place. Replace the two screws securing the back cover. Turn on your Apple iPhone 5s with its newly installed battery from NewPower99.contour iPhone 5s should now work perfectly. Be sure to charge the unit for at least two hours before continuing to use.NewPower99.com Giving New Life To Your Old Stuff.

People Also Ask about

Can I print 2018 tax forms?

What is Form 1040 EZ?

Who should file 1040-EZ and why?

Can I download and print tax forms?

What is the difference between a 1040 and a 1040EZ?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit MO 2643A in Chrome?

Can I create an electronic signature for the MO 2643A in Chrome?

Can I edit MO 2643A on an iOS device?

What is MO 2643A?

Who is required to file MO 2643A?

How to fill out MO 2643A?

What is the purpose of MO 2643A?

What information must be reported on MO 2643A?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.